Lecture 9 - Lehrstuhl für Controlling - Technische Universität München

Lecture 9 - Lehrstuhl für Controlling - Technische Universität München

Lecture 9 - Lehrstuhl für Controlling - Technische Universität München

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

<strong>Technische</strong> <strong>Universität</strong> <strong>München</strong><br />

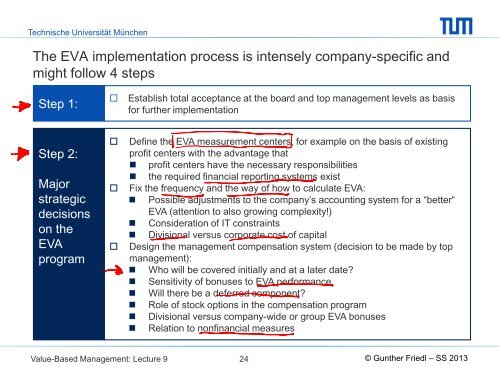

The EVA implementation process is intensely company-specific and<br />

might follow 4 steps<br />

Step 1:<br />

<br />

Establish total acceptance at the board and top management levels as basis<br />

for further implementation<br />

Step 2:<br />

Major<br />

strategic<br />

decisions<br />

on the<br />

EVA<br />

program<br />

<br />

<br />

<br />

Define the EVA measurement centers, for example on the basis of existing<br />

profit centers with the advantage that<br />

• profit centers have the necessary responsibilities<br />

• the required financial reporting systems exist<br />

Fix the frequency and the way of how to calculate EVA:<br />

• Possible adjustments to the company’s accounting system for a “better“<br />

EVA (attention to also growing complexity!)<br />

• Consideration of IT constraints<br />

• Divisional versus corporate cost of capital<br />

Design the management compensation system (decision to be made by top<br />

management):<br />

• Who will be covered initially and at a later date?<br />

• Sensitivity of bonuses to EVA performance<br />

• Will there be a deferred component?<br />

• Role of stock options in the compensation program<br />

• Divisional versus company-wide or group EVA bonuses<br />

• Relation to nonfinancial measures<br />

Value-Based Management: <strong>Lecture</strong> 9<br />

24<br />

© Gunther Friedl – SS 2013