Basics of Credit Risk - Universität Hohenheim

Basics of Credit Risk - Universität Hohenheim

Basics of Credit Risk - Universität Hohenheim

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

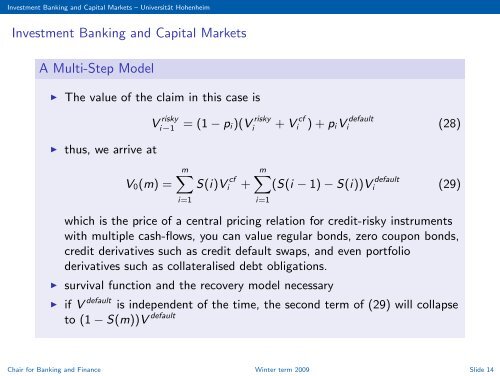

Investment Banking and Capital Markets – <strong>Universität</strong> <strong>Hohenheim</strong><br />

Investment Banking and Capital Markets<br />

A Multi-Step Model<br />

◮ The value <strong>of</strong> the claim in this case is<br />

◮ thus, we arrive at<br />

V risky<br />

i−1<br />

V0(m) =<br />

= (1 − pi)(V risky<br />

i<br />

mX<br />

i=1<br />

S(i)V cf<br />

i +<br />

mX<br />

i=1<br />

+ V cf<br />

i ) + piV default<br />

i<br />

(S(i − 1) − S(i))V default<br />

i<br />

(28)<br />

(29)<br />

which is the price <strong>of</strong> a central pricing relation for credit-risky instruments<br />

with multiple cash-flows, you can value regular bonds, zero coupon bonds,<br />

credit derivatives such as credit default swaps, and even portfolio<br />

derivatives such as collateralised debt obligations.<br />

◮ survival function and the recovery model necessary<br />

◮ if V default is independent <strong>of</strong> the time, the second term <strong>of</strong> (29) will collapse<br />

to (1 − S(m))V default<br />

Chair for Banking and Finance Winter term 2009 Slide 14