IPO Auctions: English, Dutch, ... French, and Internet

IPO Auctions: English, Dutch, ... French, and Internet

IPO Auctions: English, Dutch, ... French, and Internet

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

24 BIAIS AND FAUGERON-CROUZET<br />

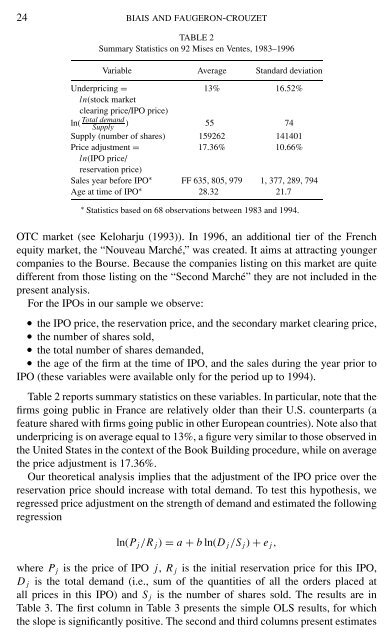

TABLE 2<br />

Summary Statistics on 92 Mises en Ventes, 1983–1996<br />

Variable Average St<strong>and</strong>ard deviation<br />

Underpricing =<br />

ln(stock market<br />

clearing price/<strong>IPO</strong> price)<br />

13% 16.52%<br />

ln(<br />

Total dem<strong>and</strong><br />

Supply<br />

) 55 74<br />

Supply (number of shares) 159262 141401<br />

Price adjustment =<br />

ln(<strong>IPO</strong> price/<br />

reservation price)<br />

17.36% 10.66%<br />

Sales year before <strong>IPO</strong>∗ FF 635, 805, 979 1, 377, 289, 794<br />

Age at time of <strong>IPO</strong>∗ 28.32 21.7<br />

∗ Statistics based on 68 observations between 1983 <strong>and</strong> 1994.<br />

OTC market (see Keloharju (1993)). In 1996, an additional tier of the <strong>French</strong><br />

equity market, the “Nouveau Marché,” was created. It aims at attracting younger<br />

companies to the Bourse. Because the companies listing on this market are quite<br />

different from those listing on the “Second Marché” they are not included in the<br />

present analysis.<br />

For the <strong>IPO</strong>s in our sample we observe:<br />

• the <strong>IPO</strong> price, the reservation price, <strong>and</strong> the secondary market clearing price,<br />

• the number of shares sold,<br />

• the total number of shares dem<strong>and</strong>ed,<br />

• the age of the firm at the time of <strong>IPO</strong>, <strong>and</strong> the sales during the year prior to<br />

<strong>IPO</strong> (these variables were available only for the period up to 1994).<br />

Table 2 reports summary statistics on these variables. In particular, note that the<br />

firms going public in France are relatively older than their U.S. counterparts (a<br />

feature shared with firms going public in other European countries). Note also that<br />

underpricing is on average equal to 13%, a figure very similar to those observed in<br />

the United States in the context of the Book Building procedure, while on average<br />

the price adjustment is 17.36%.<br />

Our theoretical analysis implies that the adjustment of the <strong>IPO</strong> price over the<br />

reservation price should increase with total dem<strong>and</strong>. To test this hypothesis, we<br />

regressed price adjustment on the strength of dem<strong>and</strong> <strong>and</strong> estimated the following<br />

regression<br />

ln(Pj/R j) = a + b ln(D j/S j) + e j,<br />

where Pj is the price of <strong>IPO</strong> j, R j is the initial reservation price for this <strong>IPO</strong>,<br />

D j is the total dem<strong>and</strong> (i.e., sum of the quantities of all the orders placed at<br />

all prices in this <strong>IPO</strong>) <strong>and</strong> S j is the number of shares sold. The results are in<br />

Table 3. The first column in Table 3 presents the simple OLS results, for which<br />

the slope is significantly positive. The second <strong>and</strong> third columns present estimates