TAX AUDIT

TAX AUDIT

TAX AUDIT

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

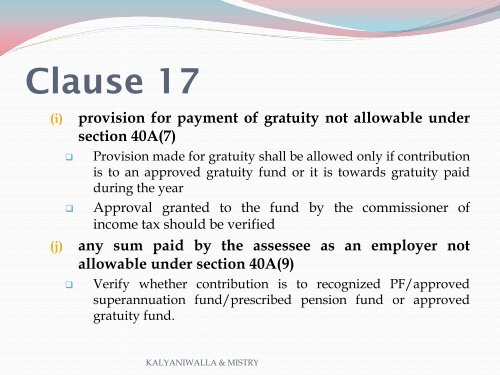

Clause 17<br />

(i) provision for payment of gratuity not allowable under<br />

section 40A(7)<br />

Provision made for gratuity shall be allowed only if contribution<br />

is to an approved gratuity fund or it is towards gratuity paid<br />

during the year<br />

Approval granted to the fund by the commissioner of<br />

income tax should be verified<br />

(j) any sum paid by the assessee as an employer not<br />

allowable under section 40A(9)<br />

Verify whether contribution is to recognized PF/approved<br />

superannuation fund/prescribed pension fund or approved<br />

gratuity fund.<br />

KALYANIWALLA & MISTRY