TAX AUDIT

TAX AUDIT

TAX AUDIT

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

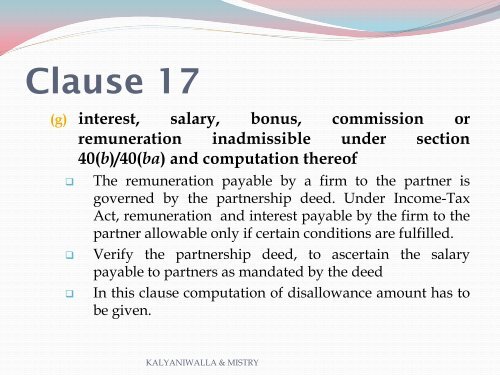

Clause 17<br />

(g) interest, salary, bonus, commission or<br />

remuneration inadmissible under section<br />

40(b)/40(ba) and computation thereof<br />

The remuneration payable by a firm to the partner is<br />

governed by the partnership deed. Under Income-Tax<br />

Act, remuneration and interest payable by the firm to the<br />

partner allowable only if certain conditions are fulfilled.<br />

Verify the partnership deed, to ascertain the salary<br />

payable to partners as mandated by the deed<br />

In this clause computation of disallowance amount has to<br />

be given.<br />

KALYANIWALLA & MISTRY