the 2009 Annual Report (pdf) - PLX Technology

the 2009 Annual Report (pdf) - PLX Technology

the 2009 Annual Report (pdf) - PLX Technology

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

PART II<br />

ITEM 5: MARKET FOR REGISTRANT'S COMMON EQUITY, RELATED STOCKHOLDER MATTERS<br />

AND ISSUER PURCHASES OF EQUITY SECURITIES<br />

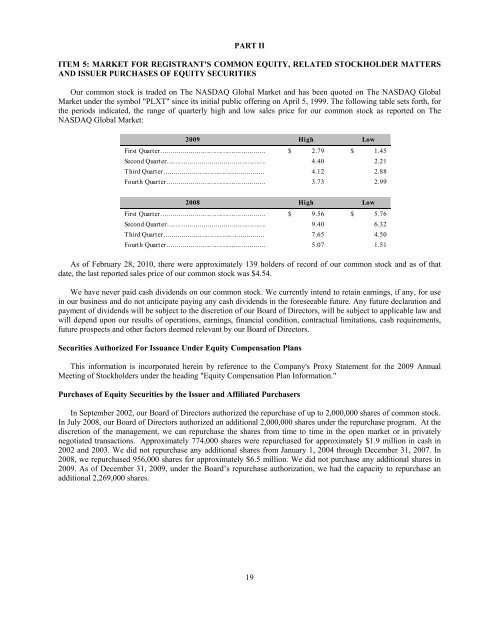

Our common stock is traded on The NASDAQ Global Market and has been quoted on The NASDAQ Global<br />

Market under <strong>the</strong> symbol "<strong>PLX</strong>T" since its initial public offering on April 5, 1999. The following table sets forth, for<br />

<strong>the</strong> periods indicated, <strong>the</strong> range of quarterly high and low sales price for our common stock as reported on The<br />

NASDAQ Global Market:<br />

<strong>2009</strong> High Low<br />

First Quart er……………………………………………… $ 2.79 $ 1.45<br />

Second Quart er…………………………………………… 4.40 2.21<br />

T hird Quart er…………………………………………… 4.12 2.88<br />

Fourt h Quart er…………………………………………… 3.73 2.99<br />

2008 High Low<br />

First Quart er……………………………………………… $ 9.56 $ 5.76<br />

Second Quart er…………………………………………… 9.40 6.32<br />

T hird Quart er…………………………………………… 7.65 4.50<br />

Fourt h Quart er…………………………………………… 5.07 1.51<br />

As of February 28, 2010, <strong>the</strong>re were approximately 139 holders of record of our common stock and as of that<br />

date, <strong>the</strong> last reported sales price of our common stock was $4.54.<br />

We have never paid cash dividends on our common stock. We currently intend to retain earnings, if any, for use<br />

in our business and do not anticipate paying any cash dividends in <strong>the</strong> foreseeable future. Any future declaration and<br />

payment of dividends will be subject to <strong>the</strong> discretion of our Board of Directors, will be subject to applicable law and<br />

will depend upon our results of operations, earnings, financial condition, contractual limitations, cash requirements,<br />

future prospects and o<strong>the</strong>r factors deemed relevant by our Board of Directors.<br />

Securities Authorized For Issuance Under Equity Compensation Plans<br />

This information is incorporated herein by reference to <strong>the</strong> Company's Proxy Statement for <strong>the</strong> <strong>2009</strong> <strong>Annual</strong><br />

Meeting of Stockholders under <strong>the</strong> heading "Equity Compensation Plan Information."<br />

Purchases of Equity Securities by <strong>the</strong> Issuer and Affiliated Purchasers<br />

In September 2002, our Board of Directors authorized <strong>the</strong> repurchase of up to 2,000,000 shares of common stock.<br />

In July 2008, our Board of Directors authorized an additional 2,000,000 shares under <strong>the</strong> repurchase program. At <strong>the</strong><br />

discretion of <strong>the</strong> management, we can repurchase <strong>the</strong> shares from time to time in <strong>the</strong> open market or in privately<br />

negotiated transactions. Approximately 774,000 shares were repurchased for approximately $1.9 million in cash in<br />

2002 and 2003. We did not repurchase any additional shares from January 1, 2004 through December 31, 2007. In<br />

2008, we repurchased 956,000 shares for approximately $6.5 million. We did not purchase any additional shares in<br />

<strong>2009</strong>. As of December 31, <strong>2009</strong>, under <strong>the</strong> Board’s repurchase authorization, we had <strong>the</strong> capacity to repurchase an<br />

additional 2,269,000 shares.<br />

19