Download Program - Global Real Estate Institute

Download Program - Global Real Estate Institute

Download Program - Global Real Estate Institute

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

asia gri 2013<br />

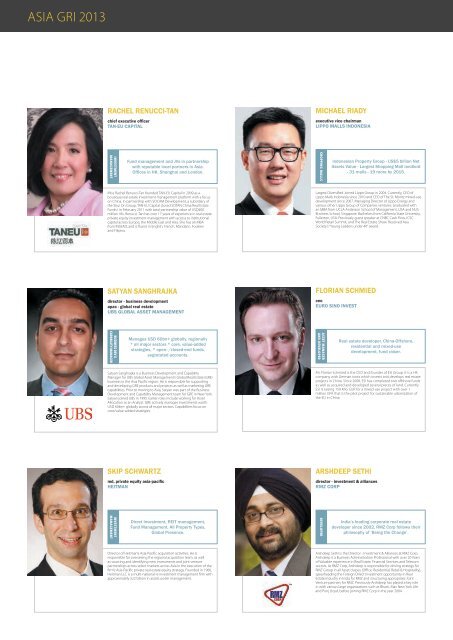

Rachel Renucci-Tan<br />

chief executive officer<br />

TAN-EU Capital<br />

Michael Riady<br />

executive vice chairman<br />

Lippo Malls Indonesia<br />

Investment<br />

Management<br />

Fund management and JVs in partnership<br />

with reputable local partners in Asia.<br />

Offices in HK, Shanghai and London.<br />

Shopping Malls<br />

Indonesian Property Group - US$5 billion Net<br />

Assets Value - Largest Shopping Mall landlord<br />

- 31 malls - 19 more by 2015.<br />

Miss Rachel Renucci-Tan founded TAN-EU Capital in 2009 as a<br />

boutique real estate investment management platform with a focus<br />

on China. In partnership with SOCAM Development, a subsidiary of<br />

the Shui On Group, TAN-EU Capital closed SOTAN China <strong>Real</strong> <strong>Estate</strong><br />

Funds I in February 2011 with total partnership value of USD400<br />

million. Ms. Renucci-Tan has over 17 years of experience in real estate<br />

private equity investment management with access to institutional<br />

capital across Europe, the Middle East and Asia. She has an MBA<br />

from INSEAD, and is fluent in English, French, Mandarin, Fookien<br />

and Filipino.<br />

Largest Diversified Joined Lippo Group in 2004. Currently, CEO of<br />

Lippo Malls Indonesia since 2010 and CEO of The St. Moritz mixed-use<br />

development since 2007. Managing Director of Lippo Energy and<br />

various other Lippo Group of Companies ventures. Graduated with<br />

an MBA from UCLA Anderson School of Management, USA and NUS<br />

Business School, Singapore. Bachelors from California State University,<br />

Fullerton, USA. Previously guest speaker at CNBC Cash Flow, ICSC<br />

World Retail Summit, and The <strong>Real</strong> <strong>Estate</strong> Show. Received Asia<br />

Society’s “Young Leaders under 40” award.<br />

Satyan Sanghrajka<br />

director - business development<br />

apac - global real estate<br />

UBS <strong>Global</strong> Asset Management<br />

Florian Schmied<br />

ceo<br />

Euro Sino Invest<br />

Business Dev &<br />

Capability Manager<br />

Manages USD 60bn+ globally, regionally<br />

* all major sectors * core, value-added<br />

strategies, * open- /closed-end funds,<br />

segretated accounts.<br />

Asset Manager<br />

and Developer<br />

<strong>Real</strong> estate developer, China-Offshore,<br />

residential and mixed-use<br />

development, fund raiser.<br />

Satyan Sanghrajka is a Business Development and Capability<br />

Manager for UBS <strong>Global</strong> Asset Management’s <strong>Global</strong> <strong>Real</strong> <strong>Estate</strong> (GRE)<br />

business in the Asia Pacific region. He is responsible for supporting<br />

and developing GRE products and projects as well as marketing GRE<br />

capabilities. Prior to moving to Asia, Satyan was part of the Business<br />

Development and Capability Management team for GRE in New York.<br />

Satyan joined UBS in 1995. Earlier roles include working for Asset<br />

Allocation as an Analyst. GRE actively manages investments worth<br />

USD 60bn+ globally across all major sectors. Capabilities focus on<br />

core/value-added strategies.<br />

Mr. Florian Schmied is the CEO and founder of ESI Group. It is a HK<br />

company with German roots which invests and develops real estate<br />

projects in China. Since 2008, ESI has completed two offshore funds<br />

as well as acquired and developed several pieces of land. Currently<br />

ESI is raising 150 Mio. EUR for a mixed-use project with over 1<br />

million GFA that is the pilot project for sustainable urbanization of<br />

the EU in China.<br />

Skip Schwartz<br />

md, private equity asia-pacific<br />

Heitman<br />

Arshdeep Sethi<br />

director - investment & alliances<br />

RMZ Corp<br />

Investment<br />

Management<br />

Direct Investment, REIT management,<br />

Fund Management, All Property Types,<br />

<strong>Global</strong> Presence.<br />

Developer<br />

India’s leading corporate real estate<br />

developer since 2002, RMZ Corp follows their<br />

philosophy of ‘Being the Change’.<br />

Director of Heitman’s Asia-Pacific acquisition activities. He is<br />

responsible for overseeing the regional acquisition team, as well<br />

as sourcing and identifying new investments and joint venture<br />

partnerships across select markets across Asia in the execution of the<br />

firm’s Asia-Pacific private real estate equity strategy. Founded in 1966,<br />

Heitman LLC is a multi-national re investment management firm with<br />

approximately $22 billion in assets under management.<br />

Arshdeep Sethi is the Director - Investment & Alliances at RMZ Corp.<br />

Arshdeep is a Business Administration Professional with over 20 Years<br />

of Valuable experience in <strong>Real</strong> <strong>Estate</strong>, Financial Services and Telecom<br />

sectors. At RMZ Corp, Arshdeep is responsible for driving strategy for<br />

RMZ Group in all Asset classes (Office, Residential, Retail & Hospitality),<br />

spearheading the Foreign Direct Investment opportunity in <strong>Real</strong><br />

<strong>Estate</strong> industry in India for RMZ and structuring appropriate Joint<br />

Venture partners for RMZ. Previously Arshdeep has played a key role<br />

in with various large organizations such as Bharti, Max New York Life<br />

and Punj Lloyd, before joining RMZ Corp in the year 2004.