IPO Auctions: English, Dutch, ... French, and Internet

IPO Auctions: English, Dutch, ... French, and Internet

IPO Auctions: English, Dutch, ... French, and Internet

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

20 BIAIS AND FAUGERON-CROUZET<br />

is rather inelastic: It takes a big price increase to increase the residual supply. This<br />

large price impact makes it unattractive for each investor to attempt to increase<br />

her purchases. Our theoretical model provides an alternative interpretation for the<br />

thought-provoking empirical findings of K<strong>and</strong>el et al. (1997) on the uniform price,<br />

market clearing <strong>IPO</strong> mechanism used in Israel. In particular, K<strong>and</strong>el et al. (1997)<br />

find that (i) there is significant underpricing, <strong>and</strong> (ii) the (absolute value of the)<br />

slope of the dem<strong>and</strong> schedules is low, i.e., there is a flat, around the <strong>IPO</strong> price.<br />

This is consistent with our theoretical result that the slope of the dem<strong>and</strong> curve σ<br />

must be low in the tacit-collusion Bayes-Nash equilibrium.<br />

Because of the strategic complementarities between the actions of the bidders<br />

in this auction, there exist multiple equilibria, some of which do not involve tacit<br />

collusion. Yet, it is likely that the bidders will focus on the tacit collusion Nash<br />

equilibrium presented in the proposition, since it is the most advantageous for<br />

them.<br />

To cope with tacit collusion within this mechanism while satisfying the individual<br />

rationality condition of the informed investor with a bad signal, it is best for<br />

the seller to set p ¯ to E(v | b).<br />

To conclude this subsection, note that although underpricing is less severe in this<br />

auction than in the fixed price offer, it is still quite significant, due the possibility<br />

of tacit collusion it offers to the bidders.<br />

3.3. The Mise en Vente<br />

The Mise en Vente is an auction-like <strong>IPO</strong> procedure commonly used in France.<br />

It operates as follows. Five days prior to the <strong>IPO</strong> the quantity offered <strong>and</strong> the<br />

reservation price are set jointly by the bank, the broker, <strong>and</strong> the firm. On the<br />

day of the <strong>IPO</strong>, investors submit limit orders to their brokers. The latter transmit<br />

these orders to the stock exchange. The total dem<strong>and</strong> function is computed<br />

<strong>and</strong> graphically plotted by the auctioneer, who is a Bourse official. As a function<br />

of this dem<strong>and</strong>, the auctioneer sets the <strong>IPO</strong> price. As in the Book Building<br />

method, there is no formal explicit algorithm mapping dem<strong>and</strong> into prices. But<br />

price adjustment in the Mise en Vente exhibits strong empirical regularities, as<br />

shown in the next section. Eligible orders, above the <strong>IPO</strong> price, obtain prorata<br />

execution.<br />

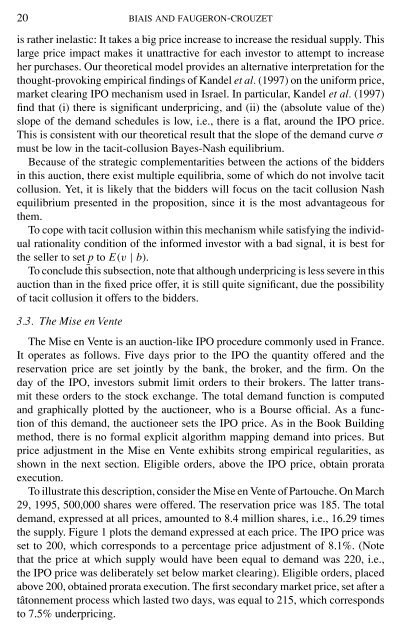

To illustrate this description, consider the Mise en Vente of Partouche. On March<br />

29, 1995, 500,000 shares were offered. The reservation price was 185. The total<br />

dem<strong>and</strong>, expressed at all prices, amounted to 8.4 million shares, i.e., 16.29 times<br />

the supply. Figure 1 plots the dem<strong>and</strong> expressed at each price. The <strong>IPO</strong> price was<br />

set to 200, which corresponds to a percentage price adjustment of 8.1%. (Note<br />

that the price at which supply would have been equal to dem<strong>and</strong> was 220, i.e.,<br />

the <strong>IPO</strong> price was deliberately set below market clearing). Eligible orders, placed<br />

above 200, obtained prorata execution. The first secondary market price, set after a<br />

tâtonnement process which lasted two days, was equal to 215, which corresponds<br />

to 7.5% underpricing.