- Page 1 and 2: Draft Prospectus August 16 , 2012 I

- Page 3: India Infoline Finance Limited SECT

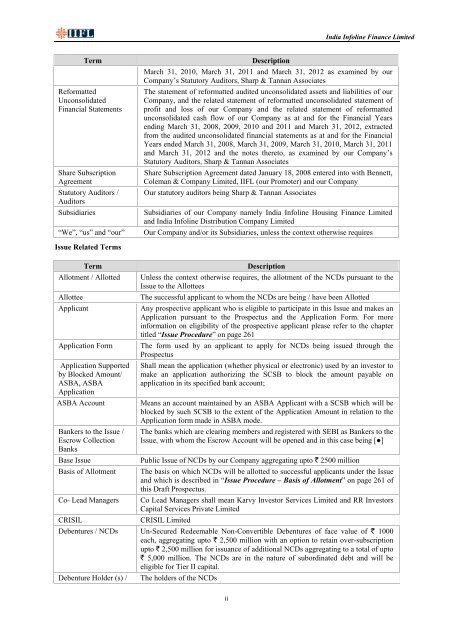

- Page 7 and 8: India Infoline Finance Limited Term

- Page 9 and 10: India Infoline Finance Limited Term

- Page 11 and 12: India Infoline Finance Limited FORW

- Page 13 and 14: India Infoline Finance Limited SECT

- Page 15 and 16: India Infoline Finance Limited expe

- Page 17 and 18: India Infoline Finance Limited duly

- Page 19 and 20: India Infoline Finance Limited exis

- Page 21 and 22: India Infoline Finance Limited our

- Page 23 and 24: India Infoline Finance Limited hist

- Page 25 and 26: India Infoline Finance Limited Risk

- Page 27 and 28: India Infoline Finance Limited 56.

- Page 29 and 30: India Infoline Finance Limited 7. O

- Page 31 and 32: India Infoline Finance Limited Boar

- Page 33 and 34: India Infoline Finance Limited Debe

- Page 35 and 36: India Infoline Finance Limited Fax:

- Page 37 and 38: India Infoline Finance Limited Coll

- Page 39 and 40: India Infoline Finance Limited Oper

- Page 41 and 42: India Infoline Finance Limited loan

- Page 43 and 44: India Infoline Finance Limited Risk

- Page 45 and 46: India Infoline Finance Limited Part

- Page 47 and 48: India Infoline Finance Limited allo

- Page 49 and 50: India Infoline Finance Limited Decr

- Page 51 and 52: India Infoline Finance Limited Opti

- Page 53 and 54: India Infoline Finance Limited Equi

- Page 55 and 56:

India Infoline Finance Limited Sr.

- Page 57 and 58:

India Infoline Finance Limited Sr.

- Page 59 and 60:

India Infoline Finance Limited Sr.

- Page 61 and 62:

India Infoline Finance Limited Sr.

- Page 63 and 64:

India Infoline Finance Limited Sr.

- Page 65 and 66:

India Infoline Finance Limited p. I

- Page 67 and 68:

India Infoline Finance Limited Sr.

- Page 69 and 70:

India Infoline Finance Limited Sr.

- Page 71 and 72:

India Infoline Finance Limited Sr.

- Page 73 and 74:

India Infoline Finance Limited OBJE

- Page 75 and 76:

India Infoline Finance Limited the

- Page 77 and 78:

India Infoline Finance Limited 1998

- Page 79 and 80:

China Malaysia Singapore Vietnam Th

- Page 81 and 82:

India Infoline Finance Limited Mark

- Page 83 and 84:

India Infoline Finance Limited ATS

- Page 85 and 86:

India Infoline Finance Limited (Rs

- Page 87 and 88:

India Infoline Finance Limited Heal

- Page 89 and 90:

India Infoline Finance Limited 2012

- Page 91 and 92:

India Infoline Finance Limited Acce

- Page 93 and 94:

India Infoline Finance Limited Stre

- Page 95 and 96:

India Infoline Finance Limited C. G

- Page 97 and 98:

India Infoline Finance Limited Segm

- Page 99 and 100:

India Infoline Finance Limited Init

- Page 101 and 102:

India Infoline Finance Limited is d

- Page 103 and 104:

India Infoline Finance Limited to w

- Page 105 and 106:

India Infoline Finance Limited Cred

- Page 107 and 108:

India Infoline Finance Limited Empl

- Page 109 and 110:

India Infoline Finance Limited Purs

- Page 111 and 112:

India Infoline Finance Limited OUR

- Page 113 and 114:

India Infoline Finance Limited Name

- Page 115 and 116:

India Infoline Finance Limited Ms.

