CIAB Market & Policy developments 2005/06 - IEA

CIAB Market & Policy developments 2005/06 - IEA

CIAB Market & Policy developments 2005/06 - IEA

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

• Fortune Minerals Limited applied for an environmental assessment for its Mount<br />

Klappan mine project in northern B.C. in October 2004. It includes an open pit mine<br />

and a preparation plant with an anticipated production of 1.5 million tonnes/year of<br />

anthracite.<br />

287. In Alberta, Sherritt and the Ontario Teachers Pension Plan applied for an environmental<br />

assessment for a coal gasification project in early January 2007. The $1.5 billion Dodds-<br />

Roundhill Gasification Project southeast of Edmonton will be the first commercial<br />

application of coal gasification technology in Canada. The proposed project involves<br />

mining sub-bituminous coal and processing it into gas. Production will begin in 2011 and<br />

will reach its designed capacity of 320 million cubic feet of synthetic gas per day by<br />

2012. Coal reserves and resources were estimated at 320 million tonnes in the project<br />

area and a 40-year mine lifespan is expected.<br />

288. In Saskatchewan, a new 300-megawatt, $1.5 billion clean coal-fired power generation<br />

plant is under feasibility study by SaskPower Inc. The SaskPower Clean Coal Project will<br />

develop and adopt Oxyfuel CO 2 separation technology. SaskPower is also considering<br />

development of potential clean coal-fired generation units in the Estevan area and the<br />

Coronach/Willow Bunch area.<br />

289. In eastern Canada, the Xstrata Donkin Mine Development Alliance (Alliance), selected<br />

by the Nova Scotia government, continued its feasibility study to develop the Donkin<br />

mine offshore of Cape Breton Island. The Alliance consists of Xstrata Coal (Australia,<br />

66%), Kaoclay (Halifax, 20%) and Atlantic Green Energy (Savannah, Georgia, 14%). The<br />

Alliance will complete the study in 2007 and start coal production in 2008.<br />

Australia<br />

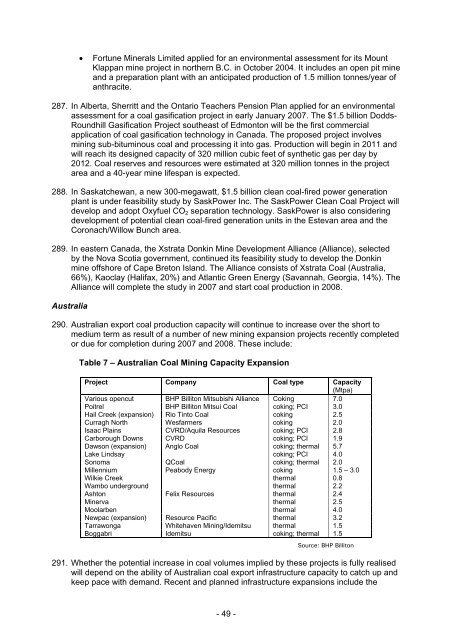

290. Australian export coal production capacity will continue to increase over the short to<br />

medium term as result of a number of new mining expansion projects recently completed<br />

or due for completion during 2007 and 2008. These include:<br />

Table 7 – Australian Coal Mining Capacity Expansion<br />

Project Company Coal type Capacity<br />

(Mtpa)<br />

Various opencut BHP Billiton Mitsubishi Alliance Coking 7.0<br />

Poitrel BHP Billiton Mitsui Coal coking; PCI 3.0<br />

Hail Creek (expansion) Rio Tinto Coal coking 2.5<br />

Curragh North Wesfarmers coking 2.0<br />

Isaac Plains CVRD/Aquila Resources coking; PCI 2.8<br />

Carborough Downs CVRD coking; PCI 1.9<br />

Dawson (expansion) Anglo Coal<br />

coking; thermal 5.7<br />

Lake Lindsay<br />

coking; PCI 4.0<br />

Sonoma QCoal coking; thermal 2.0<br />

Millennium Peabody Energy<br />

coking 1.5 – 3.0<br />

Wilkie Creek thermal 0.8<br />

Wambo underground<br />

thermal 2.2<br />

Ashton Felix Resources<br />

thermal 2.4<br />

Minerva thermal 2.5<br />

Moolarben<br />

thermal 4.0<br />

Newpac (expansion) Resource Pacific thermal 3.2<br />

Tarrawonga Whitehaven Mining/Idemitsu thermal 1.5<br />

Boggabri Idemitsu coking; thermal 1.5<br />

Source: BHP Billiton<br />

291. Whether the potential increase in coal volumes implied by these projects is fully realised<br />

will depend on the ability of Australian coal export infrastructure capacity to catch up and<br />

keep pace with demand. Recent and planned infrastructure expansions include the<br />

- 49 -