FORM 10-K IMPERIAL OIL LIMITED

FORM 10-K IMPERIAL OIL LIMITED

FORM 10-K IMPERIAL OIL LIMITED

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

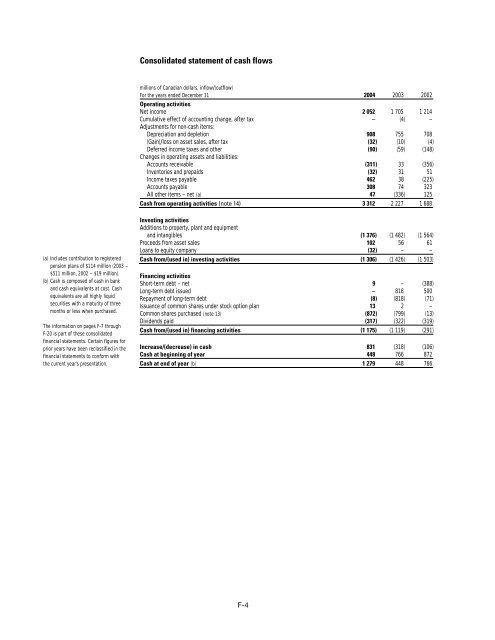

Consolidated statement of cash flows<br />

millions of Canadian dollars, inflow/(outflow)<br />

For the years ended December 31 2004 2003 2002<br />

Operating activities<br />

Net income 2 052 1 705 1 214<br />

Cumulative effect of accounting change, after tax – (4) –<br />

Adjustments for non-cash items:<br />

Depreciation and depletion 908 755 708<br />

(Gain)/loss on asset sales, after tax (32) (<strong>10</strong>) (4)<br />

Deferred income taxes and other (90) (59) (148)<br />

Changes in operating assets and liabilities:<br />

Accounts receivable (311) 33 (356)<br />

Inventories and prepaids (32) 31 51<br />

Income taxes payable 462 38 (225)<br />

Accounts payable 308 74 323<br />

All other items – net ( a ) 47 (336) 125<br />

Cash from operating activities (note 14) 3 312 2 227 1 688<br />

( a ) Includes contribution to re g i s t e re d<br />

pension plans of $114 million (2003 –<br />

$511 million, 2002 – $19 million).<br />

( b ) Cash is composed of cash in bank<br />

and cash equivalents at cost. Cash<br />

equivalents are all highly liquid<br />

securities with a maturity of thre e<br />

months or less when purc h a s e d .<br />

The information on pages F-7 through<br />

F-20 is part of these consolidated<br />

financial statements. Certain figures for<br />

prior years have been reclassified in the<br />

financial statements to conform with<br />

the current year’s pre s e n t a t i o n .<br />

Investing activities<br />

Additions to property, plant and equipment<br />

and intangibles (1 376) (1 482) (1 564)<br />

Proceeds from asset sales <strong>10</strong>2 56 61<br />

Loans to equity company (32) – –<br />

Cash from/(used in) investing activities (1 306) (1 426) (1 503)<br />

Financing activities<br />

Short-term debt – net 9 – (388)<br />

Long-term debt issued – 818 500<br />

Repayment of long-term debt (8) (818) (71)<br />

Issuance of common shares under stock option plan 13 2 –<br />

Common shares purchased (note 13) (872) (799) (13)<br />

Dividends paid (317) (322) (319)<br />

Cash from/(used in) financing activities (1 175) (1 119) (291)<br />

Increase/(decrease) in cash 831 (318) (<strong>10</strong>6)<br />

Cash at beginning of year 448 766 872<br />

Cash at end of year ( b ) 1 279 448 766<br />

F-4