- Page 117 and 118:

India Infoline Finance Limited v. R

- Page 119 and 120:

India Infoline Finance Limited 5. R

- Page 121 and 122:

India Infoline Finance Limited Key

- Page 123 and 124:

India Infoline Finance Limited Furt

- Page 125 and 126:

India Infoline Finance Limited Cate

- Page 127 and 128:

India Infoline Finance Limited Sr.

- Page 129 and 130:

India Infoline Finance Limited Sub

- Page 131 and 132:

India Infoline Finance Limited Sr.

- Page 133 and 134:

India Infoline Finance Limited OUR

- Page 135 and 136:

India Infoline Finance Limited SECT

- Page 137 and 138:

India Infoline Finance Limited Anne

- Page 139 and 140:

India Infoline Finance Limited Anne

- Page 141 and 142:

India Infoline Finance Limited Issu

- Page 143 and 144:

India Infoline Finance Limited Part

- Page 145 and 146:

India Infoline Finance Limited *The

- Page 147 and 148:

India Infoline Finance Limited Rede

- Page 149 and 150:

India Infoline Finance Limited Inte

- Page 151 and 152:

India Infoline Finance Limited Part

- Page 153 and 154:

India Infoline Finance Limited Note

- Page 155 and 156:

India Infoline Finance Limited Loan

- Page 157 and 158:

India Infoline Finance Limited Net

- Page 159 and 160:

India Infoline Finance Limited Secu

- Page 161 and 162:

India Infoline Finance Limited SBDB

- Page 163 and 164:

India Infoline Finance Limited Int

- Page 165 and 166:

India Infoline Finance Limited 19,9

- Page 167 and 168:

India Infoline Finance Limited Natu

- Page 169 and 170:

India Infoline Finance Limited 14.

- Page 171 and 172:

India Infoline Finance Limited Note

- Page 173 and 174:

India Infoline Finance Limited Amou

- Page 175 and 176:

India Infoline Finance Limited Natu

- Page 177 and 178:

India Infoline Finance Limited 12.

- Page 179 and 180:

India Infoline Finance Limited Scri

- Page 181 and 182:

India Infoline Finance Limited b) E

- Page 183 and 184:

India Infoline Finance Limited 3. B

- Page 185 and 186:

India Infoline Finance Limited Note

- Page 187 and 188:

India Infoline Finance Limited Natu

- Page 189 and 190:

India Infoline Finance Limited (b)

- Page 191 and 192:

India Infoline Finance Limited Expo

- Page 193 and 194:

India Infoline Finance Limited c) S

- Page 195 and 196:

India Infoline Finance Limited Natu

- Page 197 and 198:

India Infoline Finance Limited Asse

- Page 199 and 200:

India Infoline Finance Limited 8. O

- Page 201 and 202:

India Infoline Finance Limited Sr.

- Page 203 and 204:

India Infoline Finance Limited (665

- Page 205 and 206:

India Infoline Finance Limited (ii)

- Page 207 and 208:

India Infoline Finance Limited To,

- Page 209 and 210:

India Infoline Finance Limited Anne

- Page 211 and 212:

India Infoline Finance Limited Anne

- Page 213 and 214:

India Infoline Finance Limited duri

- Page 215 and 216:

India Infoline Finance Limited issu

- Page 217 and 218:

India Infoline Finance Limited 11.0

- Page 219 and 220:

India Infoline Finance Limited As a

- Page 221 and 222:

India Infoline Finance Limited 31,

- Page 223 and 224:

India Infoline Finance Limited Note

- Page 225 and 226:

India Infoline Finance Limited * He

- Page 227 and 228:

India Infoline Finance Limited Note

- Page 229 and 230:

India Infoline Finance Limited Anne

- Page 231 and 232:

India Infoline Finance Limited Anne

- Page 233 and 234:

India Infoline Finance Limited Anne

- Page 235 and 236:

India Infoline Finance Limited Secu

- Page 237 and 238:

