KESKO CORPORATION STOCK EXCHANGE RELEASE ... - Euroland

KESKO CORPORATION STOCK EXCHANGE RELEASE ... - Euroland

KESKO CORPORATION STOCK EXCHANGE RELEASE ... - Euroland

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

2<br />

than in the previous year (EUR 1,455 million). As part of the<br />

chain reform Kesko lowered its wholesale prices to the K-<br />

retailers from the beginning of 2001. The effect of the new<br />

pricing system on net sales is estimated to be two percentage<br />

points.<br />

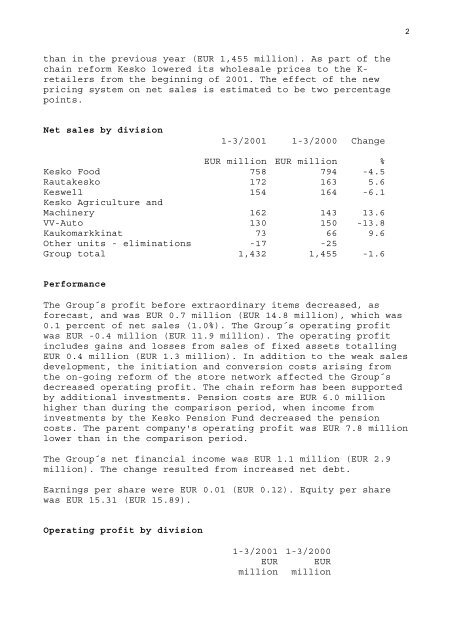

Net sales by division<br />

1-3/2001 1-3/2000 Change<br />

EUR million EUR million %<br />

Kesko Food 758 794 -4.5<br />

Rautakesko 172 163 5.6<br />

Keswell 154 164 -6.1<br />

Kesko Agriculture and<br />

Machinery 162 143 13.6<br />

VV-Auto 130 150 -13.8<br />

Kaukomarkkinat 73 66 9.6<br />

Other units - eliminations -17 -25<br />

Group total 1,432 1,455 -1.6<br />

Performance<br />

The Group´s profit before extraordinary items decreased, as<br />

forecast, and was EUR 0.7 million (EUR 14.8 million), which was<br />

0.1 percent of net sales (1.0%). The Group´s operating profit<br />

was EUR -0.4 million (EUR 11.9 million). The operating profit<br />

includes gains and losses from sales of fixed assets totalling<br />

EUR 0.4 million (EUR 1.3 million). In addition to the weak sales<br />

development, the initiation and conversion costs arising from<br />

the on-going reform of the store network affected the Group´s<br />

decreased operating profit. The chain reform has been supported<br />

by additional investments. Pension costs are EUR 6.0 million<br />

higher than during the comparison period, when income from<br />

investments by the Kesko Pension Fund decreased the pension<br />

costs. The parent company's operating profit was EUR 7.8 million<br />

lower than in the comparison period.<br />

The Group´s net financial income was EUR 1.1 million (EUR 2.9<br />

million). The change resulted from increased net debt.<br />

Earnings per share were EUR 0.01 (EUR 0.12). Equity per share<br />

was EUR 15.31 (EUR 15.89).<br />

Operating profit by division<br />

1-3/2001 1-3/2000<br />

EUR EUR<br />

million million