Carbon 2009 Emission trading coming home - UNEP Finance Initiative

Carbon 2009 Emission trading coming home - UNEP Finance Initiative

Carbon 2009 Emission trading coming home - UNEP Finance Initiative

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

17 March <strong>2009</strong><br />

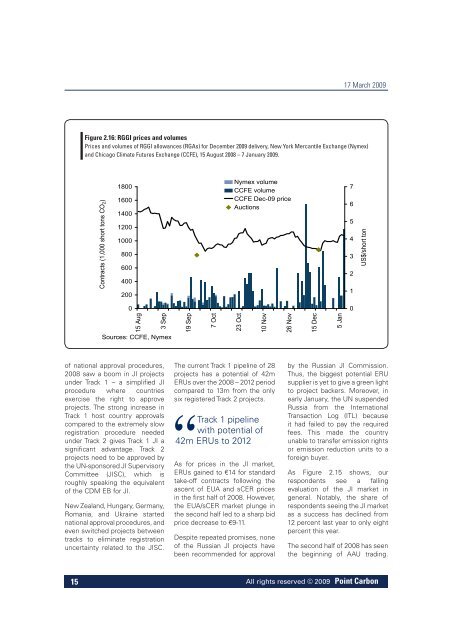

Figure 2.16: RGGI prices and volumes<br />

Prices and volumes of RGGI allowances (RGAs) for December <strong>2009</strong> delivery, New York Mercantile Exchange (Nymex)<br />

and Chicago Climate Futures Exchange (CCFE), 15 August 2008 – 7 January <strong>2009</strong>.<br />

Contracts (1,000 short tons CO 2 )<br />

1800<br />

1600<br />

1400<br />

1200<br />

1000<br />

800<br />

600<br />

400<br />

200<br />

Nymex volume<br />

CCFE volume<br />

CCFE Dec-09 price<br />

Auctions<br />

7<br />

6<br />

5<br />

4<br />

3<br />

2<br />

1<br />

US$/short ton<br />

0<br />

0<br />

15 Aug<br />

3 Sep<br />

Sources: CCFE, Nymex<br />

19 Sep<br />

7 Oct<br />

23 Oct<br />

10 Nov<br />

26 Nov<br />

15 Dec<br />

5 Jan<br />

of national approval procedures,<br />

2008 saw a boom in JI projects<br />

under Track 1 – a simplified JI<br />

procedure where countries<br />

exercise the right to approve<br />

projects. The strong increase in<br />

Track 1 host country approvals<br />

compared to the extremely slow<br />

registration procedure needed<br />

under Track 2 gives Track 1 JI a<br />

significant advantage. Track 2<br />

projects need to be approved by<br />

the UN-sponsored JI Supervisory<br />

Committee (JISC), which is<br />

roughly speaking the equivalent<br />

of the CDM EB for JI.<br />

New Zealand, Hungary, Germany,<br />

Romania, and Ukraine started<br />

national approval procedures, and<br />

even switched projects between<br />

tracks to eliminate registration<br />

uncertainty related to the JISC.<br />

The current Track 1 pipeline of 28<br />

projects has a potential of 42m<br />

ERUs over the 2008 – 2012 period<br />

compared to 13m from the only<br />

six registered Track 2 projects.<br />

Track 1 pipeline<br />

with potential of<br />

42m ERUs to 2012<br />

As for prices in the JI market,<br />

ERUs gained to €14 for standard<br />

take-off contracts following the<br />

ascent of EUA and sCER prices<br />

in the first half of 2008. However,<br />

the EUA/sCER market plunge in<br />

the second half led to a sharp bid<br />

price decrease to €9-11.<br />

Despite repeated promises, none<br />

of the Russian JI projects have<br />

been recommended for approval<br />

by the Russian JI Commission.<br />

Thus, the biggest potential ERU<br />

supplier is yet to give a green light<br />

to project backers. Moreover, in<br />

early January, the UN suspended<br />

Russia from the International<br />

Transaction Log (ITL) because<br />

it had failed to pay the required<br />

fees. This made the country<br />

unable to transfer emission rights<br />

or emission reduction units to a<br />

foreign buyer.<br />

As Figure 2.15 shows, our<br />

respondents see a falling<br />

evaluation of the JI market in<br />

general. Notably, the share of<br />

respondents seeing the JI market<br />

as a success has declined from<br />

12 percent last year to only eight<br />

percent this year.<br />

The second half of 2008 has seen<br />

the beginning of AAU <strong>trading</strong>.<br />

15<br />

All rights reserved © <strong>2009</strong> Point <strong>Carbon</strong>