the 2009 Annual Report (pdf) - PLX Technology

the 2009 Annual Report (pdf) - PLX Technology

the 2009 Annual Report (pdf) - PLX Technology

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

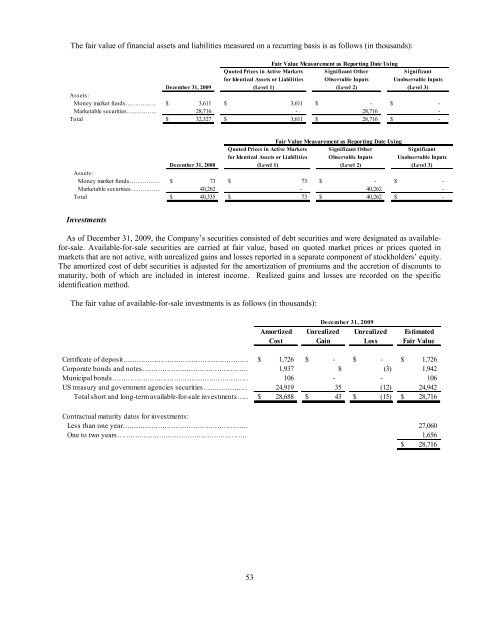

The fair value of financial assets and liabilities measured on a recurring basis is as follows (in thousands):<br />

Fair Value Measurement as <strong>Report</strong>ing Date Using<br />

Quoted Prices in Active Markets Significant O<strong>the</strong>r Significant<br />

for Identical Assets or Liabilities Observable Inputs Unobservable Inputs<br />

December 31, <strong>2009</strong> (Level 1) (Level 2) (Level 3)<br />

Assets:<br />

Money market funds……………… $ 3,611 $ 3,611 $ - $<br />

-<br />

Marketable securities……………… 28,716 - 28,716 -<br />

Total $ 32,327 $ 3,611 $ 28,716 $<br />

-<br />

Fair Value Measurement as <strong>Report</strong>ing Date Using<br />

Quoted Prices in Active Markets Significant O<strong>the</strong>r Significant<br />

for Identical Assets or Liabilities Observable Inputs Unobservable Inputs<br />

December 31, 2008 (Level 1) (Level 2) (Level 3)<br />

Assets:<br />

Money market funds……………… $ 73 $ 73 $ - $<br />

-<br />

Marketable securities……………… 40,262 - 40,262 -<br />

Total $ 40,335 $ 73 $ 40,262 $<br />

-<br />

Investments<br />

As of December 31, <strong>2009</strong>, <strong>the</strong> Company’s securities consisted of debt securities and were designated as availablefor-sale.<br />

Available-for-sale securities are carried at fair value, based on quoted market prices or prices quoted in<br />

markets that are not active, with unrealized gains and losses reported in a separate component of stockholders’ equity.<br />

The amortized cost of debt securities is adjusted for <strong>the</strong> amortization of premiums and <strong>the</strong> accretion of discounts to<br />

maturity, both of which are included in interest income. Realized gains and losses are recorded on <strong>the</strong> specific<br />

identification method.<br />

The fair value of available-for-sale investments is as follows (in thousands):<br />

December 31, <strong>2009</strong><br />

Amortized Unrealized Unrealized Estimated<br />

Cost Gain Loss Fair Value<br />

Certificate of deposit………………………………………………… $ 1,726 $ - $ - $ 1,726<br />

Corporate bonds and notes………………………………………… 1,937 8 (3) 1,942<br />

Municipal bonds……………………………………………………… 106 - - 106<br />

US treasury and government agencies securities………………… 24,919 35 (12) 24,942<br />

Total short and long-term available-for-sale investments…… $ 28,688 $ 43 $ (15) $ 28,716<br />

Contractual maturity dates for investments:<br />

Less than one year………………………………………………… 27,060<br />

One to two years…………………………………………………… 1,656<br />

$ 28,716<br />

53