Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Fixed Income Indices<br />

<strong>FTSE</strong> Actuaries UK Gilts Index Series<br />

The <strong>FTSE</strong> Actuaries UK Gilts Index Series is a comprehensive family of<br />

indices and related bond data (e.g. yield, duration, convexity) covering<br />

the conventional Gilt and index-linked Gilt markets. The indices are the<br />

premier benchmarks for eligible British Government Securities. There<br />

are headline indices plus sub-indices available for a wide range of<br />

maturity bands.<br />

Additionally, there is a yield index that provides the term structure of<br />

the Gilt market from one year up to 50 years.<br />

www.ftse.com/uk_gilts<br />

<strong>FTSE</strong> Global Bond Index Series<br />

The <strong>FTSE</strong> Global Bond Index Series is a family of fixed income indices<br />

covering the principal government bond markets and selected corporate<br />

markets. The indices are rules-based, consistent and transparent –<br />

hallmarks of all <strong>FTSE</strong> indices. The <strong>FTSE</strong> Global Bond indices represent<br />

relevant, accurate and usable benchmarks for the fixed income markets.<br />

<strong>FTSE</strong>’s independence insures delivery of objective market information,<br />

free from conflicts of interest. In addition, <strong>FTSE</strong> fixed income indices are<br />

22<br />

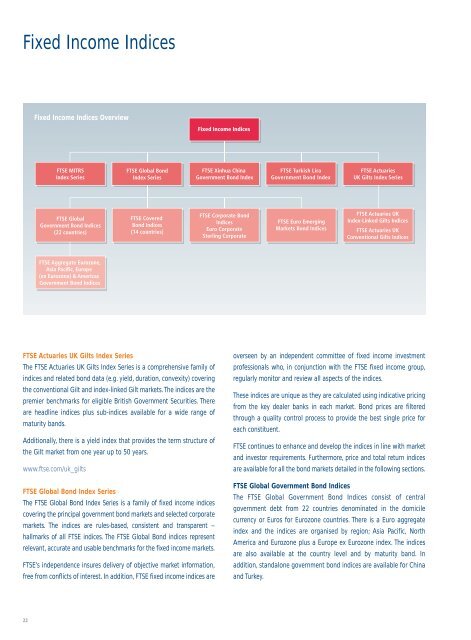

Fixed Income Indices Overview<br />

<strong>FTSE</strong> MITRS<br />

Index Series<br />

<strong>FTSE</strong> Global<br />

Government Bond Indices<br />

(22 countries)<br />

<strong>FTSE</strong> Aggregate Eurozone,<br />

Asia Pacific, Europe<br />

(ex Eurozone) & Americas<br />

Government Bond Indices<br />

<strong>FTSE</strong> Global Bond<br />

Index Series<br />

<strong>FTSE</strong> Covered<br />

Bond Indices<br />

(14 countries)<br />

Fixed Income Indices<br />

<strong>FTSE</strong> Xinhua China<br />

Government Bond Index<br />

<strong>FTSE</strong> Corporate Bond<br />

Indices<br />

Euro Corporate<br />

Sterling Corporate<br />

<strong>FTSE</strong> Turkish Lira<br />

Government Bond Index<br />

<strong>FTSE</strong> Euro Emerging<br />

Markets Bond Indices<br />

overseen by an independent committee of fixed income investment<br />

professionals who, in conjunction with the <strong>FTSE</strong> fixed income group,<br />

regularly monitor and review all aspects of the indices.<br />

These indices are unique as they are calculated using indicative pricing<br />

from the key dealer banks in each market. Bond prices are filtered<br />

through a quality control process to provide the best single price for<br />

each constituent.<br />

<strong>FTSE</strong> continues to enhance and develop the indices in line with market<br />

and investor requirements. Furthermore, price and total return indices<br />

are available for all the bond markets detailed in the following sections.<br />

<strong>FTSE</strong> Global Government Bond Indices<br />

<strong>FTSE</strong> Actuaries<br />

UK Gilts Index Series<br />

<strong>FTSE</strong> Actuaries UK<br />

Index-Linked Gilts Indices<br />

<strong>FTSE</strong> Actuaries UK<br />

Conventional Gilts Indices<br />

The <strong>FTSE</strong> Global Government Bond Indices consist of central<br />

government debt from 22 countries denominated in the domicile<br />

currency or Euros for Eurozone countries. There is a Euro aggregate<br />

index and the indices are organised by region; Asia Pacific, North<br />

America and Eurozone plus a Europe ex Eurozone index. The indices<br />

are also available at the country level and by maturity band. In<br />

addition, standalone government bond indices are available for China<br />

and Turkey.