The Global Cheese Market Report 2000-‐2015 - Moproweb

The Global Cheese Market Report 2000-‐2015 - Moproweb

The Global Cheese Market Report 2000-‐2015 - Moproweb

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

<strong>The</strong> <strong>Global</strong> <strong>Cheese</strong> <strong>Market</strong> <strong>Report</strong><br />

<strong>2000</strong>-<strong>‐2015</strong><br />

PM FOOD & DAIRY CONSULTING<br />

JANUARY 2012

New report about the global cheese market – Subscribe now!<br />

• Price: €3,500 / $4,700<br />

• 400 pages of valuable information<br />

• Order by replying to this mail and receive an invoice<br />

• Your company will receive the report electronically when the payment is registered<br />

• You can subscribe on mikkelsenpreben@hotmail.com<br />

• Find more information about PM FOOD & DAIRY CONSULTING www.pmfood.dk<br />

<strong>The</strong> World <strong>Cheese</strong> <strong>Market</strong> <strong>Report</strong><br />

PM FOOD & DAIRY CONSULTING is publishing a new report: <strong>The</strong> World <strong>Cheese</strong> <strong>Market</strong> <strong>Report</strong><br />

2010-<strong>‐2015</strong> in January 2011. It is a follow up on the report from 2009: <strong>The</strong> <strong>Global</strong> <strong>Cheese</strong> <strong>Market</strong>s<br />

–Opportunities and Challenges in a volatile <strong>Market</strong>, but the new report contains a lot of new<br />

features and valuable information (see content of the report). <strong>The</strong> report gives the overall view of<br />

the development on the world market for cheese in the <strong>2000</strong>s in all regions of the world. <strong>The</strong><br />

future prospects for cheese in the next decade is analyzed with focus on consumer trends, impact<br />

of the economic crisis, developments in the emerging dairy markets, and prognosis for the overall<br />

prospects until 2020.<br />

<strong>The</strong> report also provides in debt analysis of more than 60 countries from all region of the world.<br />

This provides all the necessary information for evaluating the different cheese markets in the<br />

world and the future potential for expansion.<br />

Is your company seeking new opportunities in the global cheese market this report is a must!<br />

Background<br />

Several dairy experts have in advocated that the future for the dairy sector will be to return to the<br />

basic commodities butter and milk powder instead of value added products like cheese.<br />

PM FOOD & DAIRY CONSULTING examine this statement and evaluates the future prospects for<br />

the world cheese market in spite of short term changes.<br />

<strong>The</strong> main thesis of the report is that cheese has a dynamic prospect in medium/long term.<br />

However, the cheese segment has to adapt to the new situation saturated markets in OECD and<br />

no tradition for consuming cheese in the emerging dairy markets.<br />

<strong>The</strong> development in the last five years in the global dairy and cheese market have shown what<br />

volatility means. <strong>The</strong> dairy commodity prices rocketed from 2005 to 2008 including cheese<br />

1

ecause of the rapid economic growth in most regions of the world. <strong>The</strong> growth was created by<br />

the demand for dairy products that for the first time in three decades surpassed the supply. <strong>The</strong><br />

general fiscal crisis from mid-‐ 2008 altered the situation and the prices declined and the global<br />

dairy sector was hit severely with declining prices and world and regional level. At the same time<br />

the production cost for both milk production and dairy processing remained at a high level. This<br />

lead to a cost squeeze and the situation eased late 2010 when the dairy prices recovered.<br />

During the financial crisis the demand for whole milk powder continued to grow due to the milk<br />

balance problems in especially China and Brazil. Several of the major exporting dairy countries<br />

with New Zealand in the lead changed strategy and turned away from cheese towards the basis<br />

dairy commodities – butter and milk powder. Opposite Russia was the driving force for expanding<br />

the cheese export because the domestic milk production still is unable to meet the demand for all<br />

dairy products especially cheese.<br />

<strong>The</strong> turbulence the last five years show how fast the world dairy market can change and how the<br />

demand for dairy products shift.<br />

Several dairy experts have in advocated that the future for the dairy sector will be to return to the<br />

basic commodities butter and milk powder instead of value added products like cheese. PM FOOD<br />

