ftse/xinhua china a50 index

ftse/xinhua china a50 index

ftse/xinhua china a50 index

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

FACTSHEET<br />

FTSE/XINHUA CHINA A50 INDEX<br />

The FTSE/Xinhua China A50 Index is a real-time tradable <strong>index</strong> comprising the largest 50 ‘A’ Share<br />

companies. Designed to meet the needs of Qualified Foreign Institutional Investors (QFIIs) it can be used<br />

as a basis for on-exchange and OTC derivative products, mutual funds and ETFs.<br />

‘A’ Shares – Securities of companies incorporated in Mainland China, that trade on the<br />

Shanghai or Shenzhen stock exchanges, quoted in Chinese Yuan (CNY). These shares are traded<br />

by Chinese or international investors (under the China Qualified Foreign Institutional Investors<br />

– QFII regulations).<br />

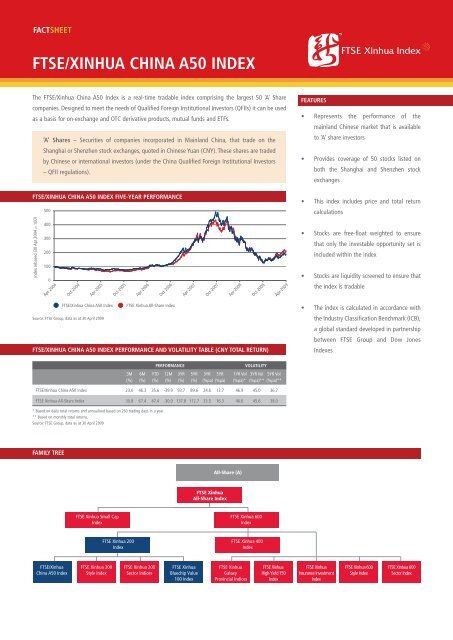

FTSE/XINHUA CHINA A50 INDEX FIVE-YEAR PERFORMANCE<br />

Index rebased (30 Apr 2004 = 100)<br />

500<br />

400<br />

300<br />

200<br />

100<br />

0<br />

Apr-2004<br />

Source: FTSE Group, data as at 30 April 2009<br />

FTSE/XINHUA CHINA A50 INDEX PERFORMANCE AND VOLATILITY TABLE (CNY TOTAL RETURN)<br />

PERFORMANCE VOLATILITY<br />

3M 6M YTD 12M 3YR 5YR 3YR 5YR 1YR Vol 3YR Vol 5YR Vol<br />

(%) (%) (%) (%) (%) (%) (%pa) (%pa) (%pa)* (%pa)** (%pa)**<br />

FTSE/Xinhua China A50 Index 23.0 46.3 35.6 -39.9 93.7 89.6 24.6 13.7 46.9 45.0 36.7<br />

FTSE Xinhua All-Share Index 30.8 67.4 47.4 -30.0 137.8 112.7 33.5 16.3 46.6 45.6 38.0<br />

* Based on daily total returns and annualised based on 260 trading days in a year.<br />

