Nigeria Banking Sector Coverage - December 2011 'Bad ... - Imara

Nigeria Banking Sector Coverage - December 2011 'Bad ... - Imara

Nigeria Banking Sector Coverage - December 2011 'Bad ... - Imara

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

EQUITY RESEARCH<br />

PAN-AFRICAN<br />

DECEMBER <strong>2011</strong><br />

BANKING<br />

Headquartered in Togo, Ecobank Transnational<br />

Incorporated (ETI), a public limited liability company,<br />

was established as a bank holding company in 1985<br />

under a private sector initiative spearheaded by the<br />

Federation of West African Chambers of Commerce and<br />

Industry with the support of ECOWAS, in a bid to try<br />

and break the dominance of foreign and state owned<br />

banks in West Africa. ETI commenced operations with<br />

its first subsidiary in Togo in March 1988. Today, ETI is<br />

a full-service regional banking institution employing<br />

over 11,000 staff in 755 branches and offices in thirty<br />

SSA countries, namely Benin, Burkina Faso, Burundi,<br />

Cape Verde, Cameroon, Central African Republic, Chad,<br />

Congo Brazzaville, DRC, Côte d'Ivoire, Gabon, The<br />

Gambia, Ghana, Guinea, Guinea Bissau, Kenya, Liberia,<br />

Malawi, Mali, Niger, <strong>Nigeria</strong>, Rwanda, Sao Tome &<br />

Principe, Senegal, Sierra Leone, Tanzania, Togo,<br />

Uganda, Zambia and Zimbabwe.<br />

• A difficult year for Ecobank <strong>Nigeria</strong> in 2009, in line<br />

with the broader industry, which saw it record a loss<br />

before tax of USD 16.6m, as well as losses by the<br />

southern Africa cluster, led to attributable earnings<br />

declining by 45.78% to USD 51.1m for the group.<br />

• In its 9M 11 results to September, net interest income<br />

put on 16.16% as NIMs improved to USD 399.0m. Net<br />

fee and commission went up by 45.16%, while net<br />

trading income also recorded strong growth of<br />

64.79%. The CIR improved to 67.91% from 70.70%, and<br />

despite an increase in provision charges of 26.73% y-oy<br />

to USD 80.4m, attributable earnings closed the<br />

period at USD 106.6m, up 51.86%.<br />

• <strong>Nigeria</strong> has been an Achilles heel for ETI, where it has<br />

not really gained enough scale. To address this, ETI<br />

has taken over one of the rescued banks, Oceanic,<br />

which will substantially boost its market position.<br />

• Pre-Oceanic, we value ETI, based on a DCF valuation,<br />

at US 10.8c per share, representing upside of 68.2%<br />

against the US 6.42c it currently trades at on its most<br />

liquid listing in <strong>Nigeria</strong>. A coverage based PBV average<br />

based on the last published post merger pro-forma<br />

accounts suggests a valuation of US 10.3c per share.<br />

BUY.<br />

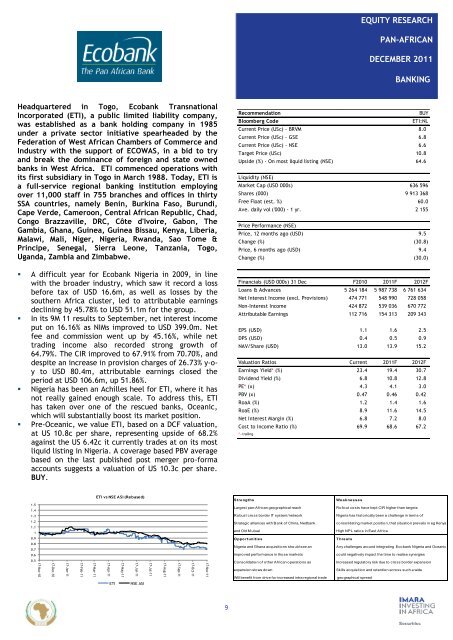

Recommendation<br />

BUY<br />

Bloomberg Code<br />

ETI:NL<br />

Current Price (USc) - BRVM 8.0<br />

Current Price (USc) - GSE 6.8<br />

Current Price (USc) - NSE 6.6<br />

Target Price (USc) 10.8<br />

Upside (%) - On most liquid listing (NSE) 64.6<br />

Liquidity (NSE)<br />

Market Cap (USD 000s) 636 596<br />

Shares (000) 9 913 368<br />

Free Float (est. %) 60.0<br />

Ave. daily vol ('000) - 1 yr. 2 155<br />

Price Performance (NSE)<br />

Price, 12 months ago (USD) 9.5<br />

Change (%) (30.8)<br />

Price, 6 months ago (USD) 9.4<br />

Change (%) (30.0)<br />

Financials (USD 000s) 31 Dec F2010 <strong>2011</strong>F 2012F<br />

Loans & Advances 5 264 184 5 987 738 6 761 634<br />

Net Interest Income (excl. Provisions) 474 771 548 990 728 058<br />

Non-Interest Income 424 872 539 036 670 772<br />

Attributable Earnings 112 716 154 313 209 343<br />

EPS (USD) 1.1 1.6 2.5<br />

DPS (USD) 0.4 0.5 0.9<br />

NAV/Share (USD) 13.0 13.9 15.2<br />

Valuation Ratios Current <strong>2011</strong>F 2012F<br />

Earnings Yield* (%) 23.4 19.4 30.7<br />

Dividend Yield (%) 6.8 10.8 12.8<br />

PE* (x) 4.3 4.1 3.0<br />

PBV (x) 0.47 0.46 0.42<br />

RoaA (%) 1.2 1.4 1.6<br />

RoaE (%) 8.9 11.6 14.5<br />

Net Interest Margin (%) 6.8 7.2 8.0<br />

Cost to Income Ratio (%) 69.9 68.6 67.2<br />

* - trailing<br />

1.5<br />

1.4<br />

1.3<br />

ETI vs NSE ASI (Rebased)<br />

Strengths<br />

Largest pan-African geographical reach<br />

Robust cross border IT system/network<br />

Weaknesses<br />

Rollout costs have kept CIR higher than targets<br />

<strong>Nigeria</strong> has historically been a challenge in terms of<br />

1.2<br />

1.1<br />

1<br />

Strategic alliances with Bank of China, Nedbank<br />

and Old M utual<br />

consolidating market position, that situation prevails in eg Kenya<br />

High NPL ratios in East Africa<br />

0.9<br />

0.8<br />

0.7<br />

0.6<br />

Oppo rtunities<br />

<strong>Nigeria</strong> and Ghana acquisitions should see an<br />

improved performance in those markets<br />

T hreats<br />

Any challenges around integrating Ecobank <strong>Nigeria</strong> and Oceanic<br />

could negatively impact the time to realise synergies<br />

0.5<br />

17-Nov-10<br />

17-Dec-10<br />

17-Jan-11<br />

17-Feb-11<br />

17-Mar-11<br />

17-Apr-11<br />

ETI<br />

17-May-11<br />

17-Jun-11<br />

NSE ASI<br />

17-Jul-11<br />

17-Aug-11<br />

17-Sep-11<br />

17-Oct-11<br />

17-Nov-11<br />

Consolidation of other African operations as<br />

Increased regulatory risk due to cross border expansion<br />

expansion slows down<br />

Skills acquisition and retention across such a wide<br />

Will benefit from drive for increased intra regional trade geographical spread<br />

9