Private Equity and Venture Capital in Brazil - BVCA admin

Private Equity and Venture Capital in Brazil - BVCA admin

Private Equity and Venture Capital in Brazil - BVCA admin

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

22549-d-092308<br />

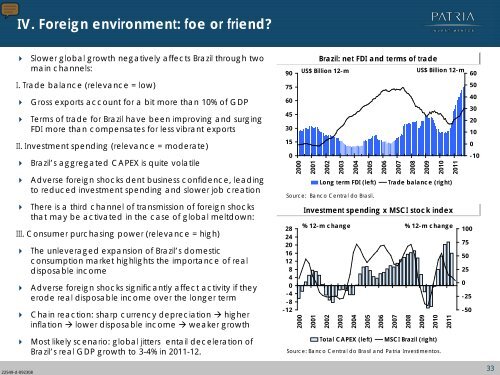

IV. Foreign environment: foe or friend?<br />

Slower global growth negatively affects <strong>Brazil</strong> through two<br />

ma<strong>in</strong> channels:<br />

I. Trade balance (relevance = low)<br />

Gross exports account for a bit more than 10% of GDP<br />

Terms of trade for <strong>Brazil</strong> have been improv<strong>in</strong>g <strong>and</strong> surg<strong>in</strong>g<br />

FDI more than compensates for less vibrant exports<br />

II. Investment spend<strong>in</strong>g (relevance = moderate)<br />

<strong>Brazil</strong>’s aggregated CAPEX is quite volatile<br />

Adverse foreign shocks dent bus<strong>in</strong>ess confidence, lead<strong>in</strong>g<br />

to reduced <strong>in</strong>vestment spend<strong>in</strong>g <strong>and</strong> slower job creation<br />

There is a third channel of transmission of foreign shocks<br />

that may be activated <strong>in</strong> the case of global meltdown:<br />

III. Consumer purchas<strong>in</strong>g power (relevance = high)<br />

The unleveraged expansion of <strong>Brazil</strong>’s domestic<br />

consumption market highlights the importance of real<br />

disposable <strong>in</strong>come<br />

Adverse foreign shocks significantly affect activity if they<br />

erode real disposable <strong>in</strong>come over the longer term<br />

Cha<strong>in</strong> reaction: sharp currency depreciation higher<br />

<strong>in</strong>flation lower disposable <strong>in</strong>come weaker growth<br />

Most likely scenario: global jitters entail deceleration of<br />

<strong>Brazil</strong>’s real GDP growth to 3-4% <strong>in</strong> 2011-12.<br />

90<br />

75<br />

60<br />

45<br />

30<br />

15<br />

0<br />

<strong>Brazil</strong>: net FDI <strong>and</strong> terms of trade<br />

Source: Banco Central do Brasil.<br />

28<br />

24<br />

20<br />

16<br />

12<br />

8<br />

4<br />

0<br />

-4<br />

-8<br />

-12<br />

2000<br />

2000<br />

US$ Billion 12-m<br />

2001<br />

Investment spend<strong>in</strong>g x MSCI stock <strong>in</strong>dex<br />

2001<br />

2002<br />

2002<br />

2003<br />

2003<br />

2004<br />

2004<br />

2005<br />

2005<br />

2006<br />

% 12-m change % 12-m change<br />

2006<br />

2007<br />

2007<br />

2008<br />

2008<br />

2009<br />

2010<br />

Total CAPEX (left) MSCI <strong>Brazil</strong> (right)<br />

US$ Billion 12-m<br />

2009<br />

Source: Banco Central do Brasil <strong>and</strong> Patria Investimentos.<br />

2010<br />

Long term FDI (left) Trade balance (right)<br />

2011<br />

2011<br />

100<br />

75<br />

50<br />

25<br />

0<br />

0<br />

-25<br />

-50<br />

60<br />

50<br />

40<br />

30<br />

20<br />

10<br />

-10<br />

33