** Based on monthly total returns.<br />

Source: FTSE Group, data as at 30 April 2009<br />

FAMILY TREE<br />

FTSE/Xinhua<br />

China A50 Index<br />

Oct-2004<br />

Apr-2005<br />

Apr-2006<br />

Oct-2006<br />

FTSE/Xinhua China A50 Index FTSE Xinhua All-Share Index<br />

FTSE Xinhua Small Cap<br />

Index<br />

FTSE Xinhua 200<br />

Style Index<br />

Oct-2005<br />

FTSE Xinhua 200<br />

Index<br />

FTSE Xinhua 200<br />

Sector Indices<br />

Apr-2007<br />

FTSE Xinhua<br />

Bluechip Value<br />

100 Index<br />

Oct-2007<br />

Apr-2008<br />

All-Share (A)<br />

FTSE Xinhua<br />

All-Share Index<br />

Oct-2008<br />

FTSE Xinhua 600<br />

Index<br />

FTSE Xinhua 400<br />

Index<br />

FTSE Xinhua<br />

Galaxy<br />

Provincial Indices<br />

Apr-2009<br />

FTSE Xinhua<br />

High Yield 150<br />

Index<br />

FEATURES<br />

• Represents the performance of the<br />

mainland Chinese market that is available<br />

to ‘A’ share investors<br />

• Provides coverage of 50 stocks listed on<br />

both the Shanghai and Shenzhen stock<br />

exchanges<br />

• This <strong>index</strong> includes price and total return<br />

calculations<br />

• Stocks are free-float weighted to ensure<br />

that only the investable opportunity set is<br />

included within the <strong>index</strong><br />

• Stocks are liquidity screened to ensure that<br />

the <strong>index</strong> is tradable<br />

• The <strong>index</strong> is calculated in accordance with<br />

the Industry Classification Benchmark (ICB),<br />

a global standard developed in partnership<br />

between FTSE Group and Dow Jones<br />

Indexes<br />

FTSE Xinhua<br />

Insurance Investment<br />

Index<br />

FTSE Xinhua 600<br />

Style Index<br />

FTSE Xinhua 600<br />

Sector Index

FTSE/XINHUA CHINA A50 INDEX TOP 10 CONSTITUENTS<br />

Rank Constituent Country ICB Supersector Net Mkt Cap Index Weight<br />

(CNYm) (%)<br />

1 Ping An of China (A) China Insurance 190,020 8.69<br />

2 China Merchants Bank (A) China Banks 139,972 6.40<br />

3 Bank of Communications (A) China Banks 131,854 6.03<br />

4 Industrial Bank (A) China Banks 121,450 5.56<br />

5 Citic Securities (A) China Financial Services 120,592 5.52<br />

6 China Vanke (A) China Financial Services 82,089 3.76<br />

7 China Minsheng Banking (A) China Banks 78,915 3.61<br />

8 China Yangtze Power (A) China Utilities 68,944 3.15<br />

9 Shanghai Pudong Development Bank (A) China Banks 65,587 3.00<br />

10 Industrial and Commercial Bank of China (A) China Banks 61,586 2.82<br />

Total 1,061,007 48.54<br />

Source: FTSE Group, data as at 30 April 2009<br />

FTSE/XINHUA CHINA A50 INDEX ICB SUPERSECTOR BREAKDOWN<br />

ICB Supersector No. of Constituents Net Mkt Cap (CNYm) Index Weight (%)<br />

Banks 12 761,447 34.83<br />

Financial Services 4 286,253 13.09<br />

Insurance 3 246,969 11.30<br />

Basic Resources 9 217,566 9.95<br />

Industrial Goods & Services 6 135,843 6.21<br />

Utilities 3 120,279 5.50<br />

Oil & Gas 3 96,889 4.43<br />

Construction & Materials 3 82,217 3.76<br />

Food & Beverage 2 64,393 2.95<br />

Telecommunications 1 57,231 2.62<br />

Retail 1 50,204 2.30<br />

Technology 1 32,118 1.47<br />

Automobiles & Parts 1 24,095 1.10<br />

Travel & Leisure 1 10,482 0.48<br />

Total 50 2,185,987 100.00<br />

Source: FTSE Group, data as at 30 April 2009<br />

FTSE/XINHUA CHINA A50 INDEX PORTFOLIO CHARACTERISTICS<br />

FTSE Xinhua China A50 Index FTSE Xinhua All-Share Index<br />

Number of Constituents 50 976<br />

Net Market Cap (CNYm)<br />

Constituent Sizes (Net Market Cap CNYm)<br />

2,185,987 5,686,185<br />

Average 43,720 5,826<br />

Largest 190,020 190,020<br />

Smallest 5,468 312<br />

Median 31,784 2,575<br />

Weight of Largest Constituent (%) 8.69 3.34<br />

Top 10 Holdings (% Index Market Cap) 48.54 18.66<br />

Source: FTSE Group, data as at 30 April 2009<br />

FOR FURTHER INFORMATION VISIT WWW.FTSE.COM, EMAIL INFO@FTSE.COM OR CALL YOUR LOCAL FTSE OFFICE:<br />

LONDON +44 (0) 20 7866 1810 BOSTON +1 888 747 FTSE (3873) FRANKFURT +49 (0) 69 156 85 144 HONG KONG +852 2230 5800<br />

BEIJING + 86 10 5864 5277 MADRID +34 91 411 3787 NEW YORK +1 888 747 FTSE (3873) PARIS +33 (0) 1 53 76 82 88<br />

SAN FRANCISCO +1 888 747 FTSE (3873) SYDNEY +61 2 9293 2866 TOKYO +81 3 3581 2811 MILAN +39 02 72426 641<br />

INFORMATION<br />

Index Universe<br />

FTSE Xinhua 200 Index<br />

Index Launch<br />

13 December 2003<br />

Base Date<br />

21 July 2003<br />

Base Value<br />

5000<br />

Investability Screens<br />

Free float adjusted and liquidity screened<br />

Index Calculation<br />

Index is calculated every 15 seconds. The <strong>index</strong><br />

is also calculated at end-of-day<br />

End-of-Day Distribution<br />

Index available at 20:00 local time (12:00 hours<br />

London time GMT or 13:00 hours BST) via FTP<br />

and email<br />

Currency<br />

CNY, HKD and USD (Base Currency is CNY)<br />

Review Dates<br />

Quarterly in January, April, July and October<br />

Index Rules<br />

Available at: www.<strong>ftse</strong>.com/<strong>xinhua</strong><br />

Vendor Codes<br />

Available at www.<strong>ftse</strong>.com/<strong>xinhua</strong><br />

© Copyright 2009 FTSE Xinhua Index Limited ("FXI"). All rights<br />

reserved. “FTSE ® ” is a trade mark jointly owned by the London Stock<br />

Exchange PLC and The Financial Times Limited and is used by FTSE<br />

® International Limited (“FTSE”) under licence. “ ” is a<br />

trademark of FTSE and is licensed for use by FXI. “Xinhua ® ” and<br />

® “ ” are service marks and trademarks of Xinhua Finance<br />

Limited. All marks are licensed for use by FXI. The FTSE/Xinhua China<br />

A50 Index is calculated by FXI and all rights therein vest in FXI. All<br />

information is provided for information purposes only. Whilst every<br />

effort is made to ensure that all information given in this publication<br />

is accurate, no responsibility or liability can be accepted by FXI for any<br />

errors or for any loss arising from use of this information. Distribution<br />

of FXI <strong>index</strong> values and the use of FXI indices to create financial<br />

products requires a licence from FXI. The Industry Classification<br />

Benchmark (“ICB”) is a joint product of FTSE and Dow Jones &<br />

Company, Inc (“Dow Jones”). “Dow Jones” and “DJ” are trade and<br />

service marks of Dow Jones. FTSE and Dow Jones do not accept any<br />

liability to any person for any loss or damage arising out of any error<br />

or omission in the ICB.