TAX AUDIT

TAX AUDIT

TAX AUDIT

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

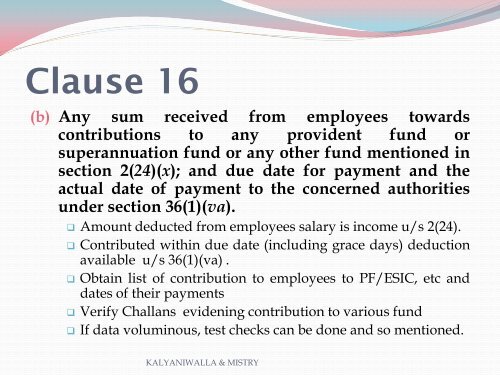

Clause 16<br />

(b) Any sum received from employees towards<br />

contributions to any provident fund or<br />

superannuation fund or any other fund mentioned in<br />

section 2(24)(x); and due date for payment and the<br />

actual date of payment to the concerned authorities<br />

under section 36(1)(va).<br />

Amount deducted from employees salary is income u/s 2(24).<br />

Contributed within due date (including grace days) deduction<br />

available u/s 36(1)(va) .<br />

Obtain list of contribution to employees to PF/ESIC, etc and<br />

dates of their payments<br />

Verify Challans evidening contribution to various fund<br />

If data voluminous, test checks can be done and so mentioned.<br />

KALYANIWALLA & MISTRY