Basics of Credit Risk - Universität Hohenheim

Basics of Credit Risk - Universität Hohenheim

Basics of Credit Risk - Universität Hohenheim

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

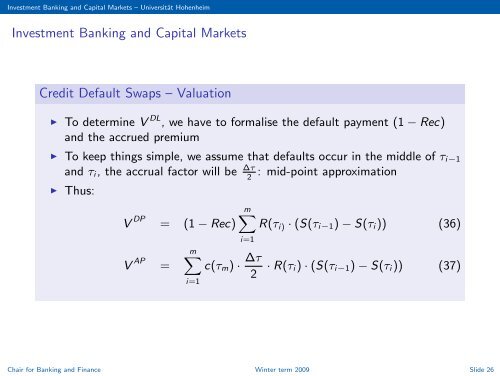

Investment Banking and Capital Markets – <strong>Universität</strong> <strong>Hohenheim</strong><br />

Investment Banking and Capital Markets<br />

<strong>Credit</strong> Default Swaps – Valuation<br />

◮ To determine V DL , we have to formalise the default payment (1 − Rec)<br />

and the accrued premium<br />

◮ To keep things simple, we assume that defaults occur in the middle <strong>of</strong> τi−1<br />

and τi, the accrual factor will be ∆τ<br />

: mid-point approximation<br />

2<br />

◮ Thus:<br />

V DP = (1 − Rec)<br />

V AP =<br />

mX<br />

i=1<br />

mX<br />

R(τi) · (S(τi−1) − S(τi)) (36)<br />

i=1<br />

c(τm) · ∆τ<br />

2 · R(τi) · (S(τi−1) − S(τi)) (37)<br />

Chair for Banking and Finance Winter term 2009 Slide 26