KESKO CORPORATION STOCK EXCHANGE RELEASE ... - Euroland

KESKO CORPORATION STOCK EXCHANGE RELEASE ... - Euroland

KESKO CORPORATION STOCK EXCHANGE RELEASE ... - Euroland

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

3<br />

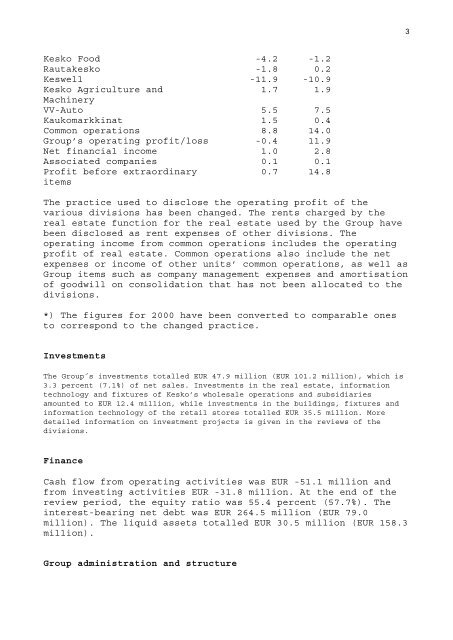

Kesko Food -4.2 -1.2<br />

Rautakesko -1.8 0.2<br />

Keswell -11.9 -10.9<br />

Kesko Agriculture and 1.7 1.9<br />

Machinery<br />

VV-Auto 5.5 7.5<br />

Kaukomarkkinat 1.5 0.4<br />

Common operations 8.8 14.0<br />

Group’s operating profit/loss -0.4 11.9<br />

Net financial income 1.0 2.8<br />

Associated companies 0.1 0.1<br />

Profit before extraordinary<br />

items<br />

0.7 14.8<br />

The practice used to disclose the operating profit of the<br />

various divisions has been changed. The rents charged by the<br />

real estate function for the real estate used by the Group have<br />

been disclosed as rent expenses of other divisions. The<br />

operating income from common operations includes the operating<br />

profit of real estate. Common operations also include the net<br />

expenses or income of other units’ common operations, as well as<br />

Group items such as company management expenses and amortisation<br />

of goodwill on consolidation that has not been allocated to the<br />

divisions.<br />

*) The figures for 2000 have been converted to comparable ones<br />

to correspond to the changed practice.<br />

Investments<br />

The Group´s investments totalled EUR 47.9 million (EUR 101.2 million), which is<br />

3.3 percent (7.1%) of net sales. Investments in the real estate, information<br />

technology and fixtures of Kesko’s wholesale operations and subsidiaries<br />

amounted to EUR 12.4 million, while investments in the buildings, fixtures and<br />

information technology of the retail stores totalled EUR 35.5 million. More<br />

detailed information on investment projects is given in the reviews of the<br />

divisions.<br />

Finance<br />

Cash flow from operating activities was EUR -51.1 million and<br />

from investing activities EUR -31.8 million. At the end of the<br />

review period, the equity ratio was 55.4 percent (57.7%). The<br />

interest-bearing net debt was EUR 264.5 million (EUR 79.0<br />

million). The liquid assets totalled EUR 30.5 million (EUR 158.3<br />

million).<br />

Group administration and structure