& DAIRY CONSULTING contests this analysis and the report will show the dynamics of the world<br />

cheese market in the medium – long term.<br />

<strong>The</strong> aim of the report is to analyze the future prospects for the world cheese market will develop<br />

in the next decade and answer the following questions:<br />

• What has been the impact on the cheese sector of the financial crisis – will the<br />

dynamic growth from the <strong>2000</strong>s return?<br />

• Can cheese be a future product in the emerging dairy markets where the expansion<br />

until now has focused on fresh dairy products and milk powder?<br />

• Can the cheese market regain the value growth in the matured OECD dairy markets<br />

where private label and discount cheese has gained market shares in recent years?<br />

• What are the future consumer trends for cheese in different parts of the world?<br />

• What has to be focus of the cheese processing companies in relation to innovation<br />

and marketing to develop the cheese market in the emerging dairy markets?<br />

• <strong>The</strong> report will identify the major cheese processing dairy company’s in the future<br />

on national, regional and global scale.<br />

• How will the trade patterns for cheese develop in the next decade and will new<br />

countries and companies enter the world market?<br />

2

Content of the report: <strong>The</strong> World <strong>Cheese</strong> <strong>Market</strong> 2010-‐2020<br />

i. Introduction<br />

ii. Methodology<br />

Part I: World cheese market 2010-‐2020<br />

1. World cheese production<br />

1.1. Production <strong>2000</strong>-‐2010<br />

1.2. Major cheese producing countries<br />

1.3. Production of the major cheese types<br />

1.4. Future prospects 2010-‐2020<br />

2. World trade patterns<br />

2.1. World trade developments <strong>2000</strong>-‐2010<br />

2.2. Major exporting and importing countries<br />

2.3. New WTO –agreement?<br />

2.4. Future trade developments<br />

3. <strong>Cheese</strong> consumption<br />

3.1. Consumption <strong>2000</strong>-‐2010<br />

3.2. Consumption per capita<br />

3.3. Consumption prognosis 2010-‐2020<br />

4. <strong>Cheese</strong> price<br />

4.1. Development in <strong>2000</strong>s<br />

4.2. Value of the world cheese market<br />

4.3. Future price developments<br />

5. Major cheese processing companies<br />

5.1. Top-‐20 cheese processing companies<br />

5.2. <strong>Global</strong> players in the next decade<br />

5.3. How to penetrate the emerging dairy markets<br />

6. Future trends<br />

6.1. <strong>Cheese</strong> as ingredient<br />

6.2. Analogue cheese<br />

6.3. Food service and food industry<br />

6.4. New cheese types for the future<br />

7. External factors affecting the cheese market<br />

7.1. Policy changes<br />

7.2. Economic development<br />

7.3. SWOT analysis of the world cheese market<br />

8. Conclusions<br />

8.1. Prognosis for 2020<br />

3

8.2. Will cheese be a success product for the 2010s?<br />

Part II: <strong>Cheese</strong> country analysis<br />

<strong>The</strong> report analysis more than 60 countries in all regions of the world and the respective cheese<br />

market analysis have the following content:<br />

1. General country information<br />

2. <strong>The</strong> dairy sector in general<br />

3. <strong>Cheese</strong> production<br />

3.1. Traditional country cheese<br />

3.2. Production <strong>2000</strong>-<strong>‐2015</strong><br />

4. Export and import<br />

5. Major cheese processing companies<br />

6. Consumption<br />

7. <strong>Cheese</strong> market<br />

8. Future prospects<br />

<strong>The</strong> description contains statistics from <strong>2000</strong>-‐2010 and the country prognosis reach until 2015.<br />

<strong>The</strong> countries included in the report are:<br />

EU 27<br />

Austria, Belgium, Denmark, Sweden, Finland, France, Germany, Netherlands, UK, Ireland,<br />

Portugal, Spain, Italy, Greece, Estonia, Latvia, Lithuania, Poland, Czech Republic, Slovakia,<br />

Hungary, Slovenia, Bulgaria, Romania<br />

Other European countries:<br />

Norway, Switzerland, Croatia, Bosnia-‐Herzegovina<br />

CIS:<br />

Russia, Ukraine, Belarus<br />

Middle East and Africa:<br />

Turkey, Israel, Egypt, Saudi Arabia, Morocco, Kenya, South Africa<br />

North America:<br />

USA, Canada, Mexico<br />

4

South America:<br />

Brazil, Argentina, Columbia, Chile, Venezuela, Uruguay, Paraguay, Peru, Bolivia, Ecuador<br />

Asia:<br />

China, India, Indonesia, Japan, Malaysia, Philippines, South Korea, Taiwan, Vietnam.<br />

Oceania:<br />

Australia, New Zealand<br />

5

Croatia<br />

1. General information<br />

EXTRACT FROM THE REPORT<br />

<strong>The</strong> lands that today comprise Croatia were part of the Austro-‐Hungarian Empire until the close of<br />

