FTSE JSE Africa Index Series Ground Rules v3.0x

FTSE JSE Africa Index Series Ground Rules v3.0x

FTSE JSE Africa Index Series Ground Rules v3.0x

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

The methodology gives rise to certain company’s investable market capitalisation falling either side of<br />

a particular band. In these circumstances the constituent’s style weight will be apportioned across the<br />

bands so as to ensure that its investable market capitalisation remains exactly the same as in the<br />

underlying benchmark.<br />

In the case of a fast entry to the <strong>FTSE</strong> All-Share <strong>Index</strong> the Value Ranking and Growth Ranking will be<br />

determined by reference to the Industry Classification Benchmark System Subsector of the fast entry<br />

constituent. In the first instance this will be by reference to the relevant Subsector of the fast entry<br />

constituent in the <strong>FTSE</strong>/<strong>JSE</strong> All-Share <strong>Index</strong>. If there are less than two companies in the Subsector,<br />

reference will be made to the relevant global Subsector in the <strong>FTSE</strong> All World <strong>Index</strong>.<br />

Rights issues, scrip issues and similar corporate events will be applied in exactly the same way as they<br />

are applied to the <strong>FTSE</strong>/<strong>JSE</strong> All-Share <strong>Index</strong>. No change will be made to the VR, GR, OSR or Style<br />

Weighting of the company due to the event.<br />

In the case of a takeover the Value Ranking, Growth Ranking and Overall Style Ranking of the largest<br />

company by full market capitalisation will be applied to the company(ies) being taken over.<br />

In the case of a merger the Value Ranking, Growth Ranking and Overall Style Ranking of the largest<br />

company, as defined by the full market capitalisation of the companies subject to the merger, will be<br />

adopted by the newly merged company.<br />

In the case of a demerger the Value Ranking, Growth Ranking and Overall Style Ranking of the<br />

demerged companies will remain the same as the unmerged company. The demerged companies will<br />

be treated as separate companies for VR, GR and OSR purposes at the next <strong>FTSE</strong>/<strong>JSE</strong> Style <strong>Index</strong><br />

review.<br />

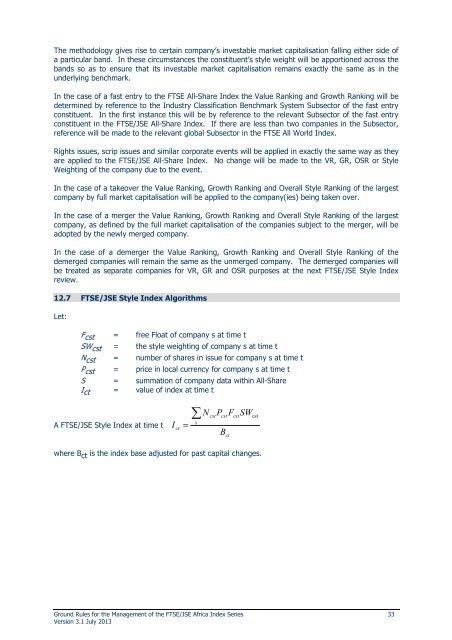

12.7 <strong>FTSE</strong>/<strong>JSE</strong> Style <strong>Index</strong> Algorithms<br />

Let:<br />

F cst = free Float of company s at time t<br />

SW cst = the style weighting of company s at time t<br />

N cst = number of shares in issue for company s at time t<br />

P cst = price in local currency for company s at time t<br />

S = summation of company data within All-Share<br />

I ct = value of index at time t<br />

A <strong>FTSE</strong>/<strong>JSE</strong> Style <strong>Index</strong> at time t<br />

I<br />

ct<br />

=<br />

∑<br />

s<br />

N<br />

cst<br />

P<br />

cst<br />

B<br />

<strong>Ground</strong> <strong>Rules</strong> for the Management of the <strong>FTSE</strong>/<strong>JSE</strong> <strong>Africa</strong> <strong>Index</strong> <strong>Series</strong> 33<br />

Version 3.1 July 2013<br />

ct<br />

F<br />

cst<br />

SW<br />

where B ct is the index base adjusted for past capital changes.<br />

cst