IPO Auctions: English, Dutch, ... French, and Internet

IPO Auctions: English, Dutch, ... French, and Internet

IPO Auctions: English, Dutch, ... French, and Internet

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

14 BIAIS AND FAUGERON-CROUZET<br />

risk neutral, <strong>and</strong> this is a common value auction. The objective of the seller is to<br />

maximize the proceeds from the sale.<br />

Each large investor can buy the whole issue <strong>and</strong> observes a private signal si, i =<br />

1,...N. The signals are identically <strong>and</strong> independently distributed <strong>and</strong> can be good<br />

(g), with probability π, or bad (b) with the complementary probability. The value v<br />

of the shares on the secondary market is increasing in the number of good signals n<br />

<strong>and</strong> its realization is denoted vn.<br />

The retail investors, as a whole, can purchase up to S(1 − k) shares, with k ∈<br />

[0, 1].<br />

The financial intermediary is assumed to act in the best interest of the seller.<br />

She is in contact with the large institutional investors, <strong>and</strong> she has a distribution<br />

network, collecting the orders from the retail investors.<br />

Consider the following direct mechanism. Each informed investor i sends a<br />

message mi ∈{g, b}. The mechanism maps these N messages into a price <strong>and</strong><br />

into allocations to the informed agents <strong>and</strong> the retail uninformed agents. The<br />

mechanism is subject to several constraints. First, the price must be the same for<br />

all. This is to reflect the constraint, observed in practice, that <strong>IPO</strong> auctions involve<br />

uniform pricing (it should be noted, however, that Benveniste <strong>and</strong> Wilhelm<br />

(1990) show that investment bankers acting in the best interest of the firm could<br />

increase expected proceeds by using price discrimination). Second, since we assume<br />

the N large traders are ex ante identical, the mechanism is symmetric. Hence<br />

the price is simply a function of the total number of investors who report good<br />

signals ˆn, <strong>and</strong> is correspondingly denoted p(ˆn), while the quantity allocated to informed<br />

agent i depends only on her message mi <strong>and</strong> the number of other informed<br />

agents who reported good signals, li. Correspondingly it is denoted q(mi; li). Similarly,<br />

the quantity allocated to the uninformed agents depends only on ˆn, <strong>and</strong><br />

it is denoted qu(ˆn). Third, the allocation must be such that exactly S shares are<br />

sold.<br />

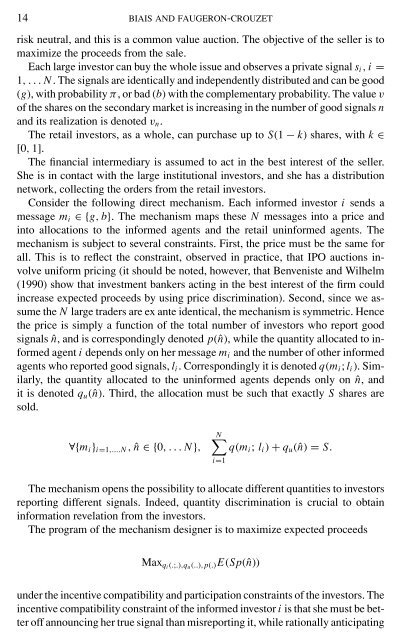

∀{mi}i=1,....N , ˆn ∈{0,...N},<br />

N<br />

q(mi; li) + qu(ˆn) = S.<br />

The mechanism opens the possibility to allocate different quantities to investors<br />

reporting different signals. Indeed, quantity discrimination is crucial to obtain<br />

information revelation from the investors.<br />

The program of the mechanism designer is to maximize expected proceeds<br />

i=1<br />

Maxqi (.;.),qu(..),p(.)E(Sp(ˆn))<br />

under the incentive compatibility <strong>and</strong> participation constraints of the investors. The<br />

incentive compatibility constraint of the informed investor i is that she must be better<br />

off announcing her true signal than misreporting it, while rationally anticipating