IPO Auctions: English, Dutch, ... French, and Internet

IPO Auctions: English, Dutch, ... French, and Internet

IPO Auctions: English, Dutch, ... French, and Internet

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

28 BIAIS AND FAUGERON-CROUZET<br />

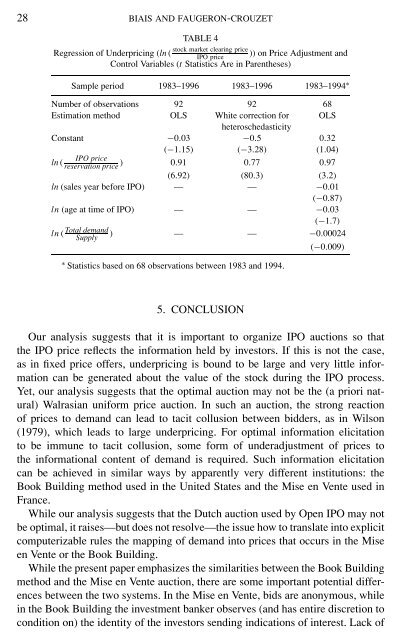

TABLE 4<br />

stock market clearing price<br />

Regression of Underpricing (ln ( <strong>IPO</strong> price )) on Price Adjustment <strong>and</strong><br />

Control Variables (t Statistics Are in Parentheses)<br />

Sample period 1983–1996 1983–1996 1983–1994 ∗<br />

Number of observations 92 92 68<br />

Estimation method OLS White correction for<br />

heteroschedasticity<br />

OLS<br />

Constant −0.03 −0.5 0.32<br />

(−1.15) (−3.28) (1.04)<br />

<strong>IPO</strong> price<br />

ln ( reservation price ) 0.91 0.77 0.97<br />

(6.92) (80.3) (3.2)<br />

ln (sales year before <strong>IPO</strong>) — — −0.01<br />

(−0.87)<br />

ln (age at time of <strong>IPO</strong>) — — −0.03<br />

(−1.7)<br />

ln (<br />

Total dem<strong>and</strong><br />

Supply<br />

) — — −0.00024<br />

(−0.009)<br />

∗ Statistics based on 68 observations between 1983 <strong>and</strong> 1994.<br />

5. CONCLUSION<br />

Our analysis suggests that it is important to organize <strong>IPO</strong> auctions so that<br />

the <strong>IPO</strong> price reflects the information held by investors. If this is not the case,<br />

as in fixed price offers, underpricing is bound to be large <strong>and</strong> very little information<br />

can be generated about the value of the stock during the <strong>IPO</strong> process.<br />

Yet, our analysis suggests that the optimal auction may not be the (a priori natural)<br />

Walrasian uniform price auction. In such an auction, the strong reaction<br />

of prices to dem<strong>and</strong> can lead to tacit collusion between bidders, as in Wilson<br />

(1979), which leads to large underpricing. For optimal information elicitation<br />

to be immune to tacit collusion, some form of underadjustment of prices to<br />

the informational content of dem<strong>and</strong> is required. Such information elicitation<br />

can be achieved in similar ways by apparently very different institutions: the<br />

Book Building method used in the United States <strong>and</strong> the Mise en Vente used in<br />

France.<br />

While our analysis suggests that the <strong>Dutch</strong> auction used by Open <strong>IPO</strong> may not<br />

be optimal, it raises—but does not resolve—the issue how to translate into explicit<br />

computerizable rules the mapping of dem<strong>and</strong> into prices that occurs in the Mise<br />

en Vente or the Book Building.<br />

While the present paper emphasizes the similarities between the Book Building<br />

method <strong>and</strong> the Mise en Vente auction, there are some important potential differences<br />

between the two systems. In the Mise en Vente, bids are anonymous, while<br />

in the Book Building the investment banker observes (<strong>and</strong> has entire discretion to<br />

condition on) the identity of the investors sending indications of interest. Lack of