INDIA INFOLINE FINANCE LIMITED - Securities and Exchange ...

INDIA INFOLINE FINANCE LIMITED - Securities and Exchange ...

INDIA INFOLINE FINANCE LIMITED - Securities and Exchange ...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

India Infoline Finance Limited<br />

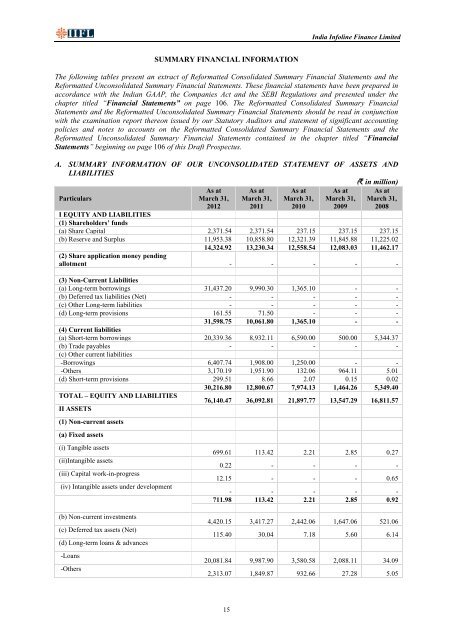

SUMMARY FINANCIAL INFORMATION<br />

The following tables present an extract of Reformatted Consolidated Summary Financial Statements <strong>and</strong> the<br />

Reformatted Unconsolidated Summary Financial Statements. These financial statements have been prepared in<br />

accordance with the Indian GAAP, the Companies Act <strong>and</strong> the SEBI Regulations <strong>and</strong> presented under the<br />

chapter titled “Financial Statements” on page 106. The Reformatted Consolidated Summary Financial<br />

Statements <strong>and</strong> the Reformatted Unconsolidated Summary Financial Statements should be read in conjunction<br />

with the examination report thereon issued by our Statutory Auditors <strong>and</strong> statement of significant accounting<br />

policies <strong>and</strong> notes to accounts on the Reformatted Consolidated Summary Financial Statements <strong>and</strong> the<br />

Reformatted Unconsolidated Summary Financial Statements contained in the chapter titled “Financial<br />

Statements” beginning on page 106 of this Draft Prospectus.<br />

A. SUMMARY INFORMATION OF OUR UNCONSOLIDATED STATEMENT OF ASSETS AND<br />

LIABILITIES<br />

(` in million)<br />

Particulars<br />

As at<br />

March 31,<br />

2012<br />

As at<br />

March 31,<br />

2011<br />

As at<br />

March 31,<br />

2010<br />

As at<br />

March 31,<br />

2009<br />

As at<br />

March 31,<br />

2008<br />

I EQUITY AND LIABILITIES<br />

(1) Shareholders’ funds<br />

(a) Share Capital 2,371.54 2,371.54 237.15 237.15 237.15<br />

(b) Reserve <strong>and</strong> Surplus 11,953.38 10,858.80 12,321.39 11,845.88 11,225.02<br />

14,324.92 13,230.34 12,558.54 12,083.03 11,462.17<br />

(2) Share application money pending<br />

allotment - - - - -<br />

(3) Non-Current Liabilities<br />

(a) Long-term borrowings 31,437.20 9,990.30 1,365.10 - -<br />

(b) Deferred tax liabilities (Net) - - - - -<br />

(c) Other Long-term liabilities - - - - -<br />

(d) Long-term provisions 161.55 71.50 - - -<br />

31,598.75 10,061.80 1,365.10 - -<br />

(4) Current liabilities<br />

(a) Short-term borrowings 20,339.36 8,932.11 6,590.00 500.00 5,344.37<br />

(b) Trade payables - - - - -<br />

(c) Other current liabilities<br />

-Borrowings 6,407.74 1,908.00 1,250.00 - -<br />

-Others 3,170.19 1,951.90 132.06 964.11 5.01<br />

(d) Short-term provisions 299.51 8.66 2.07 0.15 0.02<br />

30,216.80 12,800.67 7,974.13 1,464.26 5,349.40<br />

TOTAL – EQUITY AND LIABILITIES<br />

76,140.47 36,092.81 21,897.77 13,547.29 16,811.57<br />

II ASSETS<br />

(1) Non-current assets<br />

(a) Fixed assets<br />

(i) Tangible assets<br />

(ii)Intangible assets<br />

(iii) Capital work-in-progress<br />

(iv) Intangible assets under development<br />

(b) Non-current investments<br />

(c) Deferred tax assets (Net)<br />

(d) Long-term loans & advances<br />

-Loans<br />

-Others<br />

699.61 113.42 2.21 2.85 0.27<br />

0.22 - - - -<br />

12.15 - - - 0.65<br />

- - - - -<br />

711.98 113.42 2.21 2.85 0.92<br />

4,420.15 3,417.27 2,442.06 1,647.06 521.06<br />

115.40 30.04 7.18 5.60 6.14<br />

20,081.84 9,987.90 3,580.58 2,088.11 34.09<br />

2,313.07 1,849.87 932.66 27.28 5.05<br />

15