Basics of Credit Risk - Universität Hohenheim

Basics of Credit Risk - Universität Hohenheim

Basics of Credit Risk - Universität Hohenheim

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

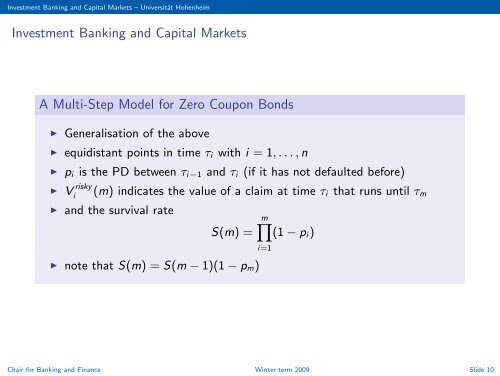

Investment Banking and Capital Markets – <strong>Universität</strong> <strong>Hohenheim</strong><br />

Investment Banking and Capital Markets<br />

A Multi-Step Model for Zero Coupon Bonds<br />

◮ Generalisation <strong>of</strong> the above<br />

◮ equidistant points in time τi with i = 1, . . . , n<br />

◮ pi is the PD between τi−1 and τi (if it has not defaulted before)<br />

◮ V risky<br />

i (m) indicates the value <strong>of</strong> a claim at time τi that runs until τm<br />

◮ and the survival rate<br />

S(m) =<br />

◮ note that S(m) = S(m − 1)(1 − pm)<br />

mY<br />

(1 − pi)<br />

Chair for Banking and Finance Winter term 2009 Slide 10<br />

i=1