TAX AUDIT

TAX AUDIT

TAX AUDIT

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

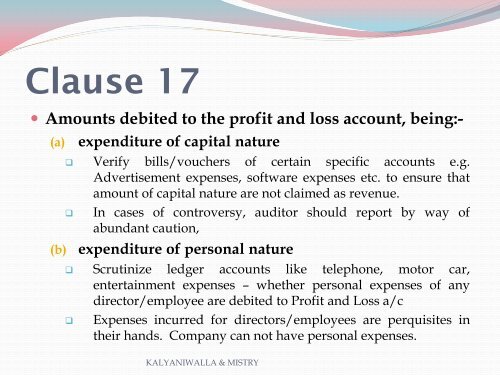

Clause 17<br />

Amounts debited to the profit and loss account, being:-<br />

(a) expenditure of capital nature<br />

Verify bills/vouchers of certain specific accounts e.g.<br />

Advertisement expenses, software expenses etc. to ensure that<br />

amount of capital nature are not claimed as revenue.<br />

In cases of controversy, auditor should report by way of<br />

abundant caution,<br />

(b) expenditure of personal nature<br />

Scrutinize ledger accounts like telephone, motor car,<br />

entertainment expenses – whether personal expenses of any<br />

director/employee are debited to Profit and Loss a/c<br />

Expenses incurred for directors/employees are perquisites in<br />

their hands. Company can not have personal expenses.<br />

KALYANIWALLA & MISTRY