the 2009 Annual Report (pdf) - PLX Technology

the 2009 Annual Report (pdf) - PLX Technology

the 2009 Annual Report (pdf) - PLX Technology

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

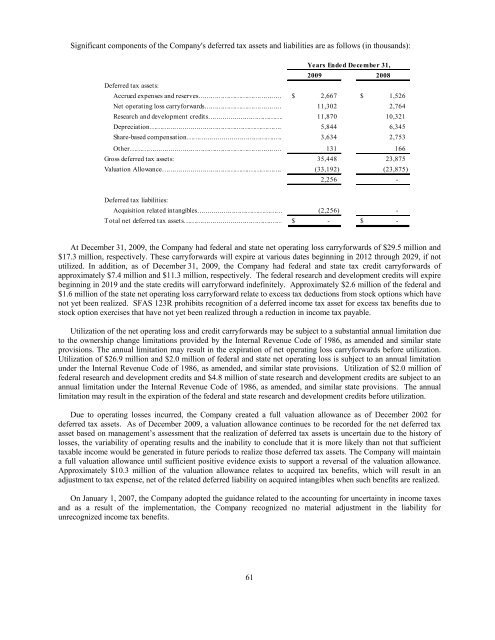

Significant components of <strong>the</strong> Company's deferred tax assets and liabilities are as follows (in thousands):<br />

Years Ended December 31,<br />

<strong>2009</strong> 2008<br />

Deferred tax assets:<br />

Accrued expenses and reserves…………………………………… $ 2,667 $ 1,526<br />

Net operat ing loss carryforwards………………………………… 11,302 2,764<br />

Research and development credits………………………………… 11,870 10,321<br />

Depreciat ion…………………………………….…………………… 5,844 6,345<br />

Share-based compensat ion…………………………………….…… 3,634 2,753<br />

Ot her…………………………………….…………………………… 131 166<br />

Gross deferred tax assets: 35,448 23,875<br />

Valuat ion Allowance…………………………………….……………… (33,192) (23,875)<br />

2,256 -<br />

Deferred tax liabilities:<br />

Acquisition relat ed int angibles…………………………………… (2,256) -<br />

T ot al net deferred t ax asset s…………………………………….…… $ - $ -<br />

At December 31, <strong>2009</strong>, <strong>the</strong> Company had federal and state net operating loss carryforwards of $29.5 million and<br />

$17.3 million, respectively. These carryforwards will expire at various dates beginning in 2012 through 2029, if not<br />

utilized. In addition, as of December 31, <strong>2009</strong>, <strong>the</strong> Company had federal and state tax credit carryforwards of<br />

approximately $7.4 million and $11.3 million, respectively. The federal research and development credits will expire<br />

beginning in 2019 and <strong>the</strong> state credits will carryforward indefinitely. Approximately $2.6 million of <strong>the</strong> federal and<br />

$1.6 million of <strong>the</strong> state net operating loss carryforward relate to excess tax deductions from stock options which have<br />

not yet been realized. SFAS 123R prohibits recognition of a deferred income tax asset for excess tax benefits due to<br />

stock option exercises that have not yet been realized through a reduction in income tax payable.<br />

Utilization of <strong>the</strong> net operating loss and credit carryforwards may be subject to a substantial annual limitation due<br />

to <strong>the</strong> ownership change limitations provided by <strong>the</strong> Internal Revenue Code of 1986, as amended and similar state<br />

provisions. The annual limitation may result in <strong>the</strong> expiration of net operating loss carryforwards before utilization.<br />

Utilization of $26.9 million and $2.0 million of federal and state net operating loss is subject to an annual limitation<br />

under <strong>the</strong> Internal Revenue Code of 1986, as amended, and similar state provisions. Utilization of $2.0 million of<br />

federal research and development credits and $4.8 million of state research and development credits are subject to an<br />

annual limitation under <strong>the</strong> Internal Revenue Code of 1986, as amended, and similar state provisions. The annual<br />

limitation may result in <strong>the</strong> expiration of <strong>the</strong> federal and state research and development credits before utilization.<br />

Due to operating losses incurred, <strong>the</strong> Company created a full valuation allowance as of December 2002 for<br />

deferred tax assets. As of December <strong>2009</strong>, a valuation allowance continues to be recorded for <strong>the</strong> net deferred tax<br />

asset based on management’s assessment that <strong>the</strong> realization of deferred tax assets is uncertain due to <strong>the</strong> history of<br />

losses, <strong>the</strong> variability of operating results and <strong>the</strong> inability to conclude that it is more likely than not that sufficient<br />

taxable income would be generated in future periods to realize those deferred tax assets. The Company will maintain<br />

a full valuation allowance until sufficient positive evidence exists to support a reversal of <strong>the</strong> valuation allowance.<br />

Approximately $10.3 million of <strong>the</strong> valuation allowance relates to acquired tax benefits, which will result in an<br />

adjustment to tax expense, net of <strong>the</strong> related deferred liability on acquired intangibles when such benefits are realized.<br />

On January 1, 2007, <strong>the</strong> Company adopted <strong>the</strong> guidance related to <strong>the</strong> accounting for uncertainty in income taxes<br />

and as a result of <strong>the</strong> implementation, <strong>the</strong> Company recognized no material adjustment in <strong>the</strong> liability for<br />

unrecognized income tax benefits.<br />

61