INDIA INFOLINE FINANCE LIMITED - Securities and Exchange ...

INDIA INFOLINE FINANCE LIMITED - Securities and Exchange ...

INDIA INFOLINE FINANCE LIMITED - Securities and Exchange ...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

India Infoline Finance Limited<br />

Reserve <strong>and</strong> Surplus 12,076.24 11,040.48 12,407.13 11,870.97 11,189.28<br />

Less : Miscellaneous expenditure 165.99 - - - 72.28<br />

Total 14,281.79 13,412.02 12,644.28 12,108.12 11,354.15<br />

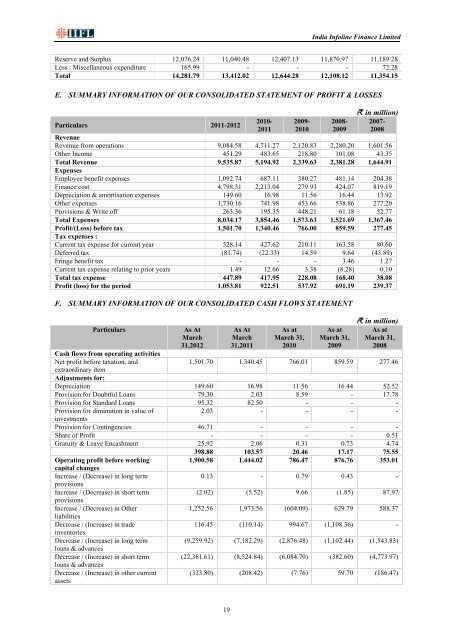

E. SUMMARY INFORMATION OF OUR CONSOLIDATED STATEMENT OF PROFIT & LOSSES<br />

Particulars 2011-2012<br />

2010-<br />

2011<br />

2009-<br />

2010<br />

2008-<br />

2009<br />

(` in million)<br />

2007-<br />

2008<br />

Revenue<br />

Revenue from operations 9,084.58 4,711.27 2,120.83 2,280.20 1,601.56<br />

Other Income 451.29 483.65 218.80 101.08 43.35<br />

Total Revenue 9,535.87 5,194.92 2,339.63 2,381.28 1,644.91<br />

Expenses<br />

Employee benefit expenses 1,092.74 687.11 380.27 481.14 204.38<br />

Finance cost 4,798.31 2,213.04 279.93 424.07 819.19<br />

Depreciation & amortisation expenses 149.60 16.98 11.56 16.44 13.92<br />

Other expenses 1,730.16 741.98 453.66 538.86 277.20<br />

Provisions & Write off 263.36 195.35 448.21 61.18 52.77<br />

Total Expenses 8,034.17 3,854.46 1,573.63 1,521.69 1,367.46<br />

Profit/(Loss) before tax 1,501.70 1,340.46 766.00 859.59 277.45<br />

Tax expenses :<br />

Current tax expense for current year 528.14 427.62 210.11 163.58 80.60<br />

Deferred tax (81.74) (22.33) 14.59 9.64 (43.89)<br />

Fringe benefit tax - - - 3.46 1.27<br />

Current tax expense relating to prior years 1.49 12.66 3.38 (8.28) 0.10<br />

Total tax expense 447.89 417.95 228.08 168.40 38.08<br />

Profit (loss) for the period 1,053.81 922.51 537.92 691.19 239.37<br />

F. SUMMARY INFORMATION OF OUR CONSOLIDATED CASH FLOWS STATEMENT<br />

Particulars<br />

Cash flows from operating activities<br />

Net profit before taxation, <strong>and</strong><br />

extraordinary item<br />

As At<br />

March<br />

31,2012<br />

As At<br />

March<br />

31,2011<br />

As at<br />

March 31,<br />

2010<br />

As at<br />

March 31,<br />

2009<br />

(` in million)<br />

As at<br />

March 31,<br />

2008<br />

1,501.70 1,340.45 766.01 859.59 277.46<br />

Adjustments for:<br />

Depreciation 149.60 16.98 11.56 16.44 52.52<br />

Provision for Doubtful Loans 79.30 2.03 8.59 - 17.78<br />

Provision for St<strong>and</strong>ard Loans 95.32 82.50 - - -<br />

Provision for diminution in value of<br />

2.03 - - - -<br />

investments<br />

Provision for Contingencies 46.71 - - - -<br />

Share of Profit - - - - 0.51<br />

Gratuity & Leave Encashment 25.92 2.06 0.31 0.73 4.74<br />

398.88 103.57 20.46 17.17 75.55<br />

Operating profit before working<br />

capital changes<br />

Increase / (Decrease) in long term<br />

provisions<br />

Increase / (Decrease) in short term<br />

provisions<br />

Increase / (Decrease) in Other<br />

liabilities<br />

Decrease / (Increase) in trade<br />

inventories<br />

Decrease / (Increase) in long term<br />

loans & advances<br />

Decrease / (Increase) in short term<br />

loans & advances<br />

Decrease / (Increase) in other current<br />

assets<br />

1,900.58 1,444.02 786.47 876.76 353.01<br />

0.13 - 0.79 0.43 -<br />

(2.02) (5.52) 9.66 (1.85) 87.97<br />

1,252.56 1,973.56 (604.09) 629.79 588.37<br />

116.45 (110.14) 994.67 (1,108.36) -<br />

(9,259.92) (7,182.29) (2,876.48) (1,102.44) (1,543.83)<br />

(22,361.61) (8,524.84) (6,084.70) (382.60) (4,773.97)<br />

(323.80) (208.42) (7.76) 59.70 (186.47)<br />

19