IPO Auctions: English, Dutch, ... French, and Internet

IPO Auctions: English, Dutch, ... French, and Internet

IPO Auctions: English, Dutch, ... French, and Internet

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

18 BIAIS AND FAUGERON-CROUZET<br />

investors do not have enough funds to buy the whole <strong>IPO</strong>. This is more realistic,<br />

given the relatively small size of <strong>IPO</strong> issues, compared to the large bidding power<br />

of institutional investors. Second, we consider N informed investors, with different<br />

<strong>and</strong> imperfect signals, rather than a single, perfectly informed investor.<br />

In the case of fixed price offers, the only choice of the seller is to set the price, p.<br />

Since the uninformed agents cannot absorb the whole issue, <strong>and</strong> since the seller<br />

must sell the S shares, he must ensure that the informed agents are willing to bid<br />

for the shares, even when they have observed bad signals. Hence, the price must<br />

be set to satisfy the individual rationality constraint of the informed agent with a<br />

bad signal.<br />

We assume that informed investors can costlessly bid for up to S shares. If they<br />

want to bid for a larger amount, up to ¯Q > S, they incur cost c. As only S shares<br />

are for sale, such very large bids are expected not to be fully executed. They can<br />

be optimal, however, to the extent that they enable the investor to obtain a larger<br />

share of underpriced <strong>and</strong> overbid issues. The cost c can be thought of as the cost<br />

of immobilizing funds during the period of the <strong>IPO</strong> (Keloharju (1993) notes that<br />

in Finl<strong>and</strong> this period can be quite long).<br />

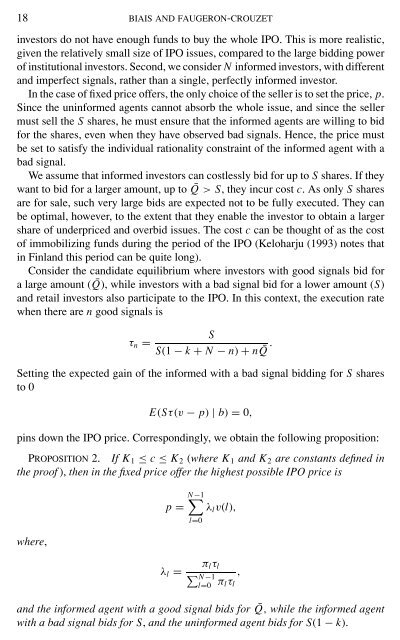

Consider the c<strong>and</strong>idate equilibrium where investors with good signals bid for<br />

a large amount ( ¯Q), while investors with a bad signal bid for a lower amount (S)<br />

<strong>and</strong> retail investors also participate to the <strong>IPO</strong>. In this context, the execution rate<br />

when there are n good signals is<br />

S<br />

τn =<br />

S(1 − k + N − n) + n ¯Q .<br />

Setting the expected gain of the informed with a bad signal bidding for S shares<br />

to 0<br />

E(Sτ(v − p) | b) = 0,<br />

pins down the <strong>IPO</strong> price. Correspondingly, we obtain the following proposition:<br />

PROPOSITION 2. If K1 ≤ c ≤ K2 (where K1 <strong>and</strong> K2 are constants defined in<br />

the proof ), then in the fixed price offer the highest possible <strong>IPO</strong> price is<br />

where,<br />

N−1<br />

p = λlv(l),<br />

λl =<br />

l=0<br />

πlτl<br />

N−1 l=0 πlτl<br />

,<br />

<strong>and</strong> the informed agent with a good signal bids for ¯Q, while the informed agent<br />

with a bad signal bids for S, <strong>and</strong> the uninformed agent bids for S(1 − k).