Uniform Bank Performance Report - Anderson School of Management

Uniform Bank Performance Report - Anderson School of Management

Uniform Bank Performance Report - Anderson School of Management

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

deposits, as well as its 100 year plus experience in the banking industry, allows the bank to quickly<br />

respond to and meet all <strong>of</strong> its clients’ cash requirements for demand deposit accounts, even throughout<br />

the 2008 credit crisis.<br />

Certificate <strong>of</strong> Deposit<br />

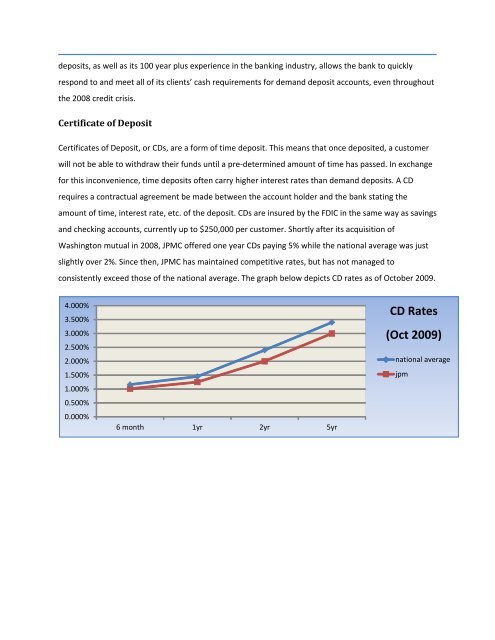

Certificates <strong>of</strong> Deposit, or CDs, are a form <strong>of</strong> time deposit. This means that once deposited, a customer<br />

will not be able to withdraw their funds until a pre‐determined amount <strong>of</strong> time has passed. In exchange<br />

for this inconvenience, time deposits <strong>of</strong>ten carry higher interest rates than demand deposits. A CD<br />

requires a contractual agreement be made between the account holder and the bank stating the<br />

amount <strong>of</strong> time, interest rate, etc. <strong>of</strong> the deposit. CDs are insured by the FDIC in the same way as savings<br />

and checking accounts, currently up to $250,000 per customer. Shortly after its acquisition <strong>of</strong><br />

Washington mutual in 2008, JPMC <strong>of</strong>fered one year CDs paying 5% while the national average was just<br />

slightly over 2%. Since then, JPMC has maintained competitive rates, but has not managed to<br />

consistently exceed those <strong>of</strong> the national average. The graph below depicts CD rates as <strong>of</strong> October 2009.<br />

4.000%<br />

3.500%<br />

3.000%<br />

2.500%<br />

2.000%<br />

1.500%<br />

1.000%<br />

0.500%<br />

0.000%<br />

6 month 1yr 2yr 5yr<br />

CD Rates<br />

(Oct 2009)<br />

national average<br />

jpm