Carbon 2009 Emission trading coming home - UNEP Finance Initiative

Carbon 2009 Emission trading coming home - UNEP Finance Initiative

Carbon 2009 Emission trading coming home - UNEP Finance Initiative

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

17 March <strong>2009</strong><br />

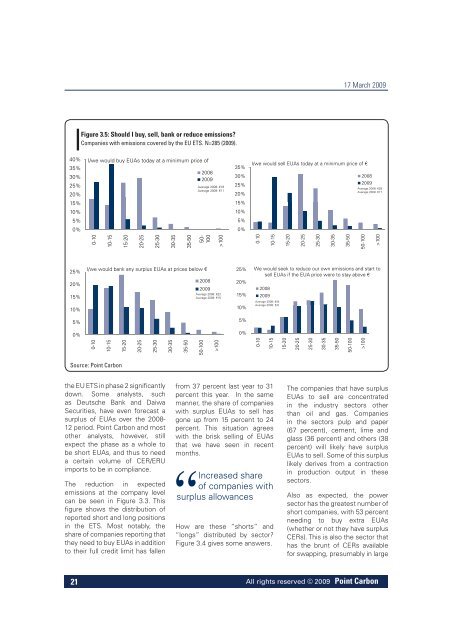

Figure 3.5: Should I buy, sell, bank or reduce emissions?<br />

Companies with emissions covered by the EU ETS. N=285 (<strong>2009</strong>).<br />

40%<br />

35%<br />

30%<br />

25%<br />

20%<br />

I/we would buy EUAs today at a minimum price of<br />

2008<br />

<strong>2009</strong><br />

Average 2008: €18<br />

Average <strong>2009</strong>: €11<br />

35%<br />

30%<br />

25%<br />

20%<br />

I/we would sell EUAs today at a minimum price of €<br />

2008<br />

<strong>2009</strong><br />

Average 2008: €28<br />

Average <strong>2009</strong>: €17<br />

15%<br />

15%<br />

10%<br />

10%<br />

5%<br />

5%<br />

0%<br />

0%<br />

0-10<br />

10-15<br />

15-20<br />

20-25<br />

25-30<br />

30-35<br />

35-50<br />

50-<br />

100<br />

>100<br />

0-10<br />

10-15<br />

15-20<br />

20-25<br />

25-30<br />

30-35<br />

35-50<br />

50-100<br />

>100<br />

25%<br />

20%<br />

15%<br />

I/we would bank any surplus EUAs at prices below €<br />

2008<br />

<strong>2009</strong><br />

Average 2008: €22<br />

Average <strong>2009</strong>: €15<br />

25%<br />

20%<br />

15%<br />

We would seek to reduce our own emissions and start to<br />

sell EUAs if the EUA price were to stay above €<br />

2008<br />

<strong>2009</strong><br />

Average 2008: €44<br />

10%<br />

10%<br />

Average <strong>2009</strong>: €33<br />

5%<br />

5%<br />

0%<br />

0%<br />

0-10<br />

10-15<br />

15-20<br />

20-25<br />

25-30<br />

30-35<br />

35-50<br />

50-100<br />

>100<br />

0-10<br />

10-15<br />

15-20<br />

20-25<br />

25-30<br />

30-35<br />

35-50<br />

50-100<br />

>100<br />

Source: Point <strong>Carbon</strong><br />

the EU ETS in phase 2 significantly<br />

down. Some analysts, such<br />

as Deutsche Bank and Daiwa<br />

Securities, have even forecast a<br />

surplus of EUAs over the 2008-<br />

12 period. Point <strong>Carbon</strong> and most<br />

other analysts, however, still<br />

expect the phase as a whole to<br />

be short EUAs, and thus to need<br />

a certain volume of CER/ERU<br />

imports to be in compliance.<br />

The reduction in expected<br />

emissions at the company level<br />

can be seen in Figure 3.3. This<br />

figure shows the distribution of<br />

reported short and long positions<br />

in the ETS. Most notably, the<br />

share of companies reporting that<br />

they need to buy EUAs in addition<br />

to their full credit limit has fallen<br />

from 37 percent last year to 31<br />

percent this year. In the same<br />

manner, the share of companies<br />

with surplus EUAs to sell has<br />

gone up from 15 percent to 24<br />

percent. This situation agrees<br />

with the brisk selling of EUAs<br />

that we have seen in recent<br />

months.<br />

Increased share<br />

of companies with<br />

surplus allowances<br />

How are these “shorts” and<br />

“longs” distributed by sector?<br />

Figure 3.4 gives some answers.<br />

The companies that have surplus<br />

EUAs to sell are concentrated<br />

in the industry sectors other<br />

than oil and gas. Companies<br />

in the sectors pulp and paper<br />

(67 percent), cement, lime and<br />

glass (36 percent) and others (38<br />

percent) will likely have surplus<br />

EUAs to sell. Some of this surplus<br />

likely derives from a contraction<br />

in production output in these<br />

sectors.<br />

Also as expected, the power<br />

sector has the greatest number of<br />

short companies, with 53 percent<br />

needing to buy extra EUAs<br />

(whether or not they have surplus<br />

CERs). This is also the sector that<br />

has the brunt of CERs available<br />

for swapping, presumably in large<br />

21<br />

All rights reserved © <strong>2009</strong> Point <strong>Carbon</strong>