Annual Report 2011 - Food Junction

Annual Report 2011 - Food Junction

Annual Report 2011 - Food Junction

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

74<br />

Notes to the Financial Statements (cont’d)<br />

31 December <strong>2011</strong><br />

4. Investment in subsidiary companies<br />

Loan to subsidiary companies (cont’d)<br />

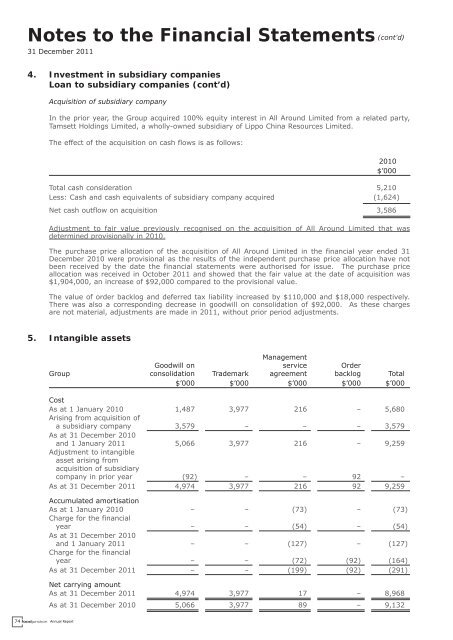

Acquisition of subsidiary company<br />

In the prior year, the Group acquired 100% equity interest in All Around Limited from a related party,<br />

Tamsett Holdings Limited, a wholly-owned subsidiary of Lippo China Resources Limited.<br />

The effect of the acquisition on cash flows is as follows:<br />

<strong>Annual</strong> <strong>Report</strong><br />

2010<br />

$’000<br />

Total cash consideration 5,210<br />

Less: Cash and cash equivalents of subsidiary company acquired (1,624)<br />

Net cash outflow on acquisition 3,586<br />

Adjustment to fair value previously recognised on the acquisition of All Around Limited that was<br />

determined provisionally in 2010.<br />

The purchase price allocation of the acquisition of All Around Limited in the financial year ended 31<br />

December 2010 were provisional as the results of the independent purchase price allocation have not<br />

been received by the date the financial statements were authorised for issue. The purchase price<br />

allocation was received in October <strong>2011</strong> and showed that the fair value at the date of acquisition was<br />

$1,904,000, an increase of $92,000 compared to the provisional value.<br />

The value of order backlog and deferred tax liability increased by $110,000 and $18,000 respectively.<br />

There was also a corresponding decrease in goodwill on consolidation of $92,000. As these charges<br />

are not material, adjustments are made in <strong>2011</strong>, without prior period adjustments.<br />

5. Intangible assets<br />

Group<br />

Goodwill on<br />

Management<br />

service<br />

Order<br />

consolidation Trademark agreement backlog Total<br />

$’000 $’000 $’000 $’000 $’000<br />

Cost<br />

As at 1 January 2010 1,487 3,977 216 – 5,680<br />

Arising from acquisition of<br />

a subsidiary company 3,579 – – – 3,579<br />

As at 31 December 2010<br />

and 1 January <strong>2011</strong> 5,066 3,977 216 – 9,259<br />

Adjustment to intangible<br />

asset arising from<br />

acquisition of subsidiary<br />

company in prior year (92) – – 92 –<br />

As at 31 December <strong>2011</strong> 4,974 3,977 216 92 9,259<br />

Accumulated amortisation<br />

As at 1 January 2010 – – (73) – (73)<br />

Charge for the financial<br />

year – – (54) – (54)<br />

As at 31 December 2010<br />

and 1 January <strong>2011</strong> – – (127) – (127)<br />

Charge for the financial<br />

year – – (72) (92) (164)<br />

As at 31 December <strong>2011</strong> – – (199) (92) (291)<br />

Net carrying amount<br />

As at 31 December <strong>2011</strong> 4,974 3,977 17 – 8,968<br />

As at 31 December 2010 5,066 3,977 89 – 9,132