Nigeria Banking Sector Coverage - December 2011 'Bad ... - Imara

Nigeria Banking Sector Coverage - December 2011 'Bad ... - Imara

Nigeria Banking Sector Coverage - December 2011 'Bad ... - Imara

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

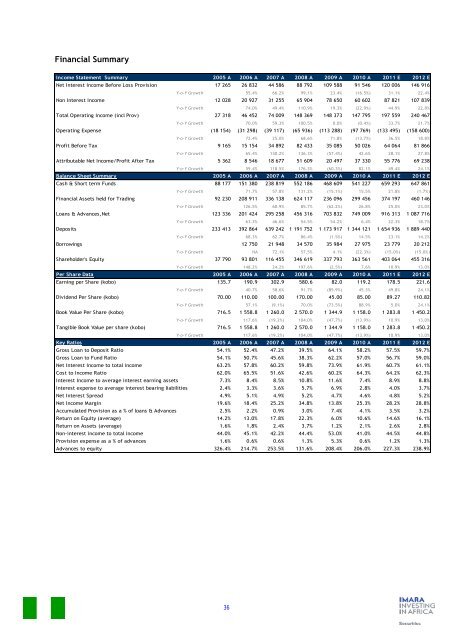

Financial Summary<br />

Income Statement Summary 2005 A 2006 A 2007 A 2008 A 2009 A 2010 A <strong>2011</strong> E 2012 E<br />

Net Interest Income Before Loss Provision 17 265 26 832 44 586 88 792 109 588 91 546 120 006 146 916<br />

Y-o-Y Growth 55.4% 66.2% 99.1% 23.4% (16.5%) 31.1% 22.4%<br />

Non Interest Income 12 028 20 927 31 255 65 904 78 650 60 602 87 821 107 839<br />

Y-o-Y Growth 74.0% 49.4% 110.9% 19.3% (22.9%) 44.9% 22.8%<br />

Total Operating Income (incl Prov) 27 318 46 452 74 009 148 369 148 373 147 795 197 559 240 467<br />

Y-o-Y Growth 70.0% 59.3% 100.5% 0.0% (0.4%) 33.7% 21.7%<br />

Operating Expense (18 154) (31 298) (39 117) (65 936) (113 288) (97 769) (133 495) (158 600)<br />

Y-o-Y Growth 72.4% 25.0% 68.6% 71.8% (13.7%) 36.5% 18.8%<br />

Profit Before Tax 9 165 15 154 34 892 82 433 35 085 50 026 64 064 81 866<br />

Y-o-Y Growth 65.4% 130.2% 136.3% (57.4%) 42.6% 28.1% 27.8%<br />

Attributable Net Income/Profit After Tax 5 362 8 546 18 677 51 609 20 497 37 330 55 776 69 238<br />

Y-o-Y Growth 59.4% 118.5% 176.3% (60.3%) 82.1% 49.4% 24.1%<br />

Balance Sheet Summary 2005 A 2006 A 2007 A 2008 A 2009 A 2010 A <strong>2011</strong> E 2012 E<br />

Cash & Short term Funds 88 177 151 380 238 819 552 186 468 609 541 227 659 293 647 861<br />

Y-o-Y Growth 71.7% 57.8% 131.2% (15.1%) 15.5% 21.8% (1.7%)<br />

Financial Assets held for Trading 92 230 208 911 336 138 624 117 236 096 299 456 374 197 460 146<br />

Y-o-Y Growth 126.5% 60.9% 85.7% (62.2%) 26.8% 25.0% 23.0%<br />

Loans & Advances,Net 123 336 201 424 295 258 456 316 703 832 749 009 916 313 1 087 716<br />

Y-o-Y Growth 63.3% 46.6% 54.5% 54.2% 6.4% 22.3% 18.7%<br />

Deposits 233 413 392 864 639 242 1 191 752 1 173 917 1 344 121 1 654 936 1 889 440<br />

