the 2009 Annual Report (pdf) - PLX Technology

the 2009 Annual Report (pdf) - PLX Technology

the 2009 Annual Report (pdf) - PLX Technology

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

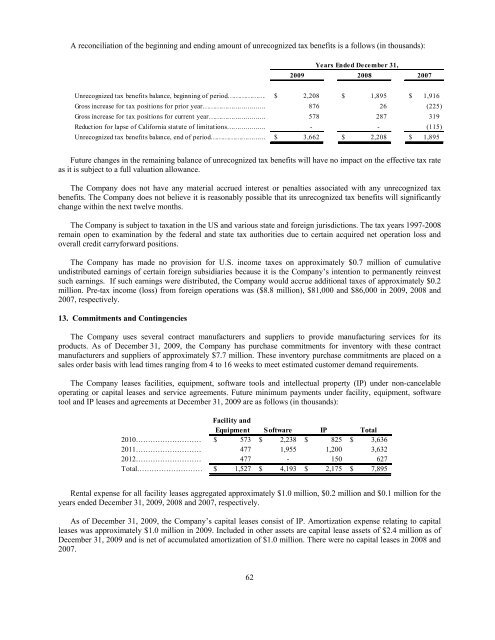

A reconciliation of <strong>the</strong> beginning and ending amount of unrecognized tax benefits is a follows (in thousands):<br />

Years Ended December 31,<br />

<strong>2009</strong> 2008 2007<br />

Unrecognized t ax benefits balance, beginning of period………………… $ 2,208 $ 1,895 $ 1,916<br />

Gross increase for t ax positions for prior year…………………………… 876 26 (225)<br />

Gross increase for t ax positions for current year………………………… 578 287 319<br />

Reduct ion for lapse of California st at ut e of limitat ions………………… - - (115)<br />

Unrecognized t ax benefits balance, end of period……………………… $ 3,662 $ 2,208 $ 1,895<br />

Future changes in <strong>the</strong> remaining balance of unrecognized tax benefits will have no impact on <strong>the</strong> effective tax rate<br />

as it is subject to a full valuation allowance.<br />

The Company does not have any material accrued interest or penalties associated with any unrecognized tax<br />

benefits. The Company does not believe it is reasonably possible that its unrecognized tax benefits will significantly<br />

change within <strong>the</strong> next twelve months.<br />

The Company is subject to taxation in <strong>the</strong> US and various state and foreign jurisdictions. The tax years 1997-2008<br />

remain open to examination by <strong>the</strong> federal and state tax authorities due to certain acquired net operation loss and<br />

overall credit carryforward positions.<br />

The Company has made no provision for U.S. income taxes on approximately $0.7 million of cumulative<br />

undistributed earnings of certain foreign subsidiaries because it is <strong>the</strong> Company’s intention to permanently reinvest<br />

such earnings. If such earnings were distributed, <strong>the</strong> Company would accrue additional taxes of approximately $0.2<br />

million. Pre-tax income (loss) from foreign operations was ($8.8 million), $81,000 and $86,000 in <strong>2009</strong>, 2008 and<br />

2007, respectively.<br />

13. Commitments and Contingencies<br />

The Company uses several contract manufacturers and suppliers to provide manufacturing services for its<br />

products. As of December 31, <strong>2009</strong>, <strong>the</strong> Company has purchase commitments for inventory with <strong>the</strong>se contract<br />

manufacturers and suppliers of approximately $7.7 million. These inventory purchase commitments are placed on a<br />

sales order basis with lead times ranging from 4 to 16 weeks to meet estimated customer demand requirements.<br />

The Company leases facilities, equipment, software tools and intellectual property (IP) under non-cancelable<br />

operating or capital leases and service agreements. Future minimum payments under facility, equipment, software<br />

tool and IP leases and agreements at December 31, <strong>2009</strong> are as follows (in thousands):<br />

Facility and<br />

Equipment Software IP Total<br />

2010……………………… $ 573 $ 2,238 $ 825 $ 3,636<br />

2011……………………… 477 1,955 1,200 3,632<br />

2012……………………… 477 - 150 627<br />

Total……………………… $ 1,527 $ 4,193 $ 2,175 $ 7,895<br />

Rental expense for all facility leases aggregated approximately $1.0 million, $0.2 million and $0.1 million for <strong>the</strong><br />

years ended December 31, <strong>2009</strong>, 2008 and 2007, respectively.<br />

As of December 31, <strong>2009</strong>, <strong>the</strong> Company’s capital leases consist of IP. Amortization expense relating to capital<br />

leases was approximately $1.0 million in <strong>2009</strong>. Included in o<strong>the</strong>r assets are capital lease assets of $2.4 million as of<br />

December 31, <strong>2009</strong> and is net of accumulated amortization of $1.0 million. There were no capital leases in 2008 and<br />

2007.<br />

62