World War I. In 1918, the Croats, Serbs, and Slovenes formed a kingdom known after 1929 as<br />

Yugoslavia. Following World War II, Yugoslavia became a federal independent Communist state<br />

under the strong hand of Marshal TITO.<br />

Although Croatia declared its independence from Yugoslavia in 1991, it took four years of<br />

sporadic, but often bitter, fighting before occupying Serb armies were mostly cleared from<br />

Croatian lands.<br />

Under UN supervision, the last Serb-‐held enclave in eastern Slavonia was returned to Croatia in<br />

1998.<br />

In April 2009, Croatia joined NATO; it is a candidate for eventual EU accession in 2013<br />

Table 1: Key indicators for Croatia<br />

Subject Information World ranking<br />

Area 56,394 km 2<br />

127<br />

Population 4.4 million 124<br />

Population growth rate -‐0.07% 224<br />

Capitol Zagreb<br />

Arable land 26%<br />

Religion 88% Roman Catholic<br />

Urbanization 58%<br />

GDP $78 billion 79<br />

GDP growth rate -‐1.4%(2010)<br />

2.0%(2011)<br />

GDP per capita $17,400 67<br />

Source: Economist, CIA, OECD, PM FOOD<br />

Once one of the wealthiest of the Yugoslav republics, Croatia's economy suffered badly during the<br />

1991-‐95 war as output collapsed and the country missed the early waves of investment in Central<br />

and Eastern Europe that followed the fall of the Berlin Wall.<br />

6

Between <strong>2000</strong> and 2007, however, Croatia's economic fortunes began to improve slowly, with<br />

moderate but steady GDP growth between 4% and 6% led by a rebound in tourism and credit-‐<br />

driven consumer spending. Inflation over the same period has remained tame and the currency,<br />

the kuna, stable. Nevertheless, difficult problems still remain, including a stubbornly high<br />

unemployment rate, a growing trade deficit and uneven regional development.<br />

<strong>The</strong> state retains a large role in the economy, as privatization efforts often meet stiff public and<br />

political resistance. While macroeconomic stabilization has largely been achieved, structural<br />

reforms lag because of deep resistance on the part of the public and lack of strong support from<br />

politicians. <strong>The</strong> EU accession process should accelerate fiscal and structural reform.<br />

While long term growth prospects for the economy remain strong, Croatia will face significant<br />

pressure as a result of the global financial crisis. Croatia's high foreign debt, anemic export sector,<br />

strained state budget, and over-‐reliance on tourism revenue will result in higher risk to economic<br />

stability over the medium term.<br />

2. <strong>The</strong> dairy sector in general<br />

<strong>The</strong> dairy industry is one of the most important parts of Croatian agriculture with 9% of the total<br />

agricultural production value. <strong>The</strong>re are more than 20,000 dairy farms in Croatia and they are very<br />

small, however the number of dairy farmers has been halved from <strong>2000</strong> to 2007. In the same<br />

period the yield per cow has increased from 2,300kg to 3,555kg.<br />

<strong>The</strong> overall milk production in Croatia declined in the last decade but the deliveries to dairies have<br />

increased significantly with 75% illustrating the improvements in the dairy sector.<br />

Table 2: Key dairy figures <strong>2000</strong>-‐2011<br />

Milk production <strong>2000</strong> 2005 2009 2010 2011<br />

Dairy cattle (1,000) 287 239 212 -‐ -‐<br />

Milk production (1,000<br />

MT)<br />

607 1,073 818 800 850<br />

Deliveries to dairies<br />

(1,000 MT)<br />

Production of dairy<br />

products (1,000 MT)<br />

380 605 675 670 710<br />

Liquid milk 296 325 322 310 300<br />

Fermented products 55 83 104 110 120<br />

Cream -‐ -‐ 27 25 26<br />

Butter 2 4 6 6 8<br />

SMP 3 3 3 4 5<br />

WMP 1 1 1 -‐ -‐<br />

WP -‐ -‐ 5 5 7<br />

Source: IDF, ZMP, PM FOOD & DAIRY CONSULTING<br />

<strong>The</strong> production of dairy products has enlarged due to the growing supply for processing mainly for<br />

liquid milk and fermented products. <strong>The</strong> production of liquid milk accounts for 65% of the milk,<br />

fermented products 11%, cheese 6% and other dairy products 18%.<br />

7

3. <strong>Cheese</strong> production<br />

<strong>Cheese</strong> still plays a minor role in the Croatian dairy industry but the production has improved<br />

along with the growing supply of milk to the dairies. From <strong>2000</strong> to 2010 the production increased<br />

by nearly 50%. However, the GFC has affected the Croatian economy severely and also the<br />

domestic demand for cheese.<br />

Table 3: <strong>Cheese</strong> production in Croatia <strong>2000</strong>-<strong>‐2015</strong><br />

