Basics of Credit Risk - Universität Hohenheim

Basics of Credit Risk - Universität Hohenheim

Basics of Credit Risk - Universität Hohenheim

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Investment Banking and Capital Markets – <strong>Universität</strong> <strong>Hohenheim</strong><br />

Investment Banking and Capital Markets<br />

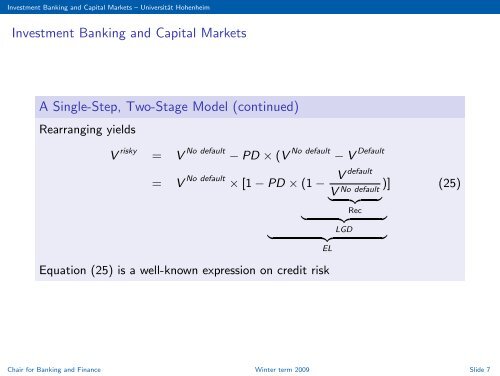

A Single-Step, Two-Stage Model (continued)<br />

Rearranging yields<br />

V risky = V No default − PD × (V No default − V Default<br />

= V No default × [1 − PD × (1 −<br />

default<br />

V<br />

) ] (25)<br />

V No default<br />

| {z }<br />

Rec<br />

| {z }<br />

LGD<br />

| {z }<br />

EL<br />

Equation (25) is a well-known expression on credit risk<br />

Chair for Banking and Finance Winter term 2009 Slide 7