Structural reforms and macro-economic policy - ETUC

Structural reforms and macro-economic policy - ETUC

Structural reforms and macro-economic policy - ETUC

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

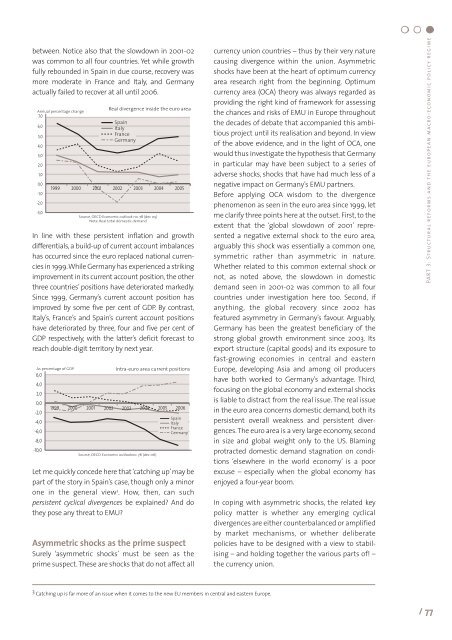

etween. Notice also that the slowdown in 2001-02<br />

was common to all four countries. Yet while growth<br />

fully rebounded in Spain in due course, recovery was<br />

more moderate in France <strong>and</strong> Italy, <strong>and</strong> Germany<br />

actually failed to recover at all until 2006.<br />

Annual percentage change<br />

7,0<br />

6,0<br />

5,0<br />

4,0<br />

3,0<br />

2,0<br />

1,0<br />

0,0<br />

-1,0<br />

-2,0<br />

-3,0<br />

Real divergence inside the euro area<br />

Spain<br />

Italy<br />

France<br />

Germany<br />

1999 2000 2001 2002 2003 2004 2005<br />

Source, OECD Economic outlook no. 78 (dec 05)<br />

Note. Real total domestic dem<strong>and</strong><br />

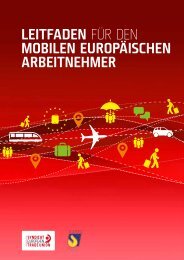

In line with these persistent inflation <strong>and</strong> growth<br />

differentials, a build-up of current account imbalances<br />

has occurred since the euro replaced national currencies<br />

in 1999.While Germany has experienced a striking<br />

improvement in its current account position, the other<br />

three countries’ positions have deteriorated markedly.<br />

Since 1999, Germany’s current account position has<br />

improved by some five per cent of GDP. By contrast,<br />

Italy’s, France’s <strong>and</strong> Spain’s current account positions<br />

have deteriorated by three, four <strong>and</strong> five per cent of<br />

GDP respectively, with the latter’s deficit forecast to<br />

reach double-digit territory by next year.<br />

As percentage of GDP<br />

6,0<br />

4,0<br />

2,0<br />

0,0<br />

-2,0<br />

-4,0<br />

-6,0<br />

-8,0<br />

-10,0<br />

Intra-euro area current positions<br />

1999 2000 2001 2002 2003 2004 2005 2006<br />

Source, OECD Economic outlookno. 78 (dec 06)<br />

Spain<br />

Italy<br />

France<br />

Germany<br />

Let me quickly concede here that ‘catching up’may be<br />

part of the story in Spain’s case, though only a minor<br />

one in the general view 3 . How, then, can such<br />

persistent cyclical divergences be explained? And do<br />

they pose any threat to EMU?<br />

Asymmetric shocks as the prime suspect<br />

Surely ‘asymmetric shocks’ must be seen as the<br />

prime suspect.These are shocks that do not affect all<br />

3 Catching up is far more of an issue when it comes to the new EU members in central <strong>and</strong> eastern Europe.<br />

currency union countries – thus by their very nature<br />

causing divergence within the union. Asymmetric<br />

shocks have been at the heart of optimum currency<br />

area research right from the beginning. Optimum<br />

currency area (OCA) theory was always regarded as<br />

providing the right kind of framework for assessing<br />

the chances <strong>and</strong> risks of EMU in Europe throughout<br />

the decades of debate that accompanied this ambitious<br />

project until its realisation <strong>and</strong> beyond. In view<br />

of the above evidence, <strong>and</strong> in the light of OCA, one<br />

would thus investigate the hypothesis that Germany<br />

in particular may have been subject to a series of<br />

adverse shocks, shocks that have had much less of a<br />

negative impact on Germany’s EMU partners.<br />

Before applying OCA wisdom to the divergence<br />

phenomenon as seen in the euro area since 1999, let<br />

me clarify three points here at the outset. First, to the<br />

extent that the ‘global slowdown of 2001’ represented<br />

a negative external shock to the euro area,<br />

arguably this shock was essentially a common one,<br />

symmetric rather than asymmetric in nature.<br />

Whether related to this common external shock or<br />

not, as noted above, the slowdown in domestic<br />

dem<strong>and</strong> seen in 2001-02 was common to all four<br />

countries under investigation here too. Second, if<br />

anything, the global recovery since 2002 has<br />

featured asymmetry in Germany’s favour. Arguably,<br />

Germany has been the greatest beneficiary of the<br />

strong global growth environment since 2003. Its<br />

export structure (capital goods) <strong>and</strong> its exposure to<br />

fast-growing economies in central <strong>and</strong> eastern<br />

Europe, developing Asia <strong>and</strong> among oil producers<br />

have both worked to Germany’s advantage. Third,<br />

focusing on the global economy <strong>and</strong> external shocks<br />

is liable to distract from the real issue. The real issue<br />

in the euro area concerns domestic dem<strong>and</strong>, both its<br />

persistent overall weakness <strong>and</strong> persistent divergences.The<br />

euro area is a very large economy, second<br />

in size <strong>and</strong> global weight only to the US. Blaming<br />

protracted domestic dem<strong>and</strong> stagnation on conditions<br />

‘elsewhere in the world economy’ is a poor<br />

excuse – especially when the global economy has<br />

enjoyed a four-year boom.<br />

In coping with asymmetric shocks, the related key<br />

<strong>policy</strong> matter is whether any emerging cyclical<br />

divergences are either counterbalanced or amplified<br />

by market mechanisms, or whether deliberate<br />

policies have to be designed with a view to stabilising<br />

– <strong>and</strong> holding together the various parts of! –<br />

the currency union.<br />

PART 3: <strong>Structural</strong> <strong>reforms</strong> <strong>and</strong> the european <strong>macro</strong>-<strong>economic</strong> <strong>policy</strong> regime<br />

/ 77