TAX AUDIT

TAX AUDIT

TAX AUDIT

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

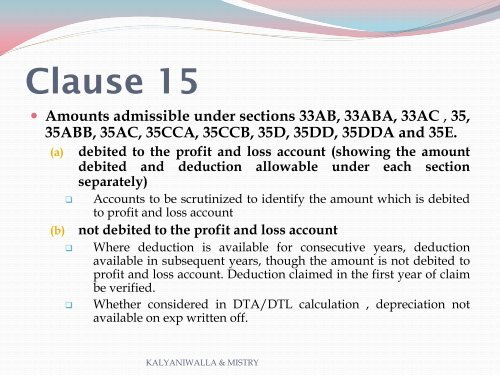

Clause 15<br />

Amounts admissible under sections 33AB, 33ABA, 33AC , 35,<br />

35ABB, 35AC, 35CCA, 35CCB, 35D, 35DD, 35DDA and 35E.<br />

(a) debited to the profit and loss account (showing the amount<br />

debited and deduction allowable under each section<br />

separately)<br />

Accounts to be scrutinized to identify the amount which is debited<br />

to profit and loss account<br />

(b) not debited to the profit and loss account<br />

Where deduction is available for consecutive years, deduction<br />

available in subsequent years, though the amount is not debited to<br />

profit and loss account. Deduction claimed in the first year of claim<br />

be verified.<br />

Whether considered in DTA/DTL calculation , depreciation not<br />

available on exp written off.<br />

KALYANIWALLA & MISTRY