TAX AUDIT

TAX AUDIT

TAX AUDIT

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

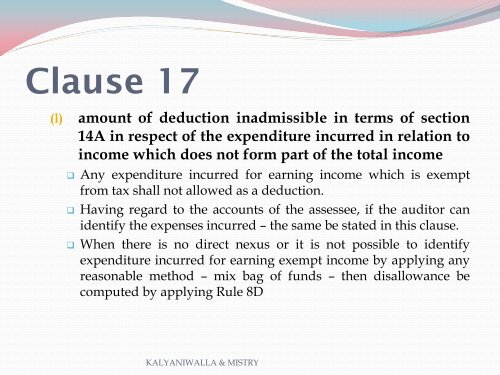

Clause 17<br />

(l) amount of deduction inadmissible in terms of section<br />

14A in respect of the expenditure incurred in relation to<br />

income which does not form part of the total income<br />

Any expenditure incurred for earning income which is exempt<br />

from tax shall not allowed as a deduction.<br />

Having regard to the accounts of the assessee, if the auditor can<br />

identify the expenses incurred – the same be stated in this clause.<br />

When there is no direct nexus or it is not possible to identify<br />

expenditure incurred for earning exempt income by applying any<br />

reasonable method – mix bag of funds – then disallowance be<br />

computed by applying Rule 8D<br />

KALYANIWALLA & MISTRY