Annual Report 2011 - Food Junction

Annual Report 2011 - Food Junction

Annual Report 2011 - Food Junction

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Notes to the Financial Statements (cont’d)<br />

31 December <strong>2011</strong><br />

2. Summary of significant accounting policies (cont’d)<br />

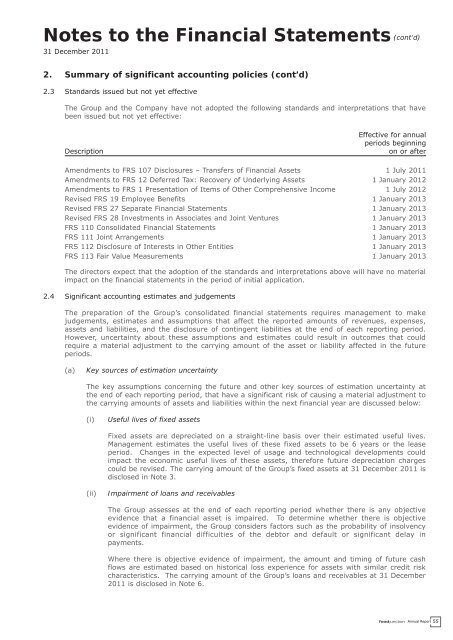

2.3 Standards issued but not yet effective<br />

The Group and the Company have not adopted the following standards and interpretations that have<br />

been issued but not yet effective:<br />

Description<br />

Effective for annual<br />

periods beginning<br />

on or after<br />

Amendments to FRS 107 Disclosures – Transfers of Financial Assets 1 July <strong>2011</strong><br />

Amendments to FRS 12 Deferred Tax: Recovery of Underlying Assets 1 January 2012<br />

Amendments to FRS 1 Presentation of Items of Other Comprehensive Income 1 July 2012<br />

Revised FRS 19 Employee Benefits 1 January 2013<br />

Revised FRS 27 Separate Financial Statements 1 January 2013<br />

Revised FRS 28 Investments in Associates and Joint Ventures 1 January 2013<br />

FRS 110 Consolidated Financial Statements 1 January 2013<br />

FRS 111 Joint Arrangements 1 January 2013<br />

FRS 112 Disclosure of Interests in Other Entities 1 January 2013<br />

FRS 113 Fair Value Measurements 1 January 2013<br />

The directors expect that the adoption of the standards and interpretations above will have no material<br />

impact on the financial statements in the period of initial application.<br />

2.4 Significant accounting estimates and judgements<br />

The preparation of the Group’s consolidated financial statements requires management to make<br />

judgements, estimates and assumptions that affect the reported amounts of revenues, expenses,<br />

assets and liabilities, and the disclosure of contingent liabilities at the end of each reporting period.<br />

However, uncertainty about these assumptions and estimates could result in outcomes that could<br />

require a material adjustment to the carrying amount of the asset or liability affected in the future<br />

periods.<br />

(a) Key sources of estimation uncertainty<br />

The key assumptions concerning the future and other key sources of estimation uncertainty at<br />

the end of each reporting period, that have a significant risk of causing a material adjustment to<br />

the carrying amounts of assets and liabilities within the next financial year are discussed below:<br />

(i) Useful lives of fixed assets<br />

Fixed assets are depreciated on a straight-line basis over their estimated useful lives.<br />

Management estimates the useful lives of these fixed assets to be 6 years or the lease<br />

period. Changes in the expected level of usage and technological developments could<br />

impact the economic useful lives of these assets, therefore future depreciation charges<br />

could be revised. The carrying amount of the Group’s fixed assets at 31 December <strong>2011</strong> is<br />

disclosed in Note 3.<br />

(ii) Impairment of loans and receivables<br />

The Group assesses at the end of each reporting period whether there is any objective<br />

evidence that a financial asset is impaired. To determine whether there is objective<br />

evidence of impairment, the Group considers factors such as the probability of insolvency<br />

or significant financial difficulties of the debtor and default or significant delay in<br />

payments.<br />

Where there is objective evidence of impairment, the amount and timing of future cash<br />

flows are estimated based on historical loss experience for assets with similar credit risk<br />

characteristics. The carrying amount of the Group’s loans and receivables at 31 December<br />

<strong>2011</strong> is disclosed in Note 6.<br />

<strong>Annual</strong> <strong>Report</strong> 55