Nigeria Banking Sector Coverage - December 2011 'Bad ... - Imara

Nigeria Banking Sector Coverage - December 2011 'Bad ... - Imara

Nigeria Banking Sector Coverage - December 2011 'Bad ... - Imara

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

EQUITY RESEARCH<br />

NIGERIA<br />

DECEMBER <strong>2011</strong><br />

BANKING<br />

Incorporated in 1989 and subsequently listed in 1998,<br />

Access Bank Plc (Access) is a full scale commercial bank<br />

in <strong>Nigeria</strong>. It has also expanded its footprint beyond<br />

<strong>Nigeria</strong>’s borders, with subsidiaries in eight other<br />

African countries, namely Ghana, Sierra Leone, The<br />

Gambia, Cote d’Ivoire, Zambia, Burundi, Rwanda and<br />

the DRC, as well as having a presence in the United<br />

Kingdom. As at FY 2010, the group had over two million<br />

customers served from 148 branches by 2,255<br />

employees across all its jurisdictions. <strong>Nigeria</strong> remains<br />

the anchor though, with 110 branches and 1,317<br />

employees out of the total.<br />

• An attributable loss in the nine months to Dec 09 of<br />

NGN 4.2bn as the CBN’s strict provisioning came to<br />

the fore was turned around in FY 10, where the group<br />

recorded an attributable profit of NGN 11.2bn.<br />

• The increase in earnings was, however, driven more<br />

by a reduction in the impairment charge, as operating<br />

income actually fell by 4.75% to NGN 65.0bn, as both<br />

net funded income fell y-o-y while non-funded income<br />

reflected a marginal increase.<br />

• In its 9M 11 results to September, a strong recovery in<br />

net interest income as well as an improved CIR led to<br />

earnings increasing by 34.89% to NGN 12.9bn.<br />

• In a move to make the step up from ‘2nd’ to ‘1st’ tier<br />

bank, Access shareholders approved the merger<br />

(effective takeover) of the bank with that of one of<br />

the ‘rescued’ banks, Intercontinental Bank. This will<br />

make the combined entity a top 3-5 bank in <strong>Nigeria</strong>,<br />

depending on the metric, and we expect the benefits<br />

to Access of the wider branch network and lower cost<br />

of funds to be significant.<br />

• Using a DCF valuation, we value Access Bank at NGN<br />

11.65 per share, without taking into account the<br />

acquisition of Intercontinental. A coverage based PBV<br />

average based on the last published post merger proforma<br />

accounts suggests a valuation of NGN 10.21 per<br />

share. In our view, Access looks best placed to benefit<br />

from M&A activity relative to its peers. BUY.<br />

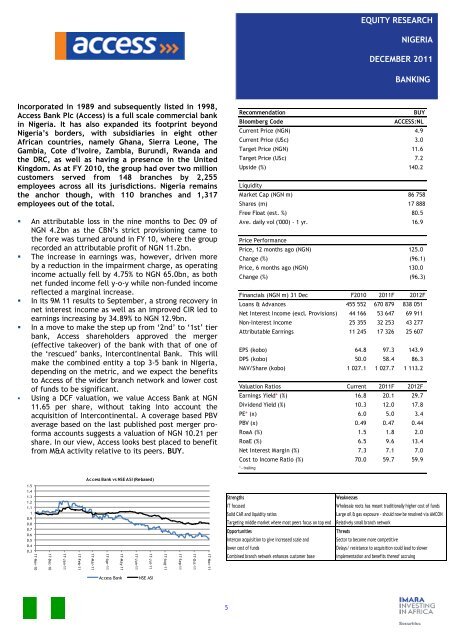

Recommendation<br />

BUY<br />

Bloomberg Code<br />

ACCESS:NL<br />

Current Price (NGN) 4.9<br />

Current Price (USc) 3.0<br />

Target Price (NGN) 11.6<br />

Target Price (USc) 7.2<br />

Upside (%) 140.2<br />

Liquidity<br />

Market Cap (NGN m) 86 758<br />

Shares (m) 17 888<br />

Free Float (est. %) 80.5<br />

Ave. daily vol ('000) - 1 yr. 16.9<br />

Price Performance<br />

Price, 12 months ago (NGN) 125.0<br />

Change (%) (96.1)<br />

Price, 6 months ago (NGN) 130.0<br />

Change (%) (96.3)<br />

Financials (NGN m) 31 Dec F2010 <strong>2011</strong>F 2012F<br />

Loans & Advances 455 552 670 879 838 051<br />

Net Interest Income (excl. Provisions) 44 166 53 647 69 911<br />

Non-Interest Income 25 355 32 253 43 277<br />

Attributable Earnings 11 245 17 326 25 607<br />

EPS (kobo) 64.8 97.3 143.9<br />

DPS (kobo) 50.0 58.4 86.3<br />

NAV/Share (kobo) 1 027.1 1 027.7 1 113.2<br />

Valuation Ratios Current <strong>2011</strong>F 2012F<br />

Earnings Yield* (%) 16.8 20.1 29.7<br />

Dividend Yield (%) 10.3 12.0 17.8<br />

PE* (x) 6.0 5.0 3.4<br />

PBV (x) 0.49 0.47 0.44<br />

RoaA (%) 1.5 1.8 2.0<br />

RoaE (%) 6.5 9.6 13.4<br />

Net Interest Margin (%) 7.3 7.1 7.0<br />

Cost to Income Ratio (%) 70.0 59.7 59.9<br />

* - trailing<br />

Access Bank vs NSE ASI (Rebased)<br />

1.5<br />

1.4<br />

1.3<br />

1.2<br />

1.1<br />

1<br />

0.9<br />

0.8<br />

0.7<br />

0.6<br />

0.5<br />

0.4<br />

0.3<br />

17-Nov-10<br />

17-Dec-10<br />

17-Jan-11<br />

17-Feb-11<br />

17-Mar-11<br />

17-Apr-11<br />

17-May-11<br />

17-Jun-11<br />

17-Jul-11<br />

17-Aug-11<br />

17-Sep-11<br />

17-Oct-11<br />

17-Nov-11<br />

Strengths<br />

Weaknesses<br />

IT focused<br />

Wholesale roots has meant traditionally higher cost of funds<br />

Solid CAR and liquidity ratios<br />

Large oil & gas exposure - should now be resolved via AMCON<br />

Targeting middle market where most peers focus on top end Relatively small branch network<br />

Opportunities<br />

Threats<br />

Intercon acquisition to give increased scale and<br />

<strong>Sector</strong> to become more competitive<br />

lower cost of funds<br />

Delays/ resistance to acquisition could lead to slower<br />

Combined branch network enhances customer base implementation and benefits thereof accruing<br />

Access Bank<br />

NSE ASI<br />

5