1,000 MT <strong>2000</strong> 2005 2009 2010 2011 2015<br />

Total 19 26 30 28 29 32<br />

Source: ZMP, IDF, CNIEL, PM FOOD & DAIRY CONSULTING<br />

<strong>The</strong> future prospects are uncertain for several reasons. First, how soon will the economy recover<br />

and improve the purchasing power of the Croatian consumers? Secondly, how much will the<br />

foreign dairy companies invest in cheese production in Croatia or will they rely on increasing<br />

import from other countries where they produce cheese. Finally, what will the impact be if Croatia<br />

becomes a member of EU in 2013 and there will be free access to the Croatian dairy market?<br />

<strong>The</strong> prognosis is that the cheese production will increase modestly with 4,000 MT from 2010 to<br />

2015.<br />

4. Export and import<br />

Croatia is a net-‐importer of dairy products and this is also the case for cheese. <strong>The</strong> export is<br />

minimal and it is expected to remain stable also until 2015. <strong>The</strong> export is mainly to the other<br />

countries in the former Yugoslavia and the majority of the import comes from Germany.<br />

Table 4 <strong>Cheese</strong> export and import 2005-<strong>‐2015</strong><br />

1,000 MT 2005 2009 2010 2011 2015<br />

Export 2 2 1 2 3<br />

Import 9 11 10 12 20<br />

Net-‐import 7 9 9 10 17<br />

Source: IDF, ZMP, PM FOOD & DAIRY CONSULTING<br />

<strong>The</strong> import is increasing and a possible membership of EU will increase the import and the<br />

competition for the domestic dairy industry.<br />

5. Major cheese producing companies<br />

<strong>The</strong> milk processing in Croatia is handled by 37 dairy companies. <strong>The</strong> 5 largest dairies process 80%<br />

of the delivered. Most other dairies are craft-‐type and they process up to 10,000 kg milk per day.<br />

<strong>The</strong> existing capacities satisfy the domestic needs for milk processing.<br />

8

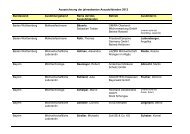

Table 5 Key dairy companies in Croatia<br />

Company Milk intake (1,000 MT) % of total milk<br />

Dukat 275 42<br />

Vindija 160 25<br />

Meggle Hvatska 45 7<br />

Ledo 30 4<br />

Kim Mljekare 22 3<br />

Others 124 19<br />

Total 656 100<br />

Source: CLC ( Croatia Livestock Centre)<br />

<strong>The</strong> two largest dairy companies Dukat and Vindija processes more than 2/3 of the milk. <strong>The</strong>y have<br />

modern production technology and comply with the hygiene and quality standards from EU.<br />

<strong>The</strong> Croatian dairy industry has penetrated by the EU dairy companies and they control the<br />

majority of the dairy production and this also includes the cheese production. Several EU based<br />

companies have in invested in Croatia before a possible EU membership in 2013 to be able to take<br />

advantage of the opportunities that follows from opening the Croatian dairy market.<br />

<strong>The</strong> major cheese producing companies are:<br />

Dukat<br />

<strong>The</strong> company was established in 1912 and it has reached a dominating position by continuous<br />

mergers and acquisitions through the years. <strong>The</strong> company has national coverage with dairy<br />

products and produces the full range of dairy products – fresh dairy products, butter, and cheese.<br />

In 2007, Lactalis acquired the company as part of their Balkan strategy that also included<br />

production in Bosnia-‐Herzegovina, Macedonia, and Romania. <strong>The</strong> focus is now to develop the<br />

Dukat brand into a regional brand. At the moment Dukat has five processing plants in Croatia and<br />

in 2009 the company took over KIM dairy company (no. 5 in Croatia) with a milk intake of 22,000<br />

MT.<br />

Dukat produces approximately 15,000 MT of cheese annually mainly hard and semi-‐hard cheese.<br />

Vindija<br />

Vindija is the second largest dairy in Croatia that process 160,000 MT milk annually. <strong>The</strong> company<br />

is a food company that operates in poultry, meat and bakery besides dairy. In the dairy business<br />

