TAX AUDIT

TAX AUDIT

TAX AUDIT

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

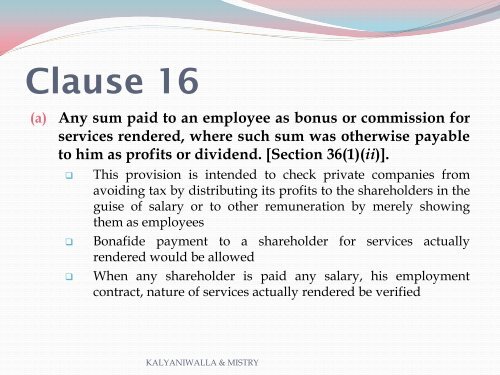

Clause 16<br />

(a) Any sum paid to an employee as bonus or commission for<br />

services rendered, where such sum was otherwise payable<br />

to him as profits or dividend. [Section 36(1)(ii)].<br />

This provision is intended to check private companies from<br />

avoiding tax by distributing its profits to the shareholders in the<br />

guise of salary or to other remuneration by merely showing<br />

them as employees<br />

Bonafide payment to a shareholder for services actually<br />

rendered would be allowed<br />

When any shareholder is paid any salary, his employment<br />

contract, nature of services actually rendered be verified<br />

KALYANIWALLA & MISTRY