TAX AUDIT

TAX AUDIT

TAX AUDIT

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

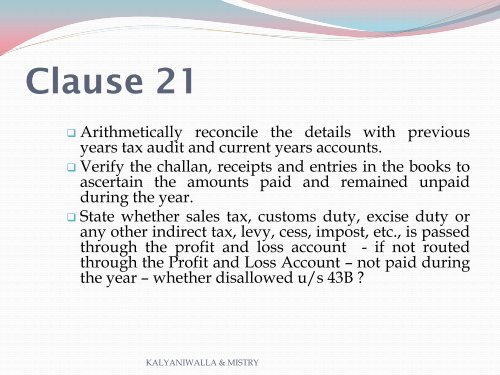

Clause 21<br />

Arithmetically reconcile the details with previous<br />

years tax audit and current years accounts.<br />

Verify the challan, receipts and entries in the books to<br />

ascertain the amounts paid and remained unpaid<br />

during the year.<br />

State whether sales tax, customs duty, excise duty or<br />

any other indirect tax, levy, cess, impost, etc., is passed<br />

through the profit and loss account - if not routed<br />

through the Profit and Loss Account – not paid during<br />

the year – whether disallowed u/s 43B ?<br />

KALYANIWALLA & MISTRY