FORM 10-K IMPERIAL OIL LIMITED

FORM 10-K IMPERIAL OIL LIMITED

FORM 10-K IMPERIAL OIL LIMITED

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

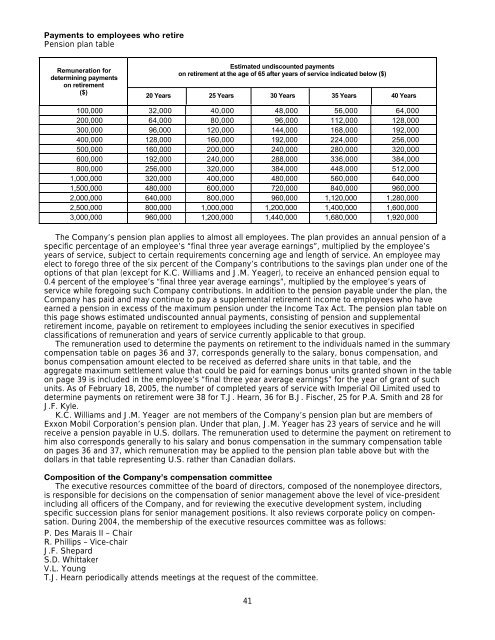

Payments to employees who retire<br />

Pension plan table<br />

Remuneration for<br />

determining payments<br />

on retirement<br />

($)<br />

Estimated undiscounted payments<br />

on retirement at the age of 65 after years of service indicated below ($)<br />

20 Years 25 Years 30 Years 35 Years 40 Years<br />

<strong>10</strong>0,000 32,000 40,000 48,000 56,000 64,000<br />

200,000 64,000 80,000 96,000 112,000 128,000<br />

300,000 96,000 120,000 144,000 168,000 192,000<br />

400,000 128,000 160,000 192,000 224,000 256,000<br />

500,000 160,000 200,000 240,000 280,000 320,000<br />

600,000 192,000 240,000 288,000 336,000 384,000<br />

800,000 256,000 320,000 384,000 448,000 512,000<br />

1,000,000 320,000 400,000 480,000 560,000 640,000<br />

1,500,000 480,000 600,000 720,000 840,000 960,000<br />

2,000,000 640,000 800,000 960,000 1,120,000 1,280,000<br />

2,500,000 800,000 1,000,000 1,200,000 1,400,000 1,600,000<br />

3,000,000 960,000 1,200,000 1,440,000 1,680,000 1,920,000<br />

The Company’s pension plan applies to almost all employees. The plan provides an annual pension of a<br />

specific percentage of an employee’s “final three year average earnings”, multiplied by the employee’s<br />

years of service, subject to certain requirements concerning age and length of service. An employee may<br />

elect to forego three of the six percent of the Company’s contributions to the savings plan under one of the<br />

options of that plan (except for K.C. Williams and J.M. Yeager), to receive an enhanced pension equal to<br />

0.4 percent of the employee’s “final three year average earnings”, multiplied by the employee’s years of<br />

service while foregoing such Company contributions. In addition to the pension payable under the plan, the<br />

Company has paid and may continue to pay a supplemental retirement income to employees who have<br />

earned a pension in excess of the maximum pension under the Income Tax Act. The pension plan table on<br />

this page shows estimated undiscounted annual payments, consisting of pension and supplemental<br />

retirement income, payable on retirement to employees including the senior executives in specified<br />

classifications of remuneration and years of service currently applicable to that group.<br />

The remuneration used to determine the payments on retirement to the individuals named in the summary<br />

compensation table on pages 36 and 37, corresponds generally to the salary, bonus compensation, and<br />

bonus compensation amount elected to be received as deferred share units in that table, and the<br />

aggregate maximum settlement value that could be paid for earnings bonus units granted shown in the table<br />

on page 39 is included in the employee’s “final three year average earnings” for the year of grant of such<br />

units. As of February 18, 2005, the number of completed years of service with Imperial Oil Limited used to<br />

determine payments on retirement were 38 for T.J. Hearn, 36 for B.J. Fischer, 25 for P.A. Smith and 28 for<br />

J.F. Kyle.<br />

K.C. Williams and J.M. Yeager are not members of the Company’s pension plan but are members of<br />

Exxon Mobil Corporation’s pension plan. Under that plan, J.M. Yeager has 23 years of service and he will<br />

receive a pension payable in U.S. dollars. The remuneration used to determine the payment on retirement to<br />

him also corresponds generally to his salary and bonus compensation in the summary compensation table<br />

on pages 36 and 37, which remuneration may be applied to the pension plan table above but with the<br />

dollars in that table representing U.S. rather than Canadian dollars.<br />

Composition of the Company’s compensation committee<br />

The executive resources committee of the board of directors, composed of the nonemployee directors,<br />

is responsible for decisions on the compensation of senior management above the level of vice-president<br />

including all officers of the Company, and for reviewing the executive development system, including<br />

specific succession plans for senior management positions. It also reviews corporate policy on compensation.<br />

During 2004, the membership of the executive resources committee was as follows:<br />

P. Des Marais II – Chair<br />

R. Phillips – Vice-chair<br />

J.F. Shepard<br />

S.D. Whittaker<br />

V.L. Young<br />

T.J. Hearn periodically attends meetings at the request of the committee.<br />

41