India Infoline Finance Limited Non-

- Page 239 and 240:

India Infoline Finance Limited the

- Page 241 and 242:

India Infoline Finance Limited valu

- Page 243 and 244:

India Infoline Finance Limited 8. S

- Page 245 and 246:

India Infoline Finance Limited Natu

- Page 247 and 248:

India Infoline Finance Limited Natu

- Page 249 and 250:

India Infoline Finance Limited (` i

- Page 251 and 252:

India Infoline Finance Limited 4. S

- Page 253 and 254:

India Infoline Finance Limited Natu

- Page 255 and 256:

India Infoline Finance Limited Mone

- Page 257 and 258:

India Infoline Finance Limited Mini

- Page 259 and 260:

India Infoline Finance Limited Sr.

- Page 261 and 262:

India Infoline Finance Limited PART

- Page 263 and 264:

India Infoline Finance Limited FINA

- Page 265 and 266:

India Infoline Finance Limited Name

- Page 267 and 268:

India Infoline Finance Limited Name

- Page 269 and 270:

India Infoline Finance Limited •

- Page 271 and 272:

India Infoline Finance Limited ` 10

- Page 273 and 274:

India Infoline Finance Limited •

- Page 275 and 276:

India Infoline Finance Limited 3. I

- Page 277 and 278:

India Infoline Finance Limited SECT

- Page 279 and 280:

India Infoline Finance Limited NCDs

- Page 281 and 282:

India Infoline Finance Limited thro

- Page 283 and 284:

India Infoline Finance Limited NCDs

- Page 285 and 286:

India Infoline Finance Limited auth

- Page 287 and 288:

India Infoline Finance Limited Prin

- Page 289 and 290:

India Infoline Finance Limited Sect

- Page 291 and 292:

India Infoline Finance Limited •

- Page 293 and 294:

India Infoline Finance Limited Appl

- Page 295 and 296:

India Infoline Finance Limited Depo

- Page 297 and 298:

India Infoline Finance Limited resp

- Page 299 and 300:

India Infoline Finance Limited Form

- Page 301 and 302:

India Infoline Finance Limited •

- Page 303 and 304:

India Infoline Finance Limited •

- Page 305 and 306:

India Infoline Finance Limited “P

- Page 307 and 308:

India Infoline Finance Limited List

- Page 309 and 310:

India Infoline Finance Limited The

- Page 311 and 312:

India Infoline Finance Limited Judi

- Page 313 and 314:

India Infoline Finance Limited file

- Page 315 and 316:

India Infoline Finance Limited thro

- Page 317 and 318:

India Infoline Finance Limited 19.

- Page 319 and 320:

India Infoline Finance Limited 3. S

- Page 321 and 322:

India Infoline Finance Limited clai

- Page 323 and 324:

India Infoline Finance Limited Agre

- Page 325 and 326:

India Infoline Finance Limited offi

- Page 327 and 328:

India Infoline Finance Limited 29,

- Page 329 and 330:

India Infoline Finance Limited Foru

- Page 331 and 332:

India Infoline Finance Limited ANAL

- Page 333 and 334:

India Infoline Finance Limited Our

- Page 335 and 336:

India Infoline Finance Limited KEY

- Page 337 and 338:

India Infoline Finance Limited term

- Page 339 and 340:

India Infoline Finance Limited Asse

- Page 341 and 342:

India Infoline Finance Limited Fore

- Page 343 and 344:

India Infoline Finance Limited SECT

- Page 345 and 346:

India Infoline Finance Limited will

- Page 347 and 348:

India Infoline Finance Limited 2. D

- Page 349 and 350:

India Infoline Finance Limited 11.

- Page 351 and 352:

India Infoline Finance Limited ANNE

- Page 353 and 354:

India Infoline Finance Limited Symb

- Page 355 and 356:

India Infoline Finance Limited Symb

- Page 357 and 358:

India Infoline Finance Limited Symb

- Page 359 and 360:

India Infoline Finance Limited Symb

- Page 361 and 362:

India Infoline Finance Limited Date

- Page 363 and 364:

India Infoline Finance Limited Date

- Page 365 and 366:

India Infoline Finance Limited Date

- Page 367 and 368:

India Infoline Finance Limited NSE

- Page 369 and 370:

Rating Table India Infoline Finance

- Page 371 and 372:

For further details please contact: