Stáhnout toto číslo ve formátu PDF - Fakulta podnikatelská - Vysoké ...

Stáhnout toto číslo ve formátu PDF - Fakulta podnikatelská - Vysoké ...

Stáhnout toto číslo ve formátu PDF - Fakulta podnikatelská - Vysoké ...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

TRENDY EKONOMIKY A MANAGEMENTU / TRENDS ECONOMICS AND MANAGEMENT<br />

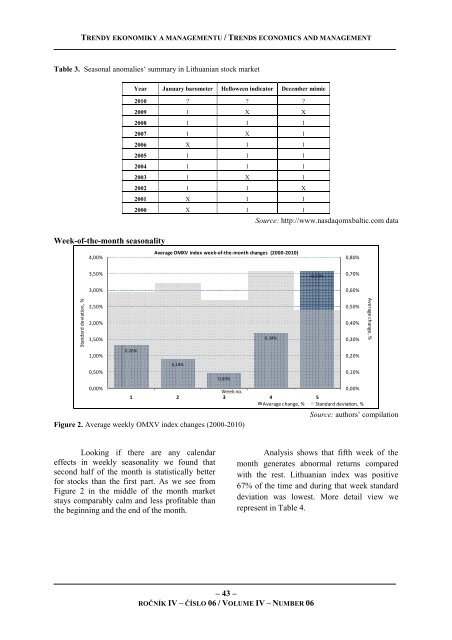

Table 3. Seasonal anomalies‘ summary in Lithuanian stock market<br />

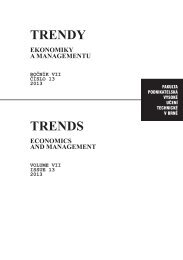

Week-of-the-month seasonality<br />

Standard deviation, %<br />

4,00%<br />

3,50%<br />

3,00%<br />

2,50%<br />

2,00%<br />

1,50%<br />

1,00%<br />

0,50%<br />

0,00%<br />

0,26%<br />

Year January barometer Helloween indicator December mimic<br />

2010 ? ? ?<br />

2009 1 X X<br />

2008 1 1 1<br />

2007 1 X 1<br />

2006 X 1 1<br />

2005 1 1 1<br />

2004 1 1 1<br />

2003 1 X 1<br />

2002 1 1 X<br />

2001 X 1 1<br />

2000 X 1 1<br />

A<strong>ve</strong>rage OMXV index week-of-the-month changes (2000-2010)<br />

0,18%<br />

0,09%<br />

– 43 –<br />

ROČNÍK IV – ČÍSLO 06 / VOLUME IV – NUMBER 06<br />

Source: http://www.nasdaqomxbaltic.com data<br />

0,34%<br />

0,72%<br />

0,80%<br />

0,70%<br />

0,60%<br />

0,50%<br />

0,40%<br />

0,30%<br />

0,20%<br />

0,10%<br />

Week no.<br />

0,00%<br />

1 2 3 4 5<br />

A<strong>ve</strong>rage change, % Standard deviation, %<br />

Figure 2. A<strong>ve</strong>rage weekly OMXV index changes (2000-2010)<br />

Looking if there are any calendar<br />

effects in weekly seasonality we found that<br />

second half of the month is statistically better<br />

for stocks than the first part. As we see from<br />

Figure 2 in the middle of the month market<br />

stays comparably calm and less profitable than<br />

the beginning and the end of the month.<br />

A<strong>ve</strong>rage change, %<br />

Source: authors’ compilation<br />

Analysis shows that fifth week of the<br />

month generates abnormal returns compared<br />

with the rest. Lithuanian index was positi<strong>ve</strong><br />

67% of the time and during that week standard<br />

deviation was lowest. More detail view we<br />

represent in Table 4.