Vindija has been focusing on the domestic market. <strong>The</strong> company has two processing plants in<br />

Varazdin County. <strong>The</strong> annual cheese production amounts to 7,000 MT.<br />

<strong>The</strong> other cheese processing dairy companies are small craft-‐type operations with local focus.<br />

Meggle from Germany has also established dairy production in Croatia but the focus is on fresh<br />

dairy products, butter and ingredients.<br />

<strong>The</strong> possible EU membership will be a huge challenge for the Croatian dairy industry and rapid<br />

concentration can be foreseen also in the cheese production.<br />

9

6. Consumption<br />

In the first part of <strong>2000</strong>s, the consumption increased due to the economic growth. From 2008 until<br />

now, the consumption of cheese has suffered from the impact of the GFC and the level has<br />

declined with 25%.<br />

Table 6: <strong>Cheese</strong> consumption 2005-<strong>‐2015</strong><br />

2005 2007 2009 2010 2015<br />

Total (1,000 MT) 33 37 31 28 38<br />

Per capita (kg) 7.0 8.2 6.9 6.6 8.3<br />

Source: IDF, PM FOOD & DAIRY CONSULTING<br />

<strong>The</strong> consumption is expected regain the dynamic path in the future along with the expected<br />

recovery of the economy. <strong>The</strong> consumption is expected to reach the 2007-‐level in 2015.<br />

7.<strong>Cheese</strong> market<br />

<strong>The</strong> Croatian consumers are very loyal to the domestic standard types of cheese in spite of the<br />

availability of imported cheese and premium products. <strong>The</strong> sales of cheese have followed the<br />

turbulence of the economy both in volume and value terms.<br />

<strong>The</strong> major outlet for cheese in Croatia is supermarkets/hypermarkets, accounting for 60% retail<br />

value sales in 2010. <strong>The</strong> share of convenience stores and independent small grocers is declining,<br />

since they cannot compete with the prices offered by the supermarkets/hypermarkets.<br />

Table 7: <strong>Cheese</strong> company shares 2005-‐2009 (%retail value)<br />

Company 2005 2007 2009 Brands<br />

Dukat 36.1 36.5 40.0 Sirela, Dukatela, Dukat<br />

Vindija 16.6 18.0 16.4 Z Bregov, Varazdinec, Vindija,<br />

Gebrüder Woerle 7.4 7.7 7.9 Happy Cow<br />

Kraft Foods 5.5 5.4 5.7 Philadelphia<br />

Meggle Hrvatska 2.5 2.9 3.3 Meggle<br />

Zott 3.5 3.4 3.0 Zottarella, Zott Toasty<br />

Bayernland 2.8 2.5 2.8 Gouda, Edamer, Kerniger, Chester Cheddar, BL<br />

Mozzarella<br />

Unilever 2.9 2.9 2.5 Rama Créme Bonjour<br />

Belje 2.3 2.3 2.1 Buco<br />

Konzum 0.6 1.1 1.4 K Plus<br />

Zanetti 0.3 0.4 0.3 Mascarpone Italioano, Ricotta<br />

Other private label 1,4 2.5 3.2<br />

Others 18.1 14.4 14.4<br />

Total 100.0 100.0 100.0<br />

Source: Euromonitor International, PM FOOD & DAIRY CONSULTING<br />

Dukat (Lactalis) is the undisputed market leader with 40% ahead of Vindija with 16% market value<br />

share. Foreign dairy companies like Kraft Foods, Meggle, Zott, Gebrüder Woerle, Bayernland,<br />

Unilever and Zanetti also play a role on the Croatian dairy market.<br />

10

Private label has gained market shares during the GFC and this trend is expected to continue in the<br />

future.<br />

8. Future prospects<br />

<strong>The</strong> Croatian cheese production and market is relatively small but in spite of this it has attracted a<br />

lot of interest from foreign dairy companies with Lactalis in the lead. <strong>The</strong> coming EU membership<br />

is the major reason, and the possibilities to get further access to the dairy market. This is also<br />

expected to have a positive effect on the cheese market and the future prospects from 2010 to<br />

2015 are:<br />

• <strong>The</strong> production will increase by 4,000 MT but this is only to regain the level before the<br />

GFC.<br />

• <strong>The</strong> export remains stable at a very level but the import will increase by 8,000 MT<br />

especially due to the coming EU membership.<br />

• <strong>The</strong> consumption will soar in line with the economic recovery with 10,000 MT.<br />

11