Informes Sectoriales OP - Icex

Informes Sectoriales OP - Icex

Informes Sectoriales OP - Icex

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

TOURISM AND RELATED SERVICES IN BULGARIA<br />

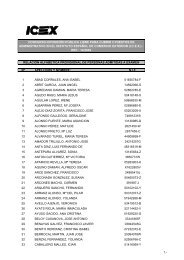

4.1.1.2. Structure of Labor Costs in 2004 (%)<br />

Economic activity groupings<br />

Total<br />

Wages<br />

and salaries<br />

Employers'<br />

imputed social<br />

contributions<br />

2004<br />

Employers' actual<br />

social contributions<br />

Other social<br />

expenses<br />

and benefits<br />

Taxes<br />

paid by<br />

the employer<br />

Total 100.00 69.16 1.73 24.05 4.22 0.84<br />

Agriculture, hunting, forestry and<br />

fishing<br />

100.00 72.98 1.28 24.09 1.38 0.27<br />

Mining and quarrying 100.00 60.63 2.92 27.37 7.50 1.58<br />

Manufacturing 100.00 69.64 2.13 24.12 3.42 0.69<br />

Electricity, gas and water supply 100.00 57.60 2.84 24.87 12.23 2.45<br />

Construction 100.00 71.55 1.66 24.61 1.82 0.36<br />

Trade, repair of motor vehicles and<br />

personal and household goods<br />

100.00 74.26 0.77 23.58 1.15 0.23<br />

Hotels and restaurants 100.00 72.20 1.23 24.14 2.05 0.38<br />

Transport, storage and communication<br />

100.00 59.49 2.00 21.97 13.77 2.77<br />

Financial intermediation 100.00 69.54 1.32 21.49 6.40 1.25<br />

Real estate, renting and business<br />

activities<br />

100.00 72.41 1.35 22.59 3.04 0.61<br />

Public administration; compulsory<br />

social security<br />

100.00 71.92 1.62 25.44 0.87 0.15<br />

Education 100.00 71.49 1.53 25.44 1.31 0.24<br />

Health and social work 100.00 73.76 1.25 24.18 0.68 0.13<br />

Other community, social and personal<br />

service activities<br />

Source: NSI<br />

100.00 73.53 1.08 23.60 1.49 0.30<br />

4.1.2. Taxation<br />

The Bulgarian tax regime can be classified in two main categories:<br />

Direct Taxation:<br />

♦ Corporate income tax<br />

♦ Personal income tax<br />

♦ Withholding taxes<br />

Indirect Taxation:<br />

♦ VAT<br />

♦ Excise Duties<br />

4.1.2.1. Corporate Income Tax<br />

Under the Corporate Income Tax Act (CITA) all companies and partnerships (including<br />

non-incorporated partnerships), carrying out business in the country, are liable<br />

to a corporate income tax at a rate of 15%. Bulgarian resident entities are taxed on a<br />

worldwide basis. Foreign entities are taxed on their Bulgarian-source income. Companies<br />

are considered to be tax residents if they are registered in Bulgaria. Companies<br />

that are non-residents in Bulgaria, but operate in Bulgaria through a branch,<br />

office, agency or other form of a permanent establishment are only liable to tax on<br />

the profits generated through their Bulgarian establishment.<br />

Spanish Economic and Commercial Office of the Spanish Embassy in Sofia 37