Y-o-Y Growth 68.3% 62.7% 86.4% (1.5%) 14.5% 23.1% 14.2%<br />

Borrowings 12 750 21 948 34 570 35 984 27 975 23 779 20 212<br />

Y-o-Y Growth NA 72.1% 57.5% 4.1% (22.3%) (15.0%) (15.0%)<br />

Shareholder's Equity 37 790 93 801 116 455 346 619 337 793 363 561 403 064 455 316<br />

Y-o-Y Growth 148.2% 24.2% 197.6% (2.5%) 7.6% 10.9% 13.0%<br />

Per Share Data 2005 A 2006 A 2007 A 2008 A 2009 A 2010 A <strong>2011</strong> E 2012 E<br />

Earning per Share (kobo) 135.7 190.9 302.9 580.6 82.0 119.2 178.5 221.6<br />

Y-o-Y Growth 40.7% 58.6% 91.7% (85.9%) 45.3% 49.8% 24.1%<br />

Dividend Per Share (kobo) 70.00 110.00 100.00 170.00 45.00 85.00 89.27 110.82<br />

Y-o-Y Growth 57.1% (9.1%) 70.0% (73.5%) 88.9% 5.0% 24.1%<br />

Book Value Per Share (kobo) 716.5 1 558.8 1 260.0 2 570.0 1 344.9 1 158.0 1 283.8 1 450.2<br />

Y-o-Y Growth 117.6% (19.2%) 104.0% (47.7%) (13.9%) 10.9% 13.0%<br />

Tangible Book Value per share (kobo) 716.5 1 558.8 1 260.0 2 570.0 1 344.9 1 158.0 1 283.8 1 450.2<br />

Y-o-Y Growth 117.6% (19.2%) 104.0% (47.7%) (13.9%) 10.9% 13.0%<br />

Key Ratios 2005 A 2006 A 2007 A 2008 A 2009 A 2010 A <strong>2011</strong> E 2012 E<br />

Gross Loan to Deposit Ratio 54.1% 52.4% 47.2% 39.5% 64.1% 58.2% 57.5% 59.7%<br />

Gross Loan to Fund Ratio 54.1% 50.7% 45.6% 38.3% 62.2% 57.0% 56.7% 59.0%<br />

Net Interest Income to total income 63.2% 57.8% 60.2% 59.8% 73.9% 61.9% 60.7% 61.1%<br />

Cost to Income Ratio 62.0% 65.5% 51.6% 42.6% 60.2% 64.3% 64.2% 62.3%<br />

Interest Income to average interest earning assets 7.3% 8.4% 8.5% 10.8% 11.6% 7.4% 8.9% 8.8%<br />

Interest expense to average interest bearing liabilities 2.4% 3.3% 3.6% 5.7% 6.9% 2.8% 4.0% 3.7%<br />

Net Interest Spread 4.9% 5.1% 4.9% 5.2% 4.7% 4.6% 4.8% 5.2%<br />

Net Income Margin 19.6% 18.4% 25.2% 34.8% 13.8% 25.3% 28.2% 28.8%<br />

Accumulated Provision as a % of loans & Advances 2.5% 2.2% 0.9% 3.0% 7.4% 4.1% 3.5% 3.2%<br />

Return on Equity (average) 14.2% 13.0% 17.8% 22.3% 6.0% 10.6% 14.6% 16.1%<br />

Return on Assets (average) 1.6% 1.8% 2.4% 3.7% 1.2% 2.1% 2.6% 2.8%<br />

Non-interest income to total income 44.0% 45.1% 42.2% 44.4% 53.0% 41.0% 44.5% 44.8%<br />

Provision expense as a % of advances 1.6% 0.6% 0.6% 1.3% 5.3% 0.6% 1.2% 1.3%<br />

Advances to equity 326.4% 214.7% 253.5% 131.6% 208.4% 206.0% 227.3% 238.9%<br />

36