Image Border - Irish Business and employers confederation

Image Border - Irish Business and employers confederation

Image Border - Irish Business and employers confederation

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

employees is exempt from Employer's PRSI. A saving equal to<br />

the Employer's PRSI on the benefit provided to the employee<br />

is made. The benefit is the difference between the cost to the<br />

employee <strong>and</strong> the open market rate for the service provided.<br />

Capital Allowances<br />

Capital allowances are available to <strong>employers</strong> that have<br />

taxable income. The capital allowances can be offset against<br />

income from the childcare centre <strong>and</strong> other income. Section<br />

5.3 elaborates on the use of capital allowances against taxable<br />

income.<br />

5.2.5 Benefit to the Employee<br />

If the conditions outlined in Sections 5.2.2 <strong>and</strong> 5.2.3 are<br />

satisfied, then the value of childcare services to the employee<br />

is not subject to Income Tax, PRSI or Health Contribution. The<br />

benefit could be savings of 42% Income Tax, Employee PRSI<br />

<strong>and</strong> Health Contribution on the cost of the childcare facilities<br />

to the employee.<br />

5.3 Capital Allowances<br />

5.3.1 Introduction<br />

Capital allowance is a method of tax depreciation used to<br />

reduce taxable trading income over a set number of years.<br />

Accelerated capital allowances at a rate of 100% are available<br />

in the first year on childcare facilities which meet the required<br />

st<strong>and</strong>ards for such facilities, as provided under the Childcare<br />

Act 1991 <strong>and</strong> the Child Care (Pre-School Services) Regulations,<br />

1996. The relief is available to all childcare facilities whether<br />

provided by <strong>employers</strong> or commercial childcare operators. The<br />

relief is available to both owners of facilities <strong>and</strong> investors<br />

who wish to invest by way of leasing arrangements. The<br />

allowances apply in respect of expenditure incurred on <strong>and</strong><br />

from December 1st 1999 on the construction, extension or<br />

refurbishment of childcare facilities. Expenditure incurred on<br />

the conversion of a building to a qualifying childcare facility is<br />

also eligible for relief.<br />

These capital allowances are also available as 15% for the first<br />

6 years <strong>and</strong> 10% in year 7.<br />

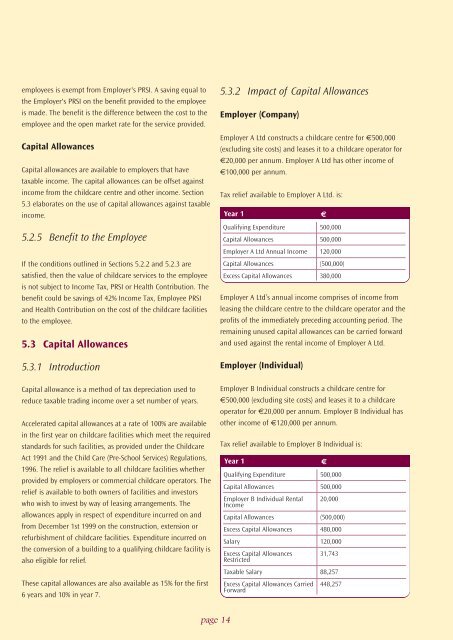

5.3.2 Impact of Capital Allowances<br />

Employer (Company)<br />

Employer A Ltd constructs a childcare centre for €500,000<br />

(excluding site costs) <strong>and</strong> leases it to a childcare operator for<br />

€20,000 per annum. Employer A Ltd has other income of<br />

€100,000 per annum.<br />

Tax relief available to Employer A Ltd. is:<br />

Year 1 €<br />

Qualifying Expenditure<br />

Capital Allowances<br />

Employer A Ltd Annual Income<br />

Capital Allowances<br />

Excess Capital Allowances<br />

Employer A Ltd’s annual income comprises of income from<br />

leasing the childcare centre to the childcare operator <strong>and</strong> the<br />

profits of the immediately preceding accounting period. The<br />

remaining unused capital allowances can be carried forward<br />

<strong>and</strong> used against the rental income of Employer A Ltd.<br />

Employer (Individual)<br />

500,000<br />

500,000<br />

120,000<br />

(500,000)<br />

380,000<br />

Employer B Individual constructs a childcare centre for<br />

€500,000 (excluding site costs) <strong>and</strong> leases it to a childcare<br />

operator for €20,000 per annum. Employer B Individual has<br />

other income of €120,000 per annum.<br />

Tax relief available to Employer B Individual is:<br />

Year 1 €<br />

Qualifying Expenditure<br />

Capital Allowances<br />

Employer B Individual Rental<br />

Income<br />

Capital Allowances<br />

Excess Capital Allowances<br />

Salary<br />

Excess Capital Allowances<br />

Restricted<br />

Taxable Salary<br />

Excess Capital Allowances Carried<br />

Forward<br />

500,000<br />

500,000<br />

20,000<br />

(500,000)<br />

480,000<br />

120,000<br />

31,743<br />

88,257<br />

448,257<br />

page 14