Titel-Trader 2.2009.indd - Agritechnica Trader

Titel-Trader 2.2009.indd - Agritechnica Trader

Titel-Trader 2.2009.indd - Agritechnica Trader

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

COMPANIES AND MARKETS<br />

Continues from page 23<br />

lowing good harvests, above<br />

all global combine production<br />

grew – by 9,000 units to some<br />

47,000 combines in 2008. (Table<br />

4 “Global production estimates”).<br />

International trade<br />

with agricultural machinery and<br />

equipment grew by as much as<br />

19 %. The major exporting nations<br />

are Germany, followed by<br />

the USA, Italy, France and now<br />

in fi fth place China too. (Table<br />

5 “Exports of agricultural machinery<br />

and equipment”). Tractors<br />

and combines are the key<br />

drivers for exports. The EU taken<br />

as a whole is the largest site<br />

for agricultural machinery production<br />

worldwide, accounting<br />

for sales of 28 billion euros in<br />

2008 (Table 6 “Production volume<br />

in the EU”).<br />

Europe’s multifaceted agricultural<br />

machinery industry can<br />

call on operational experience at<br />

an extremely wide range of sites<br />

– in small-scale and large-scale<br />

farm structures, in a wide variety<br />

of climate zones and many different<br />

crops cultivated. The fact<br />

that many West European manufacturers<br />

have concentrated in<br />

recent years on developing the<br />

markets of Eastern Europe has<br />

affected some companies all the<br />

more in the decline in the year<br />

2009, as markets such as Russia,<br />

the CIS states and Central<br />

European countries have now<br />

drastically cut their imports due<br />

to the lack of fi nancing facilities.<br />

(Table 7 “Imports by Central<br />

and East European countries”)<br />

“Tigers” – Europe’s<br />

Strongest Growing<br />

Manufacturers<br />

24 TRADER | 2 | 2009<br />

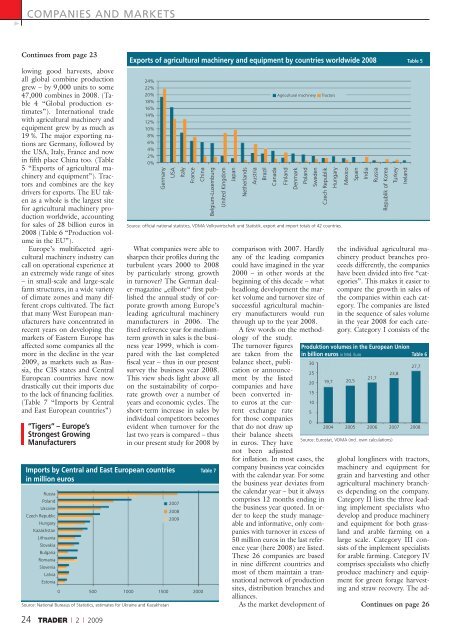

Exports of agricultural machinery and equipment by countries worldwide 2008 Table 5<br />

24%<br />

22%<br />

20%<br />

18%<br />

16%<br />

14%<br />

12%<br />

10%<br />

8%<br />

6%<br />

4%<br />

2%<br />

0%<br />

Germany<br />

USA<br />

Italy<br />

France<br />

China<br />

Belgium-Luxemburg<br />

What companies were able to<br />

sharpen their profi les during the<br />

turbulent years 2000 to 2008<br />

by particularly strong growth<br />

in turnover? The German dealer-magazine<br />

„eilbote“ fi rst published<br />

the annual study of corporate<br />

growth among Europe’s<br />

leading agricultural machinery<br />

manufacturers in 2006. The<br />

fi xed reference year for mediumterm<br />

growth in sales is the business<br />

year 1999, which is compared<br />

with the last completed<br />

fi scal year – thus in our present<br />

survey the business year 2008.<br />

This view sheds light above all<br />

on the sustainability of corporate<br />

growth over a number of<br />

years and economic cycles. The<br />

short-term increase in sales by<br />

individual competitors becomes<br />

evident when turnover for the<br />

last two years is compared – thus<br />

in our present study for 2008 by<br />

Imports by Central and East European countries Table 7<br />

in million euros<br />

Russia<br />

Poland<br />

Ukraine<br />

Czech Republic<br />

Hungary<br />

Kazakhstan<br />

Lithuania<br />

Slovakia<br />

Bulgaria<br />

Romania<br />

Slovenia<br />

Latvia<br />

Estonia<br />

Source: National Bureaus of Statistics, estimates for Ukraine and Kazakhstan<br />

United Kingdom<br />

Japan<br />

Netherlands<br />

Austria<br />

Brazil<br />

Canada<br />

Agricultural machinery Tractors<br />

Finland<br />

Denmark<br />

Poland<br />

Sweden<br />

Czech Republik<br />

Hungary<br />

Source: offi cial national statistics, VDMA Volkswirtschaft und Statistik, export and import totals of 42 countries.<br />

2007<br />

2008<br />

2009<br />

0 500 1000 1500 2000<br />

comparison with 2007. Hardly<br />

any of the leading companies<br />

could have imagined in the year<br />

2000 – in other words at the<br />

beginning of this decade – what<br />

headlong development the market<br />

volume and turnover size of<br />

successful agricultural machinery<br />

manufacturers would run<br />

through up to the year 2008.<br />

A few words on the method-<br />

ology of the study.<br />

The turnover fi gures<br />

are taken from the<br />

balance sheet, publication<br />

or announcement<br />

by the listed<br />

companies and have<br />

been converted into<br />

euros at the current<br />

exchange rate<br />

for those companies<br />

that do not draw up<br />

their balance sheets<br />

in euros. They have<br />

not been adjusted<br />

for infl ation. In most cases, the<br />

company business year coincides<br />

with the calendar year. For some<br />

the business year deviates from<br />

the calendar year – but it always<br />

comprises 12 months ending in<br />

the business year quoted. In order<br />

to keep the study manageable<br />

and informative, only companies<br />

with turnover in excess of<br />

50 million euros in the last reference<br />

year (here 2008) are listed.<br />

These 26 companies are based<br />

in nine different countries and<br />

most of them maintain a transnational<br />

network of production<br />

sites, distribution branches and<br />

alliances.<br />

As the market development of<br />

Mexico<br />

Spain<br />

India<br />

Russia<br />

Republik of Korea<br />

Turkey<br />

Ireland<br />

the individual agricultural machinery<br />

product branches proceeds<br />

differently, the companies<br />

have been divided into fi ve “categories”.<br />

This makes it easier to<br />

compare the growth in sales of<br />

the companies within each category.<br />

The companies are listed<br />

in the sequence of sales volume<br />

in the year 2008 for each category.<br />

Category I consists of the<br />

Produktion volumes in the European Union<br />

in billion euros in Mrd. Euro Table 6<br />

30<br />

27,7<br />

25<br />

20<br />

15<br />

10<br />

5<br />

0<br />

19,7 20,5<br />

21,7<br />

23,8<br />

2004 2005 2006 2007 2008<br />

Source: Eurostat, VDMA (incl. own calculations)<br />

global longliners with tractors,<br />

machinery and equipment for<br />

grain and harvesting and other<br />

agricultural machinery branches<br />

depending on the company.<br />

Category II lists the three leading<br />

implement specialists who<br />

develop and produce machinery<br />

and equipment for both grassland<br />

and arable farming on a<br />

large scale. Category III consists<br />

of the implement specialists<br />

for arable farming. Category IV<br />

comprises specialists who chiefl y<br />

produce machinery and equipment<br />

for green forage harvesting<br />

and straw recovery. The ad-<br />

Continues on page 26