INDIA INFOLINE FINANCE LIMITED - Securities and Exchange ...

INDIA INFOLINE FINANCE LIMITED - Securities and Exchange ...

INDIA INFOLINE FINANCE LIMITED - Securities and Exchange ...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

India Infoline Finance Limited<br />

Overview<br />

SUMMARY OF BUSINESS, STRENGTHS AND STRATEGIES<br />

We are a systemically important non-deposit taking NBFC focusing on Mortgage Loans, Capital Market<br />

Finance, Gold Loan <strong>and</strong> Healthcare Finance. We are a subsidiary of India Infoline Limited (“IIFL”), a<br />

diversified financial services company. We offer a broad suite of lending <strong>and</strong> other financial products to our<br />

clients both retail <strong>and</strong> corporate. Our lending <strong>and</strong> other financial products include:<br />

• Mortgage Loans, which includes Housing Loans <strong>and</strong> Loans against Property.<br />

• Capital Market Finance, which includes Loans against <strong>Securities</strong>, Promoter Funding, Margin Funding, IPO<br />

financing <strong>and</strong> other structured lending transactions.<br />

• Gold Loans, which includes finance against security of mainly used gold ornaments.<br />

• Healthcare Finance, which includes finance for medical equipments <strong>and</strong> project funding in the healthcare<br />

sector.<br />

As on March 31, 2012, Mortgage Loans accounted for 44.70% of our Loan Book, Capital Market Finance<br />

accounted for 11.86% of our Loan Book <strong>and</strong> Gold Loans accounted for 41.07% of our Loan Book. Health Care<br />

Finance is a recent product which has been introduced in FY 2011.<br />

We received a certificate of registration dated May 12, 2005 bearing registration no. - B-13.01792 from the<br />

Reserve Bank of India for carrying on activities of a Non Banking Financial Company. India Infoline Housing<br />

Finance Limited (“IIHFL”) <strong>and</strong> India Infoline Distribution Company Limited (“IIDCL”) are our wholly owned<br />

subsidiaries. IIHFL received a certificate of registration from the National Housing Bank (“NHB”) on February<br />

3, 2009 to carry on the business of a housing finance institution.<br />

Our Promoter, IIFL is a financial services organization having presence across India. The global footprint<br />

extends across geographies with offices in New York, London, Geneva, Hong Kong, Singapore, Dubai,<br />

Mauritius <strong>and</strong> Colombo. It is listed on BSE <strong>and</strong> NSE. IIFL Group’s services <strong>and</strong> products include retail broking,<br />

institutional equities, commodities <strong>and</strong> currency broking, wealth advisory, credit & finance, insurance broking,<br />

asset management, financial products distribution & investment banking. The product/ services portfolio of IIFL<br />

caters to the diverse investment <strong>and</strong> strategic requirements of retail, institutional, corporate <strong>and</strong> affluent clients.<br />

As on March 31, 2012, IIFL has presence in over 4000 business locations which include over 1,900 branches<br />

<strong>and</strong> over 2,300 registered franchisees, spread across 959 cities in 28 states <strong>and</strong> union territories in India. We<br />

leverage extensively on the infrastructure, distribution network <strong>and</strong> insights of IIFL Group into market <strong>and</strong><br />

customer needs.<br />

Over the past several years, we have exp<strong>and</strong>ed our presence into markets that are of greater relevance to the<br />

products we offer. Portfolio performance <strong>and</strong> profitability are the factors that drive the branch network. As of<br />

March 31, 2012, we have a total of 1,323 branches – 34 branches for our Mortgage Loans <strong>and</strong> Healthcare<br />

Finance distribution network of which 32 branches are co-located with the branch network of IIFL Group <strong>and</strong> a<br />

total of 1297 gold loan branches out of which 1180 are exclusive Gold Loans branches. Our Capital Market<br />

Finance business is sourced through direct sales, branch network, retail <strong>and</strong> wealth teams of IIFL. As of March<br />

31, 2012, we have an access to over 2,900 sales executives from the retail teams <strong>and</strong> over 120 sales executives<br />

from the wealth teams of IIFL for our Capital Market Finance business. Our Company’s employee strength as<br />

on March 31, 2012 was 6,094.<br />

Our Consolidated Income from Operations <strong>and</strong> Profit after Tax (PAT) for the financial year ending March 31,<br />

2012 is ` 9084.58 million <strong>and</strong> ` 1053.81 million respectively. Our Consolidated Income from Operation <strong>and</strong><br />

Profit after tax has grown at a CAGR of 54.33% <strong>and</strong> 44.85% respectively over the last four years. Our Loan<br />

Book has grown at a CAGR of 63.82% over the last four years.<br />

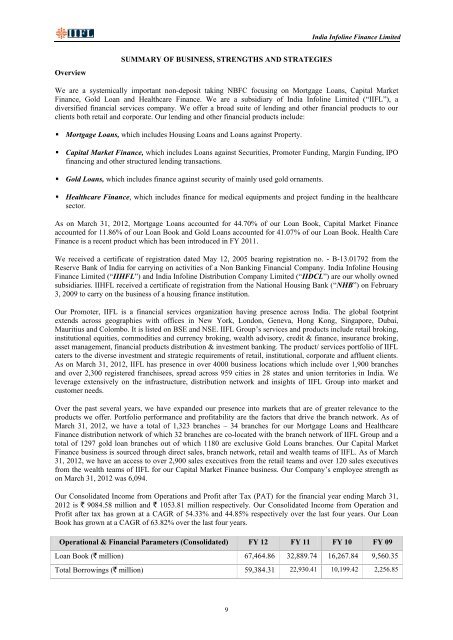

Operational & Financial Parameters (Consolidated) FY 12 FY 11 FY 10 FY 09<br />

Loan Book (` million) 67,464.86 32,889.74 16,267.84 9,560.35<br />

Total Borrowings (` million) 59,384.31 22,930.41 10,199.42 2,